Industry tailwinds and a full tech stack now ready to be deployed are a couple of reasons investors should be thinking about Sabio Holdings (Sabio Holdings Stock Quote, Charts, News, Analysts, Financials TSXV:SBIO). That’s according to Paradigm Capital analyst Daniel Rosenberg who updated clients on the company in a Thursday research note.

Sabio, a provider of Connected TV (CTV) and over-the-top (OTT) streaming advertising platforms, delivered its fourth quarter 2021 financials on Wednesday, showing record revenue of $10.6 million, up 96 per cent year-over-year, and adjusted EBITDA of $1.7 million compared to $1.6 million a year earlier. (All figures in US dollars except where noted otherwise.)

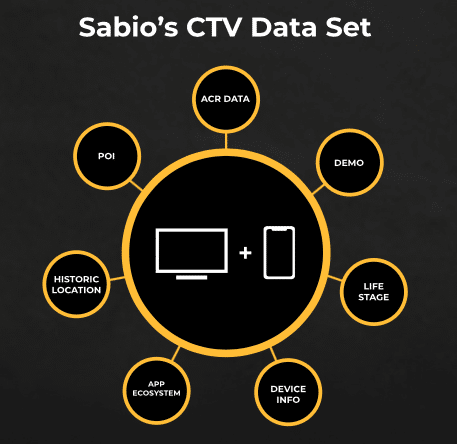

The company said it’s seeing strong momentum in sales, increasing deal sizes and greater interest from major brands and ad agencies for its tech platform which works to provide global distribution for brands and agencies along with monetization and analytics.

“The market opportunity being created by the shift from traditional TV to CTV/OTT is in the early stages and we believe it is poised for major expansion over the coming years,” said Sabio Chief Growth Officer Jon Stimmel in a press release. “We recognized this potential pending shift early and made strategic investments in technology. We believe that these investments, coupled with our recent acquisition of Vidillion and our strengthening relationships with Fortune 100 brands puts us in a strong position to take advantage of this expanding market.”

Sabio began trading on the TSX Venture in November just as the market began its rotation away from high-growth stocks such as those in the tech sector. SBIO dropped over the ensuing months but has rallied over the past month.

But Rosenberg sees lots of upside from current levels and has reiterated his “Buy” rating on Sabio along with his C$3.25 target price, which at press time represented a projected one-year return of 158 per cent.

“Sabio has built a comprehensive technology portfolio and is trusted by some of the world’s leading brands and agencies. The industry has substantial tailwinds including shifting viewer habits that are supportive of continued rapid growth. Sabio is in the early stages of commercializing its analytics platform, App Science. We see meaningful optionality to monetize App Science in the attractive TV analytics market, estimated to be a $1.9-billion opportunity,” Rosenberg said.

On the quarterly results, Rosenberg said the $10.6 million in revenue topped the high end of previous guidance, which was between $9.6 and $10.4 million, with CTV revenue climbing to $5.2 million (up 664 per cent year-over-year). The analyst said gross margins were strong at 59.0 per cent versus 58.3 per cent for the previous quarter, while adjusted EBITDA at $1.7 million was ahead of Rosenberg’s forecast at $0.9 million.

“Sabio reported Q4/21 results that were at the higher end of previously released guidance. The company saw traction from leading Fortune 500 brands and growth in the CTV segment, which accounted for ~50 per cent of Q4 revenue. Contract renewals were strong with the average deal size increasing 70 per cent in 2021. The outlook for Q1/22 is positive with the company signing multiple deals across industry verticals,” Rosenberg wrote.

On Sabio’s recent acquisition of US-based CTV/OTT company Vidillion for $3 million, Rosenberg said Vidillion’s premium CTV inventory will drive incremental margin improvement for Sabio, previously a customer of Vidillion. Meanwhile, the analyst said Sabio’s balance sheet ($3.3 million in cash at the end of 2021 and $4.1 million in debt) has room to support organic operations but that additional M&A this year will likely require more funding.

Rosenberg also pointed to Sabio’s ability to grow its deal sizes, from $59,000 as of 2020 to an average of $100,000 in 2021, with over 80 per cent of CTV brands with $100,000 in spending and a full 100 per cent of CTV brands with over $1.0 million in spending having renewed their contracts in 2021.

“We view the long-term commitment from large brands as a testament to the differentiated offering that Sabio provides and a notable achievement for a company of Sabio’s size,” he said.

Rosenberg has adjusted his forecast and now thinks Sabio will generate 2022 revenue of $34.8 million (previously $33.0 million) and adjusted EBITDA of $2.2 million (previously $1.2 million). His 2023 numbers remain unchanged at $43.9 million in revenue and $3.7 million in EBITDA.

At the same time, Rosenberg has dropped his valuation multiple due to a broader contraction across the ad tech industry, putting his valuation of SBIO at an EV/Revenue 2023 multiple of 4.5x compared to the previous 6.0x. The analyst said Sabio’s peer group of AdTech players trade at an average of 4.2x 2023 EV/Revenue estimates where Sabio is currently trading at 1.8x.

“Sabio is growing rapidly and its differentiated insights around CTV are seeing significant traction with blue-chip customers. We believe the commercialization of App Science along with double-digit growth and strong SaaS margin potential make Sabio a compelling investment opportunity in a very attractive space. We reiterate our Buy recommendation,” Rosenberg said.

Disclosure: Sabio Holdings is an annual sponsor of Cantech Letter.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment