After previously hitting some rough waters, Adhir Kadve of Eight Capital believes Voyager Digital (Voyager Digital Stock Quote, Chart, News CSE:VOYG) has steadied the ship, with the analyst maintaining a “Buy” rating on the digital asset focused agency broker and financial services firm in an update to clients on October 29.

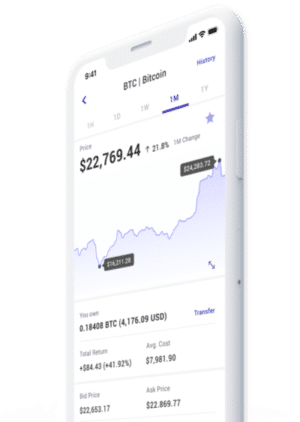

Founded in 2018 and headquartered in New York City, Voyager Digital is in the digital asset and cryptocurrency industry, first being publicly listed in the opening quarter of 2019 before adding iOS and Android apps to its arsenal before the end of that year, with a desktop launch completed at the end of 2020.

Kadve’s latest analysis comes after Voyager reported financial results for the fourth quarter of 2021 that were largely in line with Eight Capital’s expectations, or slightly below, in some cases.

“Both Operating and Adj. EBITDA margins came in lower than expectations, as the company continues to invest in growth via marketing and via new hires,” Kadve said. “The company notes that it is beginning to see a rebound in industry trading volumes, post the weakness seen during the summer months.”

The quarterly report was headlined by revenue of $109 million (all report figures in US dollars), matching the Eight Capital projection and coming in just shy of the consensus estimate of $109.6 million. The report represents sequential growth of 80 per cent, and a year-over-year increase of over 15,000 per cent.

However, the company’s margins told a slightly different story, as the company reported $31.2 million in operating income for a margin of 29 per cent, significantly missing the $44.7 million and 41 per cent margin predicted by Eight Capital, as well as the consensus targets of $49.3 million and a 45 per cent margin.

EBITDA produced a similar picture, as the company’s reported $21.1 million and 19 per cent EBITDA margin came in well behind the Eight Capital estimates of $47 million and a 43 per cent margin, as well as the consensus marks of $41.2 million with a 38 per cent margin.

“Fiscal 2021 was a breakout year for Voyager, positioning our platform to be a leading player in the digital asset arena as crypto and related blockchain technologies are increasingly embraced by the mainstream,” said Steve Ehrlich, Voyager’s CEO and Co-founder in the company’s October 29 press release.

“Voyager continues to deliver noteworthy performance through verified user and funded account growth punctuated by providing users with a transparent, safe, secure and trusted personal cryptocurrency platform. We continued to see significant net new funded accounts and net new asset inflows on the platform and as we add more product extensions, we believe the ability to leverage our growing user base will accelerate our revenue growth and provide diversification to our revenue mix,” Ehrlich said.

The company’s optimism has been buoyed by some of the recent waves it’s made, including a five-year agreement to become the official cryptocurrency brokerage partner for the NBA’s Dallas Mavericks, with an aim toward making cryptocurrency more accessible.

“The Mavs are proud to welcome Voyager to the Dallas Mavericks family,” said Mavs governor Mark Cuban in Voyager’s October 27 press release. “Crypto assets and applications are changing how business and personal finance are done. We believe our partnership with Voyager will allow Mavs and NBA fans to learn more about Voyager and how they can earn more from Voyagers’ platform than from traditional financial applications.”

In addition, the company’s pockets got a little deeper after a $75 million investment from crypto market maker Alameda Research, which also comes with a four per cent ownership stake in the company.

With the initial pre-release of the quarterly results on October 7, Kadve had modified his longer-term financial projections, having raised his 2021 revenue estimate to $175 million with $78.4 million in adjusted EBITDA to produce a 45 per cent margin.

However, Kadve’s projections are diminished for 2022, lowering his revenue target to $353.5 million, which would still produce a potential year-over-year increase of 102 per cent, though the EBITDA projection has dipped to $77.9 million, with the EBITDA margin projection slashed in half to 22 per cent.

Kadve’s modified valuation projections also pointed to mixed fortunes for Voyager, with an expectation for the EV/Revenue to drop from 9.1x in 2021 to a projected 4.5x in 2022, while the EV/EBITDA remains relatively flat, moving from 20.4 to a projected 20.5x in 2022.

Meanwhile, with a reduced earnings per share projection of $0.31/share, Kadve introduced a price-earnings ratio multiple for the first time for 2022 at 22x. Along with his “Buy” rating, Kadve has maintained a target price of $20.00/share for a potential return of 13.1 per cent.

Since it began trading on the Toronto Stock Exchange on September 7, Voyager Digital’s stock price is up 13.5 per cent from its initial listing price of $18.85/share, having recently rebounded in a big way after bottoming out at $11.28/share on October 26, having nearly doubled in the last week to hit a new high mark of $21.40/share today.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment