Renewable energy stock Algonquin Power (Algonquin Power Stock Quote, Chart, News, Analysts, Financials TSX:AQN) is well off its high hit earlier this year, and with the whole renewable sector seemingly now taking a breather, investors might have the opportune moment to get in on AQN stock.

Renewable energy stock Algonquin Power (Algonquin Power Stock Quote, Chart, News, Analysts, Financials TSX:AQN) is well off its high hit earlier this year, and with the whole renewable sector seemingly now taking a breather, investors might have the opportune moment to get in on AQN stock.

Oakville, Ontario-based Algonquin is a diversified international power generation, transmission and distribution company with about $12 billion in assets across sustainable and renewable power generation. The company has long-term contracted wind, solar and hydroelectric generating plants worldwide representing over 2.5 gigawatts of installed capacity.

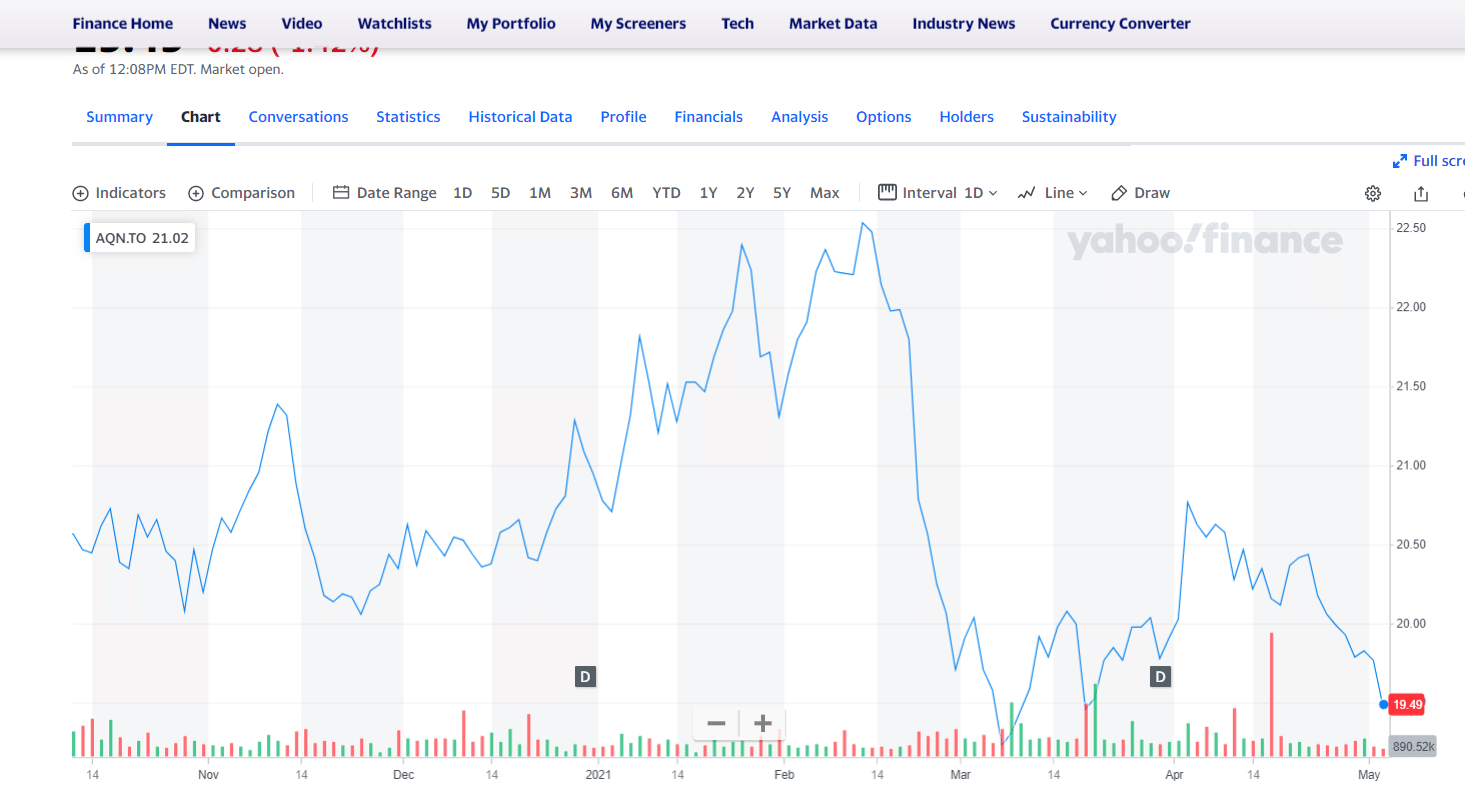

Algonquin’s share price has been performing well for years, but the stock cranked it up a notch over the back end of 2020, returning 19 per cent over July to December and maintaining that pace through January and early February.

But then came the cold snap and power outage event in Texas which impacted Algonquin’s wind farms in the state, resulting in a major hit to the company’s bottom line. Algonquin’s revenue from its Texas facilities comes from a mix of financial hedges and swaps, long-term power purchases and market energy settlements, and with the power outages, Algonquin was on the hook to deliver energy at vastly inflated pricing. All told, the company said its 2021 adjusted EBITDA could see a five to six per cent drop.

“The Company continues to assess the aggregate net impact of these unusual weather conditions on its business, operations, results and financial performance. Based on available information, the unfavourable financial impact of these weather events on 2021 adjusted earnings before interest, taxes, depreciation and amortization (‘Adjusted EBITDA’) is currently estimated to be between $45 million and $55 million,” said Algonquin in a February 19 press release.

Get Cantech picks before anyone else does.

Cantech Alerts delivered straight to your inbox. Click here for this free service.

The result was a precipitous decline in share price — big for a utility, at least — at about 13 per cent between mid-February and early March. And the stock has yet to recoup those losses.

But Algonquin’s fate so far this year has also been impacted by a general malaise in the recently red-hot renewables space. Renewables (pardon the pun) cleaned up in 2020, as witnessed by the S&P Global Clean Energy Index, which tracks the sector across developed and emerging markets worldwide and ended the year up 138 per cent. The story has been less grand so far in 2021, with the Index currently down 18 per cent for the year.

Is AQN stock a buy?

But the pullback should be a buying opportunity for investors looking to pick up renewable stocks like Algonquin.

Portfolio manager Brendan Caldwell of Caldwell Investment Management thinks the dip in AQN’s share price could be a temporary blip in a much longer upward trajectory.

“The power outage would seem to be a temporary setback. There are power outages — it’s part of the business that power goes out — and little, short term negatives like that on stocks in general, if it’s a company you really like and the thing is going to be fixed then I think that it’s a good time, generally, to get into stocks,” said Caldwell, speaking on BNN Bloomberg on Monday.

“I am really keen on renewable power and really keen on energy in general. And we’ve seen not only Algonquin Power but all the renewable stocks have not done particularly well this calendar year. So, if you believe in renewable energy on a longer term basis, this pause is probably a good opportunity to begin to build a position in the sector,” Caldwell said.

Algonquin, currently sitting at an almost $12-billion market cap and just shy of a four per cent dividend yield, is set to deliver its first quarter financials on Thursday. The company last reported earnings in March where its fourth quarter 2020 featured revenue of $492.4 million, up 12 per cent year-over-year, and adjusted EBITDA of $253.1 million, up ten per cent year-over-year.

For the 2020 year, Algonquin saw decreased customer demand due to the COVID-19 pandemic, while at the same time the company hit a number of milestones, including now over one million customer connections in its Regulated Services Group and undertaking the company’s largest construction program to date, with 1,600 MW of renewable energy projects under construction. AQN was busy on the A&M front, as well, buying assets in Latin America and the Caribbean along with wind facilities in south Texas.

By the numbers, Algonquin’s 2020 featured annual revenue up three per cent to $1.677 billion and adjusted EBITDA up four per cent to $869.5 million.

“We are pleased to report solid fourth quarter and full year 2020 results, which, despite the year’s challenges due to the COVID-19 pandemic, reflect year-over-year growth in all of our key financial metrics and several exciting new growth initiatives,” said Arun Banskota, President and CEO, in a March 4 press release. “We remain confident that our robust $9.4 billion capital expenditure plan from 2021 through 2025 will continue to drive further growth in earnings and cash flows.”

Get Cantech picks before anyone else does.

Cantech Alerts delivered straight to your inbox. Click here for this free service.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment