Auxly Cannabis (Auxly Cannabis Stock Quote, Chart, News, Analysts, Financials TSXV:XLY) is well-positioned to excel in Canada’s emerging Cannabis 2.0 market, according to Mackie Research Capital analyst Greg McLeish, who delivered an update on the company on Tuesday. McLeish maintained his “Buy” rating for the stock with a raised target price of $0.50 (previously $0.40).

Auxly Cannabis (Auxly Cannabis Stock Quote, Chart, News, Analysts, Financials TSXV:XLY) is well-positioned to excel in Canada’s emerging Cannabis 2.0 market, according to Mackie Research Capital analyst Greg McLeish, who delivered an update on the company on Tuesday. McLeish maintained his “Buy” rating for the stock with a raised target price of $0.50 (previously $0.40).

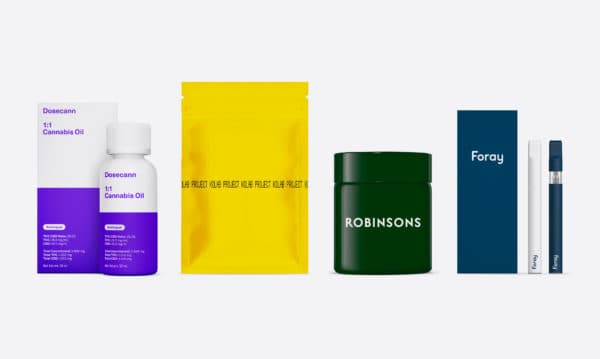

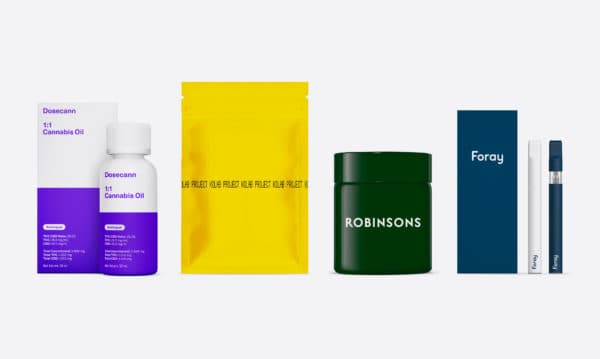

Toronto-based Auxly Cannabis has a portfolio of Cannabis 1.0 and 2.0 products including derivatives such as vapes, chewables and chocoates under the Kolab Project and Foray brands. Auxly announced on Monday the closing of a bought deal short form prospectus offering where it issued about 54 million units (one common share and one-half of a purchase warrant) at $0.37 per unit for gross proceeds of about $20 million including over-allotment.

Auxly said the net proceeds (about $18.9 million) will go towards: incremental costs from the purchase of automated manufacturing and packaging equipment ($2.0 million), $900,000 in additional cash reserves to joint venture partner Sunens to support cannabis production, $11.3 million towards interest expenses payable on December 31, 2021, associated with outstanding convertible debentures and working capital purposes for the balance ($4.7 million).

Last month, Auxly, which was one of the first companies in Canada to distribute and sell Cannabis 2.0 products, announced it had the number one market share position for cannabis derivative products in Canada for 2020, according to data from Headset Canadian Insights. Auxly achieved a 19.2-per-cent share of the vape market (the largest 2.0 market) and 12 per cent of the edibles market during 2020, the first year for the newly-opened industry.

“We are extremely proud to be the Number One LP for Cannabis 2.0 in Canada,” said Hugo Alves, CEO, in a press release. “The amount of support and overwhelmingly positive feedback we have received from Canadian retail consumers throughout this first year of sales has been tremendous.”

“Our commitment to delivering high- quality, differentiated and innovative cannabis products has clearly struck a chord with Canadians and our entire team remains highly motivated to continue our growth trajectory as we start a new year,” Alves said.

On Auxly, McLeish said the company continues to be a leader in Cannabis 2.0 in Canada.

“We believe that Auxly’s assets and capabilities, in particular the powerful combination of Dosecann and KGK, make them uniquely positioned to become a market leader for Cannabis 2.0 products,” McLeish wrote.

“Auxly’s strategic partnership with Imperial Brands will further advance the company’s capabilities in relation to Cannabis 2.0 products. Under the partnership, Imperial Brands has granted Auxly global vape IP licences for cannabis use. Imperial Brands’ subsidiary, Nerudia, has a growing scientific team dedicated to cannabis research and a facility licenced for R&D activities with cannabis,” McLeish said.

“In addition to its vape IP and R&D, Auxly is leveraging Imperial Brands’ expertise to spur new product development and global expansion, including: commercial expansion into new jurisdictions where Imperial Brands’ sales and distribution reach is strongest; global brand building in highly regulated markets; consumer insights and intelligence capabilities; product commercialization expertise; and scalable operational excellence and supply chain management,” McLeish said.

By the numbers, the analyst sees Auxly delivering full 2020 net revenue and EBITDA of $46.5 million and negative $31.5 million, respectively, 2021 net revenue and EBITDA of $107.6 million and $2.9 million, respectively, and 2022 net revenue and EBITDA of $170.1 million and $35.6 million, respectively.

At press time, McLeish’s $0.50 target represented a projected 12-month return of 49.3 per cent. For 2020, XLY finished the year down 53 per cent while so far in 2021 the stock is up 31 per cent.

“Following the 2020 US Presidential election there has been a much more positive tone cannabis companies and this has positively impacted industry valuations,” McLeish said. “As a result, we are increasing our target multiple on Auxly to 12x EV/EBITDA (previous 10x). To arrive at our new $0.50 target, we applied a 12x EV/EBITDA multiple to our new 2022 estimate.”

Auxly reported its third quarter 2020 earnings on November 30, showing net revenues of $13.4 million for the period ended September 30 compared to $1.6 million a year earlier and an adjusted EBITDA loss of $6.8 million compared to a loss of $11.1 million a year earlier. The company reported SG&A expenses dropping to $11.4 million compared to $16.6 million a year earlier, and Auxly ended the quarter with cash and equivalents of $13.6 million.

“Our improved performance was driven primarily by continued improvements in operational and supply chain capabilities, expanding distribution, better alignment of our resources with our commercial objectives and, of course, our continued focus on understanding our consumers and delivering cannabis products that delight them,” said Alves in a press release.

Over the third quarter, Auxly introduced a number of new products including Foray’s Hard Maple Caramels, Dosecann’s omega-Rich Ahiflower Oil Capsules, Kolab Kalifornia dried flower as well as the launch of its Back Forty brand.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment