Chelsea Stellick of iA Capital Markets remains a supporter of Microbix Biosystems (Microbix Biosystems Stock Quote, Chart, News, Analysts, Financials TSX:MBX), maintaining a “Buy” rating and target price of $1.70/share for a projected return of 117.9 per cent in an update to clients on December 23.

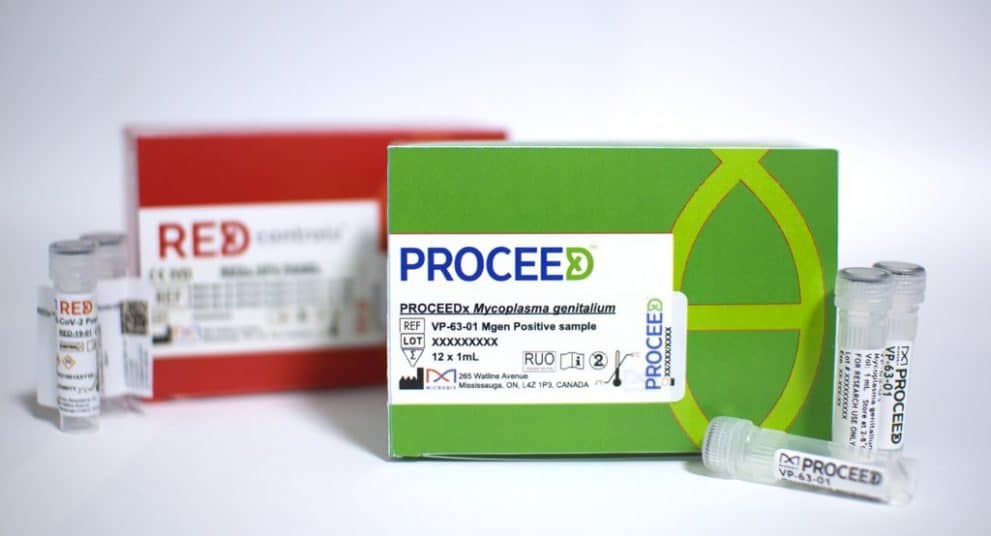

Founded in 1988 and headquartered in Mississauga, Microbix Biosystems develops and commercializes proprietary biological and technological solutions used for diagnostic testing, has quality assessment products and optionality in a partnered asset, Kinlytic urokinase a clot-busting drug.

Stellick’s updated analysis comes after Microbix released its fourth quarter financial results, with Stellick noting the company’s broad-based growth.

“MBX continued its rapid growth with record revenue and profitability in Q4/F21 and F2021, with the inexorable continuation of the pandemic improving the F2022 outlook for QAPs and DxTM,” Stellick said. “We anticipate respiratory testing to spike in H1/F22 as flu season combines with the emergence of the omicron variant to make COVID-19 testing a continued priority.”

The company’s financial report was headlined by $5.6 million in revenue for a 108 per cent year-over-year increase, though it slightly missed the iA Capital Markets projection of $6.5 million, with Stellick largely attributing the miss to its antigens business, which came in at $2 million compared to the $2.5 million projection.

Meanwhile, the company reported a gross margin of 58 per cent, a significant spike compared to the 35 per cent reported in the final quarter of 2020 due to a greater proportion of QAP sales, new viral transport media sales, antigens sales mix and bioreactor production. Stellick believes the company’s gross margin will ultimately settle in at around 60 per cent throughout 2022.

Since the release of Stellick’s report, the company has also received a follow-on order of $4.7 million from the province of Ontario for its DxTM viral transport medium on which Stellick expects an expansion of the regulatory file to make it a universal VTM, compatible with many diagnostic tests to help DxTM remain a core component of the operation.

“We are very pleased to be able to rapidly respond to Ontario’s needs for critical healthcare products such as our DxTM viral transport medium and QAPs IVD test controls – reliably delivering when and where these vital products are most needed,” said Dr. Ken Hughes, COO of Microbix in the company’s December 24 press release. “The secure and highest-quality domestic innovation and manufacturing that Microbix provides not only helps guard against supply disruptions, it also helps create health and prosperity for Ontarians and Canadians.”

The updated reports have also prompted Stellick to revise her financial projections, as she has lowered her revenue forecast for 2021 from $21.4 million to $18.6 million, which would still mark a year-over-year increase of 77.1 per cent. She has also taken a chunk out of her 2022 projection, which is now at $25.2 million instead of $35.5 million (35.5 per cent year-over-year increase), while her 2023 projection has also dropped from $39.7 million to $27.3 million (8.3 per cent increase).

Notably, the reduced projections were on account of Ontario not having completed a reorder, which has since happened, though Stellick expects Ontario to be a significant contributor to revenue and gross profit in 2022, as demand for local supply of COVID-19 testing components is stronger than ever given ongoing supply chain issues.

Stellick has also lowered her EBITDA projections for 2021 from $5.6 million to $5.1 million for a margin of 27.4 per cent. Meanwhile, Stellick also dropped her 2022 projection from $11.6 million to $7.8 million for a margin of 31 per cent, and the 2023 projection has dropped from $12.8 million to $9 million, yielding a margin of 33 per cent.

From a valuation perspective, Stellick forecasts the EV/Revenue multiple to increase from 1x in 2021 to 4x in 2022 before settling down to 3.7x in 2023, while the EV/EBITDA multiple is forecast to drop from 19.5x in 2021 to a projected 12.8x in 2022, then to 11.2x in 2023.

Overall, Stellick believes Microbix is executing on its growth strategy and that its VTM and QAP segments will continue to find demand in a post-pandemic world.

“Although we are more bullish on COVID-19 testing than last quarter due to the emergence of the omicron variant, we also believe MBX will continue growing its non-COVID product sales and creating new offerings as excess molecular testing capacity pivots to new tests over the medium-term,” Stellick said. “We continue to believe COVID-19 is endemic and regardless of vaccine successes, there will be some level of diagnostic testing necessary in perpetuity, particularly given the recent FDA approval of an oral antiviral for high risk COVID-19 patients.”

Microbix’s stock value has had a great 2021 and is currently up 95 per cent year-to-date.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment