Qualcomm (Qualcomm Stock Quote, Chart, News NASDAQ:QCOM) had a heck of a year but investors should keep the stock in mind, nonetheless, especially with the rise of 5G networks, says Christine Poole, CEO of GlobeInvest Capital Management.

Qualcomm (Qualcomm Stock Quote, Chart, News NASDAQ:QCOM) had a heck of a year but investors should keep the stock in mind, nonetheless, especially with the rise of 5G networks, says Christine Poole, CEO of GlobeInvest Capital Management.

Qualcomm has pulled back over the past week but overall it’s been a banner year for QCOM, which is currently up 67 per cent year-to-date. And that’s on top of a dividend currently yielding 1.8 per cent.

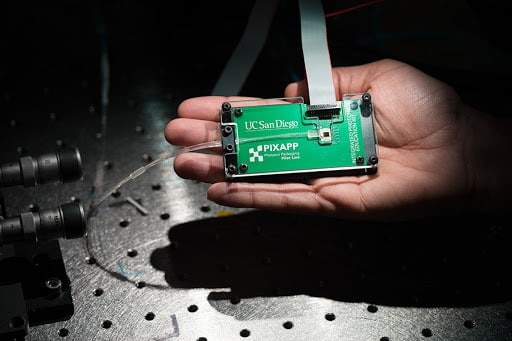

Those gains are more or less industry-wide, as semiconductors stocks have seen a nice lift in 2020. Qualcomm has brought strong financials to the table, too, as exemplified last month in its fiscal fourth quarter earnings which came in ahead of expectations.

Qualcomm said after slower days earlier in the pandemic, consumer demand for smartphones has returned, while adoption of 5G networks and handsets are likely to provide a tailwind going forward.

“Our fiscal fourth quarter results demonstrate that our investments in 5G are coming to fruition and showing benefits in our licensing and product businesses,” said Steve Mollenkopf, CEO of Qualcomm, writing in the Q4 press release.

Qualcomm hit $6.5 billion in adjusted revenue, up 35 per cent year-over-year, while diluted earnings were $1.45 per share, up a full 86 per cent from a year earlier. Analysts were calling for revenue of $5.93 billion and EPS of $1.17 per share. (All figures in US dollars.)

Management also gave fiscal first quarter guidance which called for revenue to climb to between $7.8 billion and $8.6 billion compared to $5.0 billion a year earlier and EPS to be between $1.95 and $2.15 per share compared to $0.99 per share for Q1 of fiscal 2019.

“We concluded the year with exceptional fourth quarter results and are well positioned for growth in 2021 and beyond. As the pace of disruption in wireless technology accelerates, we will continue to drive growth and scale across our RF front-end, Automotive and IoT adjacencies,” wrote Mollenkopf.

But the semiconductor space is fairly tied to externals such as general swings in the economy and trade tensions between the US and China, which make it a tougher space to invest, says Poole, even when it comes to a good-looking stock like Qualcomm.

“We don’t own Qualcomm but it’s on our watch list,” said Poole, speaking on BNN Bloomberg on Monday. “Generally speaking, I find that semiconductor stocks tend to be more cyclical and it’s not an area to which we usually commit a lot of client money.”

“We’ve just found other opportunities for growth stocks in other areas that are more attractive right now, so it’s not a name that we’re planning to add in the near term. But I think it will give you a good exposure by 5G and it should have a nice ramp up as that unfolds in the next couple of years,” Poole said.

“Qualcomm is well-positioned for 5G and even though it’s trading at a relatively reasonable multiple for a semiconductor stock, the stock has done very well this past year. So I’m not surprised the stock has pulled back in the last few days on this potentially negative news on the longer term,” she said.

Cowen analyst Matthew Ramsay recently upped his price target on Qualcomm, calling it the industry’s premier 5G pure-play and one well-positioned for the 2021-22 global 5G volume ramp.

In an update last week to clients on Qualcomm, Ramsay reasserted his “Outperform” rating while raising his target from $170.00 to $180.00, which at the time of publication represented a projected 12-month return of 13 per cent.

“We model material upside to fiscal 2021/22 consensus driven by expanding 5G share/ASPs (global and China), RF content growth, and strong 5G iPhone units … with still conservative RF/Auto/IoT assumptions in our fiscal 2022 estimates,” said Ramsay.

Poole said one potential dark cloud on the horizon for Qualcomm may be a loss of business from Apple, which is increasingly making its own chips and processors rather than partner with companies like Qualcomm.

Poole said, “In the past, Qualcomm had various litigation issues outstanding but those have been resolved and they signed a new agreement with Apple to be a supplier of modem chips for their phones.”

“But one of the reasons I think in the last three days this stock has pulled back is that Apple made mention that they’re looking at doing more work in that area and maybe potentially bringing it in-house at some point,” Poole said. “I think that from what I’ve read it’s still a few years out but that once again highlights the vulnerability for a lot of these suppliers that supply into Apple if they decide to do this more in-house — and that appears for Apple to be the kind of road they’re on because that’s what they’ve done with their chips.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment