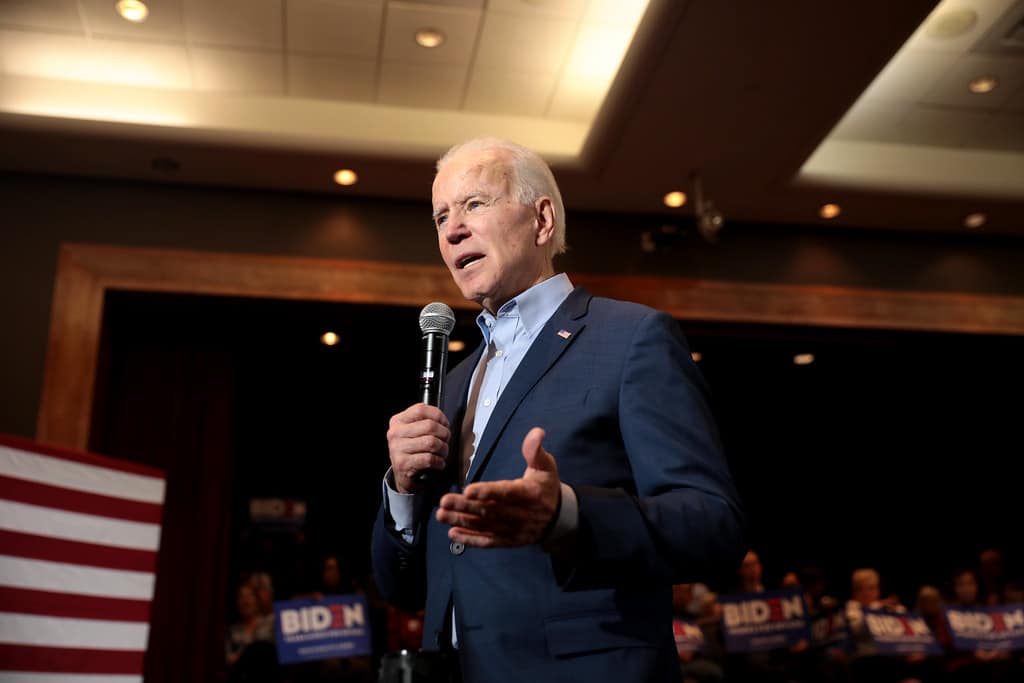

Stocks in the defense sector keep performing well this year but opinions are divided over the longer-term outlook for the space. Count portfolio manager Norman Levine among the skeptics, as Levine argues the Biden administration is going to be bad news for defense stocks.

Stocks in the defense sector keep performing well this year but opinions are divided over the longer-term outlook for the space. Count portfolio manager Norman Levine among the skeptics, as Levine argues the Biden administration is going to be bad news for defense stocks.

“The defense industry in total is starting, I believe, to roll over here, and the reason is that the Biden administration is not viewed to be as hostile, shall we say, as the Trump administration more,” said Levine, managing director and Portfolio management Corp, who spoke on BNN Bloomberg on Friday.

“It’s not as defense-spending oriented as Trump and that’s really what the defense stocks trade off of,” says Levine.

That same viewpoint on defense stocks vis a vis their largest customer by far — the US government — was recently expressed by Danielle Shay, director of operations at Simpler Trading, who spoke on CNBC in April.

“I’m not anticipating this group to do well under President Biden. It’s just simply not going to be the same environment that we had under President Trump,” Shay said in an April 12 edition of Trading Nation.

“This is a ‘buy the rumour, sell the news’ [situation]. Call credit spreads up here at resistance are going to be a great options trade, and I’m looking to trade lower here, near term,” she said.

But while a Democrat in the Oval Office might normally equate to a more dovish outlook on defense, so far, the markets haven’t read it that way.

It’s been five months now since the Joe Biden win over ex-president Donald Trump and there’s been surprisingly less volatility in defense stocks over that time span. In fact, ETFs tracking the sector like iShares US Aerospace & Defense and SPDR S&P Aerospace & Defense are up 35 per cent and 41 per cent, respectively, since election day on November 3.

Meanwhile, defense titans like Raytheon Technologies and General Dynamics have returned huge at 47 per cent and 42 per cent, respectively, while aviation-heavy Lockheed Martin is up just six per cent.

Want more evidence? President Biden delivered his first budget proposal to Congress in early April, which at $1.5 trillion called for increases to areas like schools in low-income areas and federal funds for action on climate change but was light on defense spending. In total, the discretionary spending budget request included a 16-per-cent increase in non-defense spending but only a 1.7-per-cent increase in defense spending, with that bump mostly going towards salary increases.

“The focus will be on investments on non-defense, but also ensuring the Defense Department can continue its strategic goals as we outcompete China, and as we ensure that the men and women in uniform have everything that they need,” said an administration official to reporters on April 9.

With that much of a comparative snub, one would think defense stocks would have suffered, but the near-term impact has been fairly negligible, as stocks like GD and RTX have kept up their winning ways while XAR is flat since early April and ITA is up slightly.

For a bullish perspective, Craig Johnson of Piper Sandler says the ITA chart shows good technicals.

“I think sometimes a good defense might be a good offence and if you look at this chart, it looks very good. It looks like your classic sort of a sunny triangle setup. You’ve been breaking out to new highs and from my perspective we trade back to the old highs you’d be looking at about 14-per-cent upside,” Johnson said on CNBC’s Trading Nation.

“Better yet just the size of the chart the setup suggests that you can have kind of mid 20s type upside from here and when you look through the stocks that make up the ITA,” Johnson said. “A lot of those charts, whether it’s Raytheon or whether it’s Northrop Grumman, they look like pretty attractive looking charts and this is an index that I would be buying in here.”

Raytheon posted its latest quarter in late April where its first quarter 2021 featured revenue of $15.25 billion compared to $18.2 billion a year earlier and adjusted EPS of $0.90 per share compared to analysts’ consensus estimate at $0.88 per share.

General Dynamics reported its Q1 2021 on April 28, showing revenue up seven per cent to $9.4 billion and EPS of $2.48 per share versus the Street expectation of $2.30 per share.

Speaking on the defense space in January, Citigroup analyst Jonathan Raviv said he’s buying any weakness in the sector.

“We don’t think Biden is actually that bad for defense,” said Raviv to clients, as reported by CNBC. “[Biden] said in September that he doesn’t foresee major budget reductions. And his national security nominees appear as if they’ll focus on a smaller, more technologically-advanced military to face rising challenges.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment