It’s taken a while for investors to come around to the new iteration of Maxar Technologies (Maxar Technologies Stock Quote, Chart, News NYSE:MAXR) but those who take the plunge are likely to be rewarded, says portfolio manager Jennifer Radman, who argues that demand for its satellite imaging will drive the company and stock.

It’s taken a while for investors to come around to the new iteration of Maxar Technologies (Maxar Technologies Stock Quote, Chart, News NYSE:MAXR) but those who take the plunge are likely to be rewarded, says portfolio manager Jennifer Radman, who argues that demand for its satellite imaging will drive the company and stock.

What a difference a year makes. Maxar Technologies was down and out this time last year, with its share price having tanked from $85 to sub-$10 territory in a little over 12 months. The market was reacting a string of bad news from the satellite and aerospace company that ran the gamut. Debt issues, accounting mishaps and short-seller attacks combined with a writedown of its satellite business and, in January 2019, the loss of one of its imaging satellites, one that was being pegged as a major revenue source for the company going forward.

Perhaps the turnaround started with the selling off of the Canadian segment of its business, the former MacDonald Dettwiler, which ended up back north of the border in the hands of an investor group that included RIM founder Jim Balsillie. The $1-billion sale helped to reduce Maxar’s debt load and left the company to focus on its satellite and imaging business.

“The sale of MDA furthers execution on the company’s near-term priority of reducing debt and leverage,” said Dan Jablonsky, chief executive of Maxar, said in a December 2019 statement. “It also provides increased flexibility, range, and focus to take advantage of substantial growth opportunities across Earth Intelligence and Space Infrastructure categories.”

And it’s those opportunities in satellite imaging which will be the bread and butter for Maxar going forward, says Radman, who gave Maxar her “Top Pick” designation when she spoke on BNN Bloomberg on Wednesday.

“It’s another stock we own in our Value Momentum strategy,” said Radman, senior portfolio manager for Caldwell. “Strong demand is one of the catalysts that we see. It’s these restructuring stories and Maxar is certainly one of those.”

“Going back a little bit further than a year, there were still question marks on whether this company would be successful. There was issues with the balance sheet. So, they brought in a new management team at the start of 2019 and they made some very good progress on the balance sheet selling off some non-core assets. And we're now at a point where I think once investors can focus beyond that noise,” Radman said.

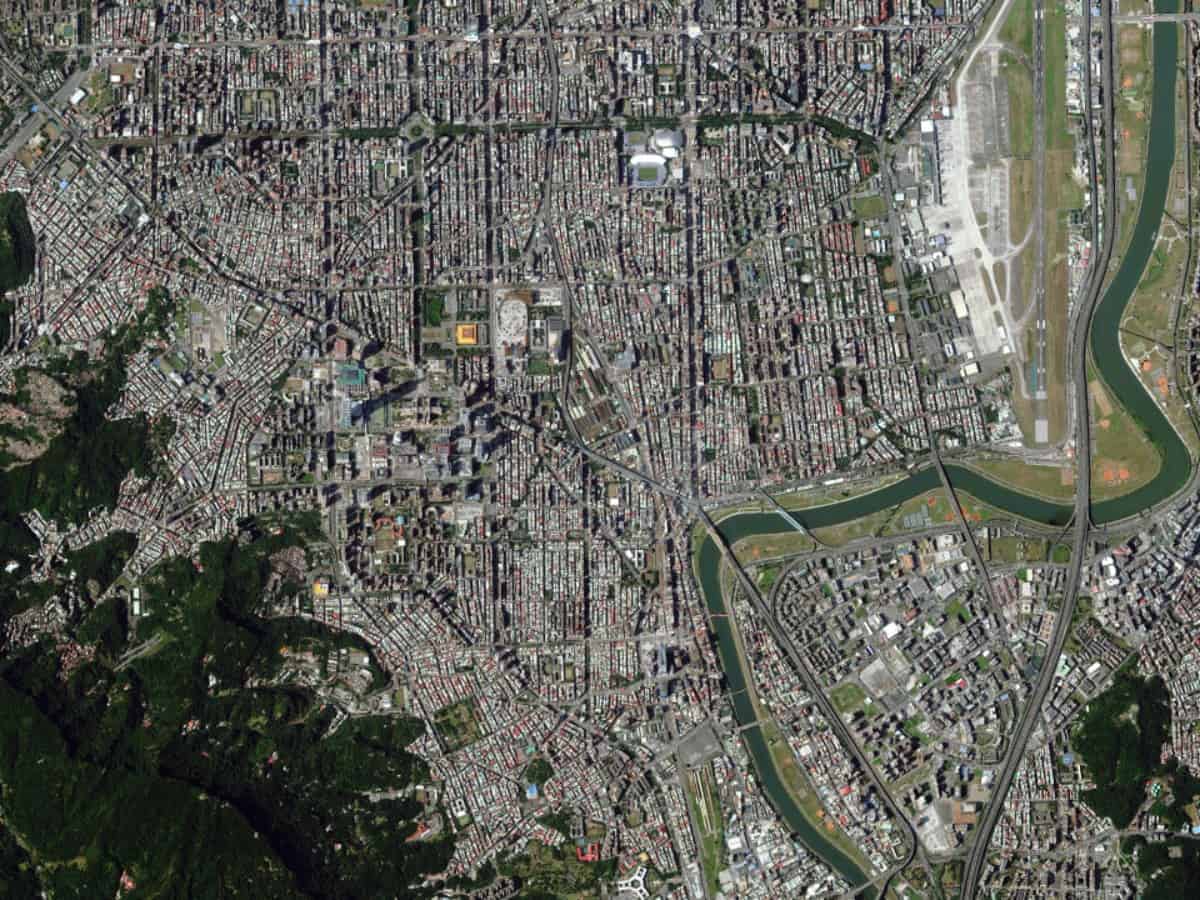

“You have a business that does Earth imaging for government so if the US government wants to know what’s happening in Russia or Korea or the Middle East it’s Maxar that provides that satellite imaging and from what we understand it’s sort of the best that’s out there in terms of the quality of the imagery and so forth,” she said. “And that’s really a very value type of a business and the demand is strong, too.”

Maxar’s strengths were put on display last week when the company announced it had passed the 200-customer mark for its SecureWatch geospatial subscription service, which offers monitoring and mapping capabilities. Maxar said contracted revenue for the product has doubled over the past year.

“Maxar’s SecureWatch platform provides an intuitive way to extract Earth intelligence from massive amounts of satellite imagery to enable better decision making,” said Jeff Culwell, Maxar’s Chief Product Officer, in an October 1 press release.

Maxar will launch its WorldView Legion next-generation Earth imaging satellites next year, and its Maxar’s satellite-launching business itself is gaining more traction, Radman said.

“[That] business really had a tough go of it and it’s coming out of that cyclical bottom where they help communications companies launch satellites. They’re starting to see an uptick of orders there and that should help margins,” Radman added.

“They’re coming off an investment cycle so free cash flow should inflect positively going forward,” she said. “If you put all that together we think there’s some pretty good upside on earnings but then also kind of the multiple that investors are willing to pay on that stock, especially as it comes out of that uncertainty and penalty box of that restructuring.”

The market responded well to Maxar’s latest quarterly earnings, its second quarter delivered on August 6, where the company posted revenue of $439 million compared to $412 million a year earlier and adjusted EBITDA of $11 million compared to $7 million a year earlier.

Analysts seem to have been positive, as well, with Royal Bank of Canada giving an “Outperform” rating to the stock on August 6 and raising their target price from $21.00 to $25.00. And on the second quarter numbers, J.P. Morgan Chase said in a note to clients on August 6, “We think that Maxar’s Q2 should clear a high bar following strong stock performance the past week. Bookings were strong, as expected, but Q2 growth was solidly above expectations … the likelihood of positive [free cash flow] in 2021 is growing.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment