M Partners analyst Paul Piotrowski says cleantech name Xebec Adsorption (Xebec Adsorption Stock Quote, Chart, News TSXV:XBC) is hitting a stride in hydrogen purification, as evidenced by its latest announcement.

M Partners analyst Paul Piotrowski says cleantech name Xebec Adsorption (Xebec Adsorption Stock Quote, Chart, News TSXV:XBC) is hitting a stride in hydrogen purification, as evidenced by its latest announcement.

In an update to clients on Monday, Piotrowski reiterated his “Buy” rating and $5.00 target for XBC, which at press time amounted to a projected 12-month return of 19 per cent.

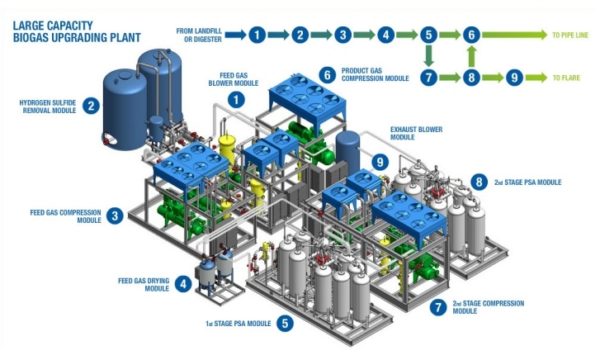

Montreal-based Xebec, which provides gas generation, purification and filtration solutions for the industrial, energy and renewables sectors, announced on Monday $6.3 million in new orders for hydrogen and helium pressure swing adsorption (PSA) purification. Ranging in size from $400,000 to $800,000, the orders are from customers in South Korea, United States, Canada, Italy, Poland, Trinidad and Tobago and China.

The company said the uptick in worldwide adoption of hydrogen power means ore business for Xebec’s PSA technology.

“Xebec is in a unique position with our PSA platform because it can be used in all hydrogen generation system,” said Dr. Prabhu Tao, COO of Xebec, in a press release. “We’ve been developing our purification technology for decades and it is a tried and tested solution that can be applied to everything from helium, renewable natural gas, and hydrogen. It’s exciting to see our Cleantech systems order flow pick up as we continue to grapple with the need to decarbonize and fight climate change.”

Piotrowski called the new orders an important milestone in the development of Xebec’s Cleantech segment.

“Hydrogen purification for fuel cell electric vehicles (FCEV) provides important exposure to a key long-term growth opportunity as governments around the world progressively support the increased use of hydrogen. In the US, demand for hydrogen could reach 13 million metric tons by 2025 (according to Fuel Cell & Hydrogen Energy Association) and China’s installed capacity of hydrogen fuel cells continues to soar highlighting the opportunity for Xebec,” Piotrowski wrote.

The analyst said the heightened demand for Xebec’s technology for hydrogen generation has allowed the company to capture attractive pricing versus its other segments, with gross margins coming in between 40 to 55 per cent on these new orders versus about 30 per cent for other system sales.

Piotrowski noted that while Xebec’s hydrogen business has mainly been in service of the growing demand in China, the company is now seeing “significant demand” from beyond the Chinese market, a trend the analyst thinks will continue to accelerate as governments worldwide increase support for the use of hydrogen.

“We are revising our estimates to reflect the new orders,” said Piotrowski. “In 2020, we now expect $89 million in revenue (versus $88 million previously) and $11.7 million in EBITDA (versus $11.6 million previously). In 2021, we are anticipating $131 million in revenue (versus $128 million previously) and $20.6 million in EBITDA (versus $20.2 million previously).”

“We continue to remain optimistic on the Xebec story and believe the premium to the peer group is increasingly justified. Further, we continue to believe that EBITDA could greatly exceed expectations in 2021 through the new BOO segment, acquisitions, new product offerings and growth supported by renewable energy mandates globally,” Piotrowski said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment