A NASDAQ listing should be a bonus for shareholders of Quipt Home Medical (Quipt Home Medical Stock Quote, Chart, News, Analysts, Financials TSXV:QIPT), says Raymond James analyst Rahul Sarugaser, who delivered an update to clients on Friday. Sarugaser said Quipt should continue to do well in the growing US durable medical equipment (DME) industry, with M&A activity on the horizon.

A NASDAQ listing should be a bonus for shareholders of Quipt Home Medical (Quipt Home Medical Stock Quote, Chart, News, Analysts, Financials TSXV:QIPT), says Raymond James analyst Rahul Sarugaser, who delivered an update to clients on Friday. Sarugaser said Quipt should continue to do well in the growing US durable medical equipment (DME) industry, with M&A activity on the horizon.

Quipt Home Medical, a provider of clinical respiratory equipment across 51 locations in the United States, provided a corporate update on Friday where it summarized the company’s recent moves, including a share consolidation, preparation for listing on the NASDAQ, a change from reporting in Canadian to US currency and a rebranding from the former Protech Home Medical to Quipt.

The company said it plans to carry on its acquisitive strategy and patient-centric business model in full-service home respiratory solutions, now featured in 11 states with over 17,000 referring physicians and about 120,000 currently active patients.

“There continue to be extraordinary tailwinds for our business, and with our deep acquisition pipeline, highly-scalable infrastructure, pristine balance sheet and continued operating momentum we are ready to capitalize on the overarching opportunity and aggressively grow into a national provider of respiratory equipment in the United States,” said CEO Greg Crawford in a press release.

Quipt completed a four-for-one share consolidation on May 13 in preparation for joining the NASDAQ, reducing its issued and outstanding shares to now 30.7 million. The NASDAQ listing remains subject to approval, with Quipt having announced on May 14, 2021, that it had filed a Form 40-F with the US SEC for the listing.

Sarugaser said the new listing should be a catalyst for the stock, and he has now adjusted his target price to reflect the company changes including the share consolidation.

“In anticipation of a NASDAQ listing during the next month, the broad exposure from which we anticipate being catalytic for the stock, Protech Home Medical has enacted a series of corporate transformations, including a name and ticker change, a share consolidation, and a shift in reporting currency to USD,” Sarugaser wrote.

“In light of all these changes, and in anticipation of QIPT’s 2Q21 earnings on June 1, we have updated our model, estimates, and valuation. Accounting for QIPT’s shift to USD reporting currency and its 4:1 share consolidation, we adjust our target price to $10.00 (was C$3.00 pre-consolidation (C$12.00 post)),” he said.

With the update, Sarugaser has maintained his “Outperform 2” rating for QIPT while the new target of $10.00 (previously C$12.00) represented at the time of publication a projected one-year return of 41.5 per cent. (All figures in US dollars except where noted otherwise.)

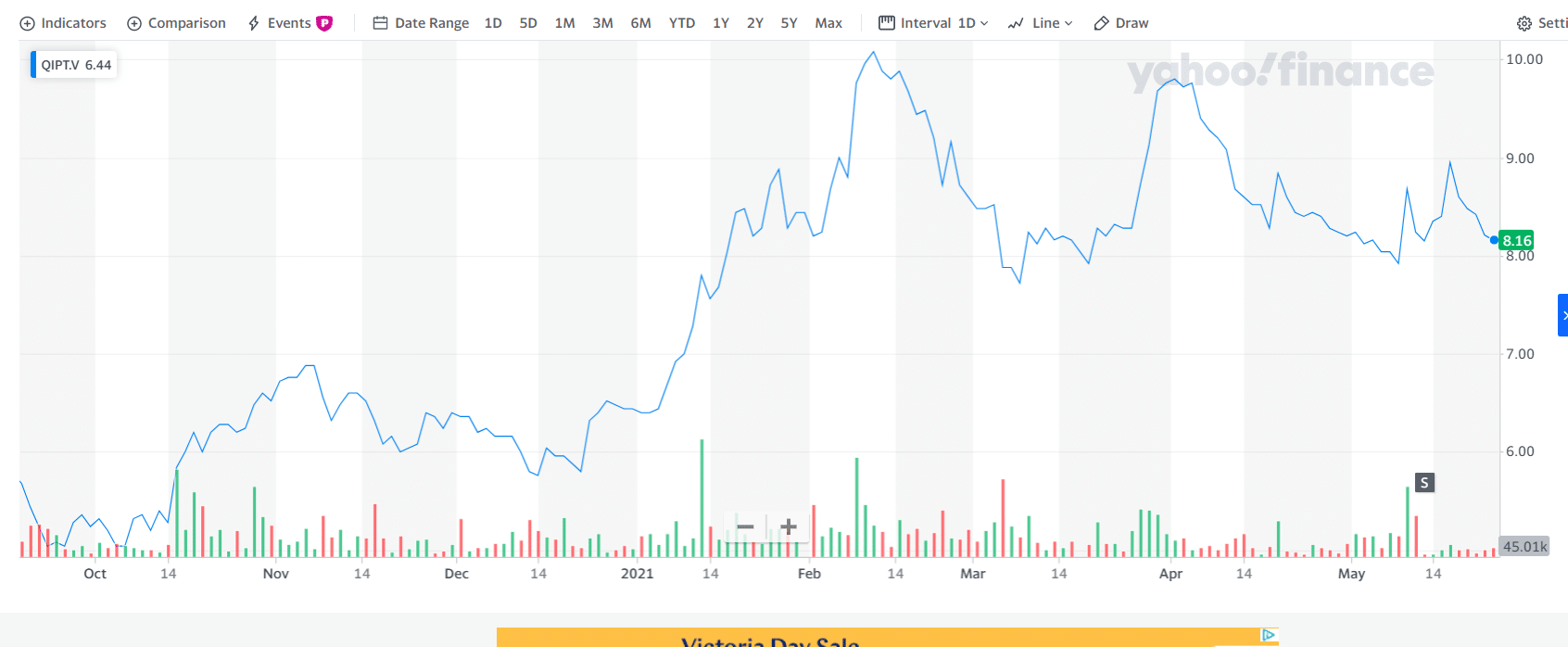

QIPT finished 2020 up 66 per cent, while so far in 2021 the stock is up a further 31 per cent.

Quipt last reported earnings on March 2, 2021, where its fiscal first quarter 2021 (ended December 31, 2020) featured revenue of $22.8 million, up 32 per cent year-over-year, and adjusted EBITDA up 53 per cent year-over-year to $5.1 million. Quipt showed a 33-per-cent increase in its customer base in the Q1 2021 compared to the same quarter a year earlier, with the company saying it continues to see strong demand for respiratory equipment such as oxygen concentrators and ventilators along with demand for CPAP and other supplies.

“As seen in our financials, our recurring revenue grew to 75 per cent of total revenue and we anticipate a further uptick with a full quarter of contribution from SleepWell. This strong recurring revenue platform provides us further stability and consistency as it relates to our growth outlook and is a direct result of the infrastructure we have developed,” said Crawford in a press release. “Our path forward is crystal clear, and with an extremely healthy balance sheet our focus for 2021 is to seek larger, more transformative acquisitions.”

With his update, Sarugaser has revised his estimates on QIPT and is now calling for fiscal 2021 and 2022 revenue of $101 million and $128 million, respectively, and fiscal 2021 and 2022 EBITDA of $23 million and $30 million, respectively.

The analyst estimates QIPT to be currently trading at 7.3x his 2022 EV/EBITDA estimates compared to its North American medical equipment provider peer group average at 10x.

“Beyond the incorporation of QIPT’s recent acquisitions into our model, we assume the company will continue to be acquisitive. Based on the pacing of QIPT’s historical M&A, we estimate three additional acquisitions through 2022, conservatively assuming each contributing $7 million in annualized revenue and having 23 per cent EBITDA margins,” Sarugaser wrote.

“As we highlighted in our [December 15, 2020 initiation-of-coverage report], we see the potential for significant value creation among well-capitalized, acquisitive, technology-enabled healthcare services operators — operators like QIPT —i n the fast-growing US DME industry,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment