The stock looks to be ending the year slightly underwater, but with strong growth prospects from its healthcare segment investors should see a pop in 2022 from CAE Inc (CAE Inc Stock Quote, Charts, News, Analysts, Financials TSX:CAE). That’s portfolio manager David Driscoll’s take on the simulation tech company, which has dropped about 24 per cent over the past month and a half.

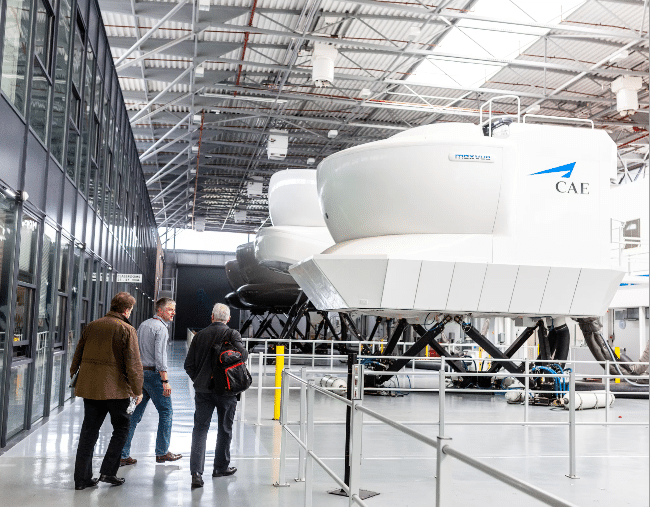

Montreal-based and $10-billion market cap company CAE makes simulation software and hardware for civil aviation training, for defence and security in the form of training and mission systems integration and for education and training in the healthcare space. As you might expect with the pandemic’s impact on aviation and the airlines over the past two years, CAE has seen a drop in its business and was sporting quarterly losses as COVID took a sledgehammer to the company’s training centre and flight simulation business.

CAE’s revenue dropped for its fiscal 2021, year ended March 31, 2021, going from $3.6 billion for fiscal 2020 to $3.0 billion for fiscal 2021. The previous fiscal 2019 had a topline of $3.3 billion.

But with a rebound in the aviation space and the closing earlier this year of its acquisition of the military training business of US defence contractor L3Harris Technologies, CAE is looking for a bounce back year ahead.

“While COVID-related impacts continue to affect all of our business units, we increasingly see a clearer path to recovery and a larger, more resilient and more profitable CAE in the future,” said President and CEO Marc Parent in the November 11 press release announcing CAE’s second quarter fiscal 2022 results.

“Specifically, we are currently targeting to reach a consolidated adjusted segment operating margin of approximately 17 per cent by the time our markets are generally recovered, with steady room for further improvement thereafter. We expect to reach this level of profitability on a significantly larger base of business with a post-pandemic capital structure that will allow us to sustain ample flexibility to further invest in our future,” he said.

For Driscoll, CAE’s upside will depend a lot on its healthcare business, where the company sells products such as surgical and ultrasound simulators, patient manikins and an end-to-end simulation management platform.

“Some of their businesses have run into headwinds, and that’s really on the commercial side,” said Driscoll, President and CEO of Liberty International Investment Management, speaking on BNN Bloomberg on Friday.

“But they’ve been starting to grow their business from the military and from the healthcare side it’s going to be a longer runway of growth because it’s really just in its infancy,” he said.

By segment, CAE’s fiscal 2021 saw revenue of $1.4 billion from its Civil Aviation Training Solutions business, down 35 per cent from 2020’s $2.2 billion. Defence and Security was down nine per cent to $1.2 billion and healthcare was up a big 183 per cent to $351.9 million, with the company pointing to ongoing progress in helping healthcare institutions manage their digital transformations in terms of training and education.

Earnings also look better in the healthcare space, with CAE posting a fiscal 2021 operating income of $26.4 million compared to a loss of $41.0 million a year earlier and compared to operating income of just $6.5 million in Civil and $15.5 million in Defence.

More recently in the fiscal Q2 2022, CAE saw overall revenue climb 16 per cent to $814.9 million, with Civil down one per cent to $362.1 million, Defence up 38 per cent to $417.9 million and Healthcare down six per cent to $34.9 million. CAE’s adjusted earnings for the quarter were $0.17 per diluted share compared to $0.13 per share a year earlier. Analysts had been expecting an adjusted profit of $0.20 per share, and CAE’s share price dropped significantly after the release of the earnings.

“We continue to play offence during this period of disruption, as evidenced by our recent announcement of the proposed acquisition of Sabre’s AirCentre business, which marks our ninth accretive acquisition since the pandemic began. As business conditions continue to improve further, we look to extend this posture as it relates to both organic and inorganic growth investment,” said Parent in the quarterly press release.

For Driscoll, investors interested in CAE should keep their eyes on the longer-term picture.

“Trying to grow military contracts through other types of aeronautics simulation is really where they’re trying to be focused, so you have to be patient,” Driscoll said.

“The stock stock has been bouncing between that $27 and $42 range and it’s currently around $32. It’s just a matter of having to wait until they can start firing on all cylinders, at which time you’ll start to see movement in the earnings and better share price,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment