It may be billing itself as the go-to option for secure and connected tech but not everyone is convinced that BlackBerry (BlackBerry Stock Quote, Chart, News TSX:BB) is the right investment choice among a growing field of cybersecurity players. Count Rob Lauzon of Middlefield Capital among the skeptics.

It may be billing itself as the go-to option for secure and connected tech but not everyone is convinced that BlackBerry (BlackBerry Stock Quote, Chart, News TSX:BB) is the right investment choice among a growing field of cybersecurity players. Count Rob Lauzon of Middlefield Capital among the skeptics.

“We don’t own it right now. We owned it a few years back and it just really hasn’t met our expectations for growth,” said Lauzon, managing director at Middlefield, who spoke on BNN Bloomberg on Monday. “So we moved on to US technology companies that give us some cybersecurity [exposure] like Okta (Okta Stock Quote, Chart, News Nasdaq:OKTA). A company like Okta definitely trades at a higher multiple than BlackBerry. ”

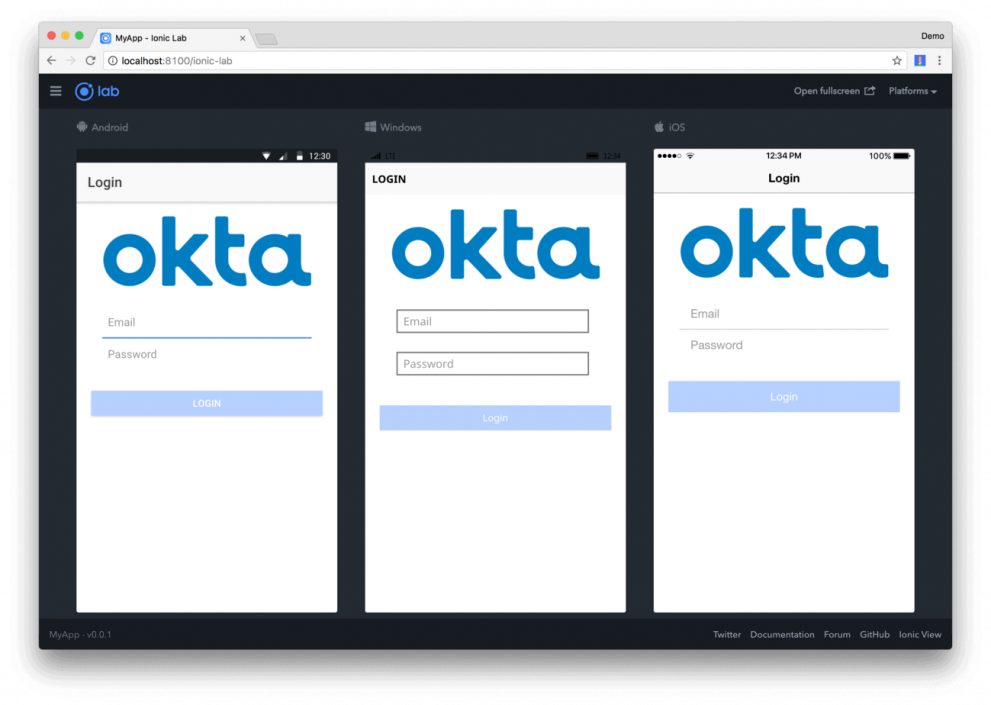

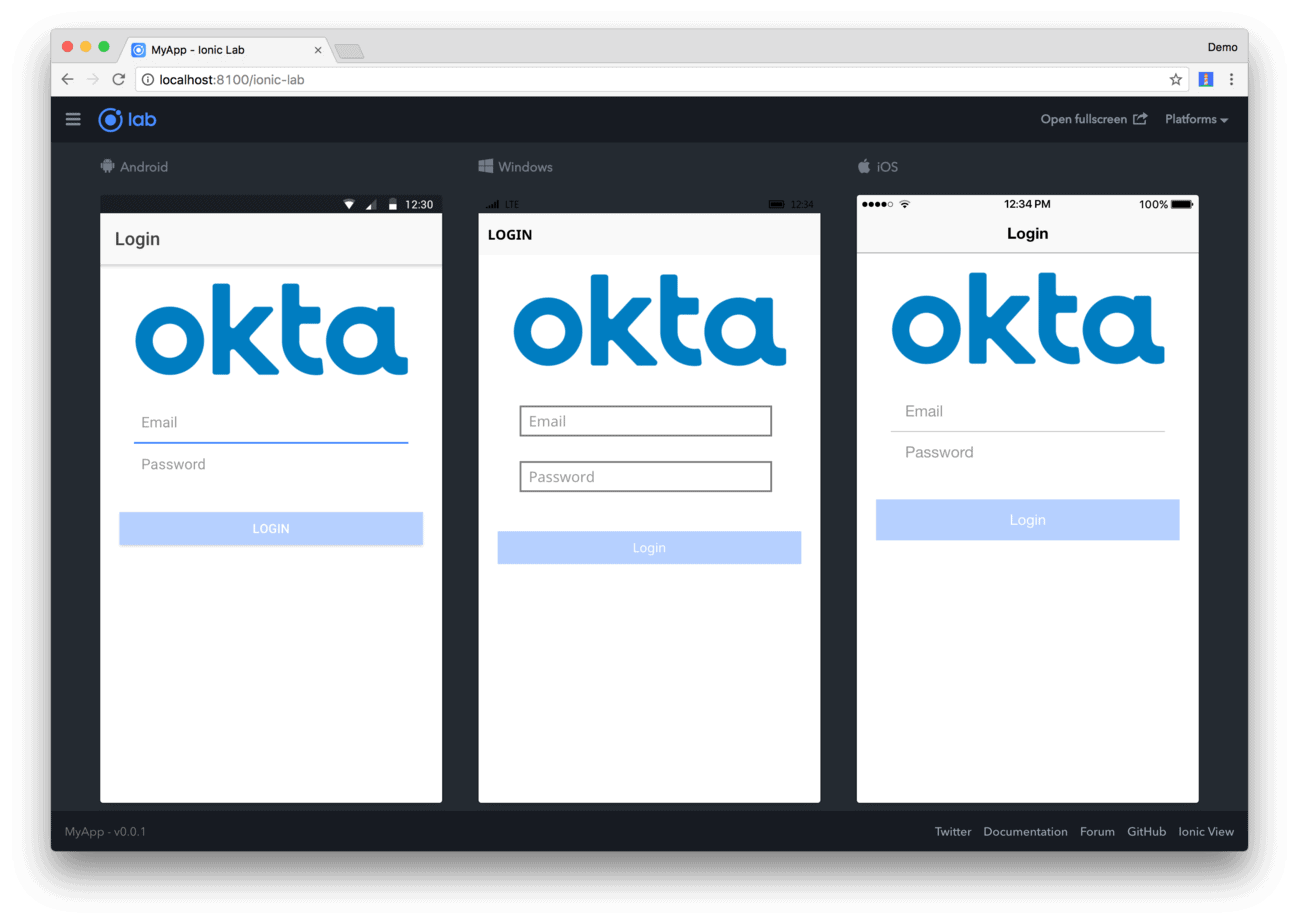

BlackBerry has struggled to get its head back above water in 2020, having made up about half of the ground the stock lost in February and March but it’s still trading at about negative 20 per cent for the year. That contrasts with Okta, a cloud-based user authentication and access management company whose share price has spiked during the COVID-19 pandemic, going from $115 at the start of the year to a double now at $236.

Even before the pandemic, Okta was a strong performer, regularly hitting 45 per cent revenue growth per quarter, but the COVID pandemic has sped up business as remote work becomes more and more the norm.

“The three mega-trends that have been driving our business for the past several years -the adoption of cloud and hybrid IT, digital transformation, and zero trust security- are all being accelerated globally by the current environment," said Todd McKinnon, Okta CEO in the company’s quarterly press release in August.

Contrast that with BlackBerry, whose focus has in part been on connected, IoT technology in the automotive space, one of the unlucky sectors during the current economic downturn. Those car troubles have hit the performance of the company’s QNX platform. Nevertheless, BlackBerry has been reporting stronger results from its endpoint security business, Spark, which helped keep the company in the black in its latest quarter. BlackBerry reported its fiscal second quarter 2021 results in September, featuring overall revenue up six per cent year-over-year and a loss of $23 million or $0.04 per share. In his

quarterly comments, CEO John Chen said he’s seeing signs of life in the auto sector which should help his QNX segment. (All figures in US dollars.)

But Lauzon said the likely endgame scenario will see BlackBerry being bought out by a bigger tech firm.

“One day I think BlackBerry will be taken over and be integrated with another one of these larger global tech companies, but for the time being we just don’t see BlackBerry running on all all cylinders to give us the growth that we need,” Lauzon said. “So we’ve chosen other names in the States for more of the security side of things where BlackBerry’s now specializing through their automotive division.”

Not all Canadian fund managers agree with Lauzon’s assessment of BlackBerry. Fund manager John Zechner of J. Zechner Associates says the firm has sometimes been a rock in his shoe, but he still has love for it anyway.

“I like BlackBerry. It’s been a frustrating trade. I’ve had it as a Top Pick recently,” said Zechner, speaking on BNN Bloomberg earlier this month. “I think cybersecurity is a huge growth area and that was always their strength [with] their cyber network and the software. And I think what [CEO John Chen] has done in terms of changing the direction of this company from a smartphone maker into a cybersecurity [company] has been fantastic.”

But Zechner agrees with Lauzon’s take on the takeout appeal of BB.

First of all, obviously, someone will take a run at this thing at some point. It’s an easy fit-in target for one of the larger company,” he added. “But even without that on a valuation basis I think it’s good. “It’s been under-owned, it’s unloved and I don’t think it’s well-appreciated what an amazing pivot this company has done within the technology industry from a maker of phones to effectively a cybersecurity company. They’re getting very little credit for that, so it’s a buy. I like it,” he concluded.

Earlier in October, BlackBerry announced a new integration between its critical event management platform BlackBerry AtHoc and Microsoft Teams, enabling Teams users to connect quickly with members of an organization in the event of an incident.

“This new capability to manage the incident response process through Teams will streamline communications and give greater visibility over the recovery progress of an unfolding event. This is a great opportunity for us to expand our footprint and provide necessary support to those who are already using the Teams platform,” said David Wiseman, Vice President of Secure Communications for BlackBerry, in a press release.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment