Canadian flight simulation company CAE (CAE Stock Quote, Chart, News, Analysts, Financials TSX:CAE) still hasn’t returned to its pre-COVID highs, but portfolio manager Christine Poole says that may take a while.

Canadian flight simulation company CAE (CAE Stock Quote, Chart, News, Analysts, Financials TSX:CAE) still hasn’t returned to its pre-COVID highs, but portfolio manager Christine Poole says that may take a while.

“The stock has had a good run and I think that it’s fully valued, near term,” said Poole, CEO and managing director for GlobeInvest Capital Management, who spoke to BNN Bloomberg on Tuesday.

“We don’t own [CAE] in our client portfolios, but it is a well run company and I do like this acquisition they’ve recently done because it diversifies out of the commercial aviation space,” Poole said.

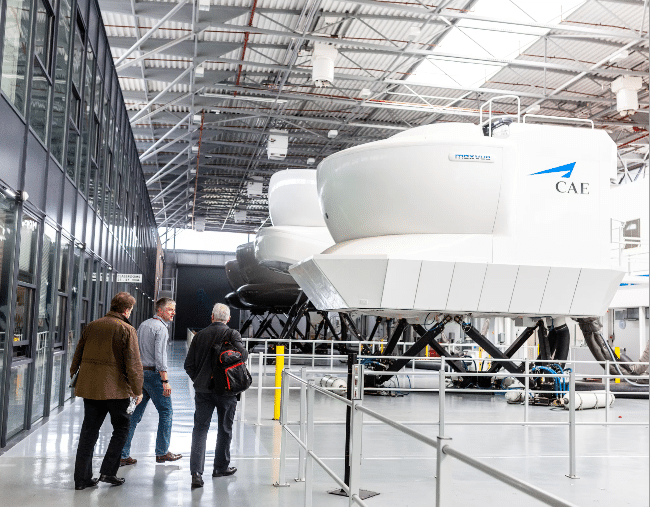

Montreal-based CAE is a flight training solutions company with tech geared at the airline, healthcare and defence sectors and training facilities now in 35 countries. CAE saw its share price skewered in the early days of the pandemic as the market connected the stock with the wider aviation space which ground to a halt with global lockdowns and border restrictions.

CAE’s business did take a hit from COVID. Facility closures and travel restrictions impacted its Civil Aviation Training Solutions segment and the company’s simulator manufacturing slowed over the first half of 2020. In its Defence and Security segment new government contracts dried up, while Healthcare, the company’s smallest business, the market in simulation products to academic institutions and nursing schools faltered as schools dealt with lockdown protocols and hospitals shifted focus to the pandemic.

But the company started to see the light at the end of the tunnel last fall with its fiscal second quarter financials delivered in early November. There, CAE reported revenue up 28 per cent compared to the previous quarter (while still down 21 per cent year-over-year) to $704.7 million and EPS was almost back in black at negative $0.02 per share compared to negative $0.42 per share in the previous quarter. (All figures in Canadian dollars except where noted otherwise.)

The trend continued with CAE’s fiscal third quarter, delivered in February, where the company reported a topline up 18 per cent sequentially to $832.4 million and EPS rising to $0.18 per share.

Just released on Wednesday, CAE’s fiscal fourth quarter showed a company slowly reaching for its pre-COVID game, hitting Q4 revenue of $894.3 million compared to $977.3 million a year earlier. For the fiscal year, CAE’s revenue was down 18 per cent to $2,981.9 million.

“In the face of the biggest-ever shock in the history of civil aviation and major disruptions across the defence and healthcare markets, CAE rebounded to quarterly profitability and positive free cash flow after only our first quarter,” said CEO and president Marc Parent in a press release.

“Our recovery momentum has continued into the fourth quarter with average training network utilization of 55 per cent and sequentially higher margins in Civil, order bookings to sales breaking above 1.1x in Defence, and record quarterly revenue in Healthcare.”

Perhaps just as noteworthy over the quarter CEA announced the acquisition of L3Harris Technologies, a global aerospace and defence tech company with about $18 billion in annual revenue, 48,000 employees and customers in over 100 countries. The announced deal would see CAE pay US$1.05 billion for L3Harris, with CAE saying the company is expected to add a low-teens percentage to its EPS over the first full year after closing.

CAE said acquiring L3Harris will accelerate its growth strategy in defence and broadens its position in the US.

“The acquisition will expand CAE’s position as a platform-agnostic training systems integrator by diversifying CAE’s training and simulation leadership in the air domain, complementing land and naval training solutions, and enhancing CAE’s training and simulation capabilities in space and cyber,” CAE said in a March 1 press release.

CAE has raised a lot of cash of late, some of which will go towards the L3Harris buy. In mid-March, CAE closed on a public offering of about 10.5 million shares for gross proceeds of about $360 million. That came after two earlier private placements for aggregate net proceeds of $700 million.

Poole says the L3Harris deal will help fill out CAE’s business.

“[CAE] is a great industrial company,” Poole said. “They actually just issued some equity to fund their acquisition of L3Harris for military training, so that increases their expansion on the military side and not just commercial aviation.”

After falling off a cliff in February and March last year, CAE’s share price rose just as dramatically over the second half of the year, finishing 2020 up almost three per cent. The stock is currently down about five per cent for 2021.

With the fiscal fourth quarter 2021 results on Wednesday, CAE’s adjusted earnings for the year were $0.47 per share compared to $1.34 per share for fiscal 2020. The company’s backlog at the fiscal year end stood at $8,201.1 million compared $9.458.1 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment