Dialogue is a B2B virtual healthcare platform providing on-demand access to over 500 multidisciplinary providers and trained professionals across 12 clinical specialties as well as non-clinical healthcare including career counselling and financial advising. The company has relationships with over 2,000 customers in Canada and Germany, over 50,000 customers served through partnerships and as of January 31, 2021, had about 2.5 million Canadians and dependants with access to its virtual platform, representing the largest telemedicine market share in Canada.

The Montreal-headquartered company closed on its initial public offering on March 30, 2021, selling an aggregate of about 8.3 million common shares at $12.00 per share for gross proceeds of about $100 million. Begun in 2016 as a virtual care app, the company launched its in-house developed stress and mental health offering in 2019 and then its internally-developed Employee Assistance Program offering in 2020. Dialogue entered the German market with the acquisition of Argumed in 2020, while its acquisition of EAP solutions company Optima put Dialogue in the category of one of the three largest EAP providers in Canada.

In her initiation, Stellick pointed to the ongoing digital revolution in healthcare, where technology that empowers the patient has been a positive disruptor. Stellick said there’s an increasing acceptance of digital health options, where both patients and providers can benefit in a number of ways including better data collection, lower-cost alternatives to traditional therapies, the ability to access treatment remotely, large reach, improved outcomes and medication adherence, better access to underserved populations, better promotion of self-management, early intervention and prevention and patient personalization.

Stellick says the sea change in healthcare dovetails with Dialogue’s business and its Integrated Health Platform.

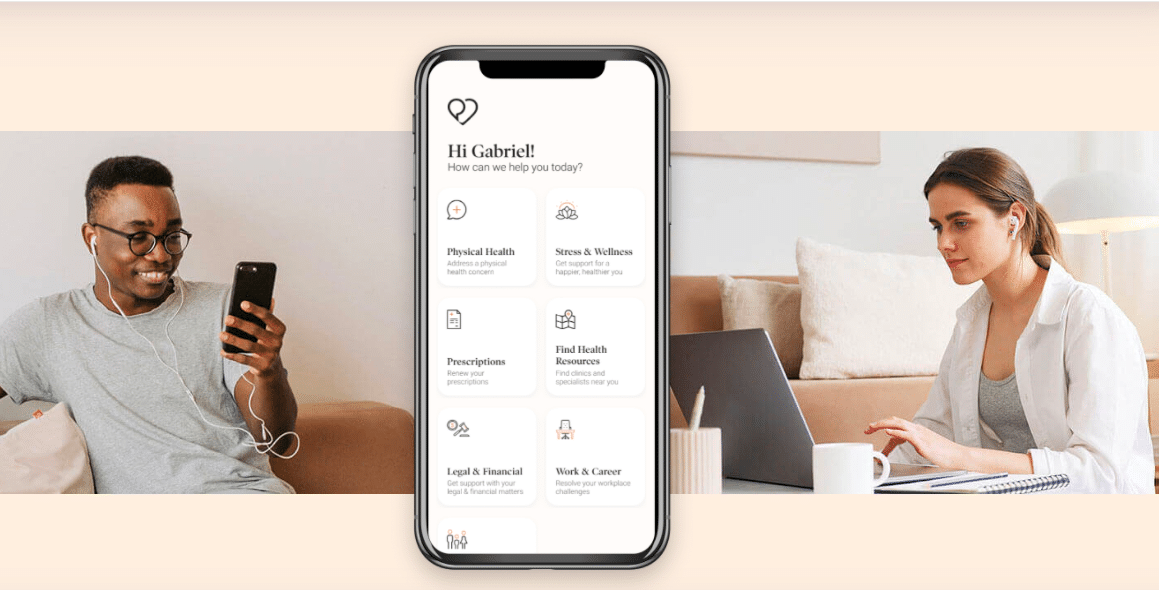

“Dialogue has built its platform using proprietary technology that links users, providers and customers together. It is Canada’s only integrated platform housing three programs: Primary Care (PC), Mental Health (MH), and employee assistance programs,” Stellick wrote.

“By being first to the business-to-business (B2B) market, Dialogue maintains strong and growing relations with some of Canada’s top employers. CARE’s cloud-based infrastructure is designed to support its increasing customer base as well as growing service offerings that will be deployed across new and existing geographies,” Stellick said.

Stellick said that while on their own, Dialogue’s product offerings (across primary care, mental health, EAP and occupational heath & safety (OHS)) are not unique in the market, the company’s seamless integration of the offerings in a single platform represent a difference-maker. Moreover, the analyst said Dialogue’s national presence in Canada with its bilingual support in French and English give it a scale “not realized by several more regional competitors or by those whose app and team of providers are monolingual,” Stellick wrote.

On the EAP side, Canada’s largest insurance company, Sun Life, became a Dialogue shareholder in May, 2020, when the company was looking for a COVID-19 virtual care app. Dialogue launched a complete white labelled app for Sun Life in April 2020, branded Lumino Health Virtual Care, with Sun Life now remaining “a close strategic partner” with Dialogue, according to Stellick.

By the numbers, Stellick thinks Dialogue will generate 2021, 2022 and 2023 revenue of $69.4 million, $100.8 million and $131.7 million, respectively, and 2021, 2022 and 2023 adjusted EBITDA of negative $14.7 million, negative $3.5 million and $8.2 million, respectively.

Stellick said multiples in the health tech sector are justifiably expansive given the rapid growth profile of the digital healthcare space and that Dialogue will benefit “at least as much as its peers” from the low cost of capital during its scaling-up phase and perhpas more, given what the analyst has outlined as its unique competitive advantages.

“Although health technology is increasingly competitive and crowded, we believe the sector’s rapid growth will be a boon for early entrants like Dialogue, which were positioned in this space before the pandemic and immediately capitalized on the accelerated transition to telehealth,” Stellick wrote.

“Dialogue has all the advantages of a market leader, with upside potential for remarkable organic revenue growth given the durable sector expansion through growing both customers and revenue per customer. Costs and operational difficulties of switching software providers for a large organization are meaningful, and in combination with high user satisfaction Dialogue has highly sticky customers. Revenue is both recurring and predictable, which simplifies operational decision making and is desirable for investors. Dialogue’s infrastructure and software are highly scalable with modest expansion of gross margins possible with increasing scale in the coming year,” Stellick said.

Stellick initiated coverage of CARE with a “Buy” rating and $21.00 target, which at press time represented a one-year return of 23.5 per cent.

Upon its debut, Dialogue’s share price immediately jumped 30 per cent and hit as high as $19.49 by its fifth day of trading. The stock has pulled back a bit since and is in the $18.00 range

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment