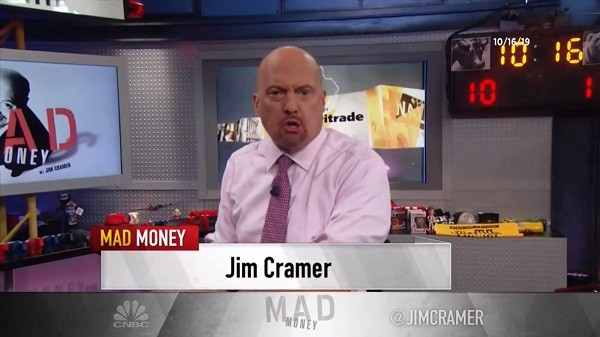

It’s going to be a bumpy road ahead for ride-hailing services like Uber (Uber Stock Quote, Chart, News NYSE:UBER) and Lyft (Lyft Stock Quote, Chart, News NASDAQ:LYFT) but given the choice, Uber appears to have more upside, says CNBC’s Jim Cramer, who thinks there’s a contrarian move to be made with Uber.

It’s going to be a bumpy road ahead for ride-hailing services like Uber (Uber Stock Quote, Chart, News NYSE:UBER) and Lyft (Lyft Stock Quote, Chart, News NASDAQ:LYFT) but given the choice, Uber appears to have more upside, says CNBC’s Jim Cramer, who thinks there’s a contrarian move to be made with Uber.

The COVID-19 crisis has been rough on a number of sectors and that list certainly includes ride services where demand has dropped significantly, reportedly by 94 per cent for Uber in the United States, as social distancing and working from home have been devastating to the industry.

Uber management has tried to calm investors’ worries by saying that while it predicts up to 80 per cent reduction in usage for the rest of 2020, the company’s cash position is still incredibly strong at $10 billion, meaning that Uber can take a number of direct hits and keep on trucking.

For Lyft’s part, the company has almost $3 billion in cash, also a hefty cushion, but Lyft’s business is less diversified than Uber’s. Where Uber is spread out internationally, Lyft is still primarily a US and Canada-based enterprise and on focused directly on ride-sharing versus Uber’s other platforms such as Uber Eats, Uber Freight and its autonomous vehicle initiatives.

Both companies have seen their share prices ripped up by COVID-19, with Uber now down 33 per cent since February 21 when the markets really started heading south and Lyft down 32 per cent for the same time frame. Year-to-date, Uber is down seven per cent and Lyft is down 29 per cent.

Cramer says Uber looks to be the better buy from here.

“I like Uber more than Lyft because Uber’s down a lot and I think people have given up on it,” says Cramer on CNBC’s Lightning Round on Wednesday.

“I sure with they’d get out rather than doubling down on food, though,” he said.

While Uber’s ride-sharing segment is profitable now, Uber Eats is still a work in progress, as witnessed by Uber’s latest quarterly numbers delivered in early February.

Uber saw its Rides business grow by 18 per cent in its fourth quarter 2019 to gross booking of $13.51 billion with an adjusted EBITDA of $742 million and a margin of 24.3 per cent. Eats saw an adjusted EBITDA loss of $461 million, with management pointing to further investment in markets worldwide as determining the loss.

Earlier this year, Uber sold its India food delivery business to competitor Zomato, a move said to be prompted by the company’s newfound need to tighten up and push towards profitability in its segments.

“We recognize that the era of growth at all costs is over,” said CEO Dara Khosrowshahi in the fourth quarter press release. “In a world where investors increasingly demand not just growth, but profitable growth, we are well-positioned to win through continuous innovation, excellent execution, and the unrivalled scale of our global platform.”

Uber’s fourth quarter saw a loss of $0.64 per share and revenue of $4.07 billion. Analysts had been expecting a loss of $0.68 per share and revenue of $4.06 billion.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment