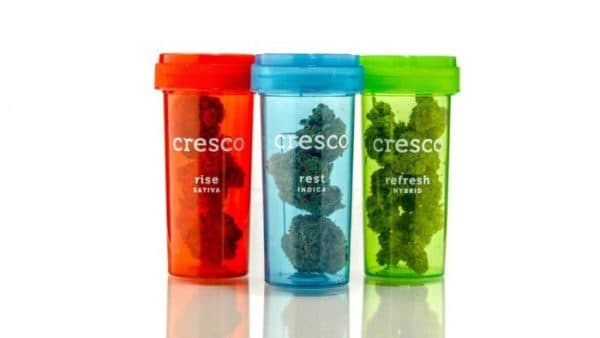

Looking for a pot stock amongst that carnage in the sector? Beacon Securities analyst Russell Stanley says Cresco Labs (Cresco Labs Stock Quote, Chart, News CSE:CL) fits the bill.

Looking for a pot stock amongst that carnage in the sector? Beacon Securities analyst Russell Stanley says Cresco Labs (Cresco Labs Stock Quote, Chart, News CSE:CL) fits the bill.

This morning, Cresco announced that its five Illinois dispensaries -Lakeview, Elmwood Park, Champaign, Buffalo Grove and Rockford, Sunnyside- had opened to a warm reception. The company said customers lined around the building beginning ten hours before opening, which happened at 6am on New Year’s Day.

“We’re ecstatic for our Sunnyside* dispensaries to begin serving recreational customers on such a historic day that launches a new era of cannabis and the development of an industry that will bring greater justice, social equity and business ownership opportunities throughout the state,” CEO Charlie Bachtell said. “With 13 million residents and 100 million annual tourists, Illinois is predicted to be one of the largest recreational cannabis markets in the United States. Cresco is uniquely positioned in the supply-constrained state, with permission for the largest cultivation footprint at 630,000 square feet and 10 retail dispensaries, including three in high traffic areas in the city of Chicago.”

In a research report to clients this morning, Stanley said this development is a clear positive for Cresco Labs.

“IL is the 6th largest state in the US by population with 12.7M people, and the 2nd largest state to legalize adult-use after California,” the analyst noted. “It is also the first state to implement adult-use (including a commercial market structure) legislatively, with other markets having done so via voter ballot initiative. Cresco announced that its stores served 3,145 customers on day 1, with an average ticket of $135. Management noted that lineups began forming on New Year’s Eve as early as 8PM local time, with the dispensaries opening to long lineups at 6AM local time on January 1st. Lt. Governor Juliana Stratton visited the company’s Lakeview location, with local media reports indicating she purchased some Mindy’s glazed clementine orange gummies. Illinois, along with Pennsylvania and California, represent the company’s core three markets, driving the bulk of our revenue forecast. We therefore view the strong opening of the adult-use market in IL favourably.

Stanley today maintained his “Buy” rating and one-year price target of $24.00 on Cresco Labs, a figure that implied a return of 187 per cent at the time of publication.

The analyst thinks CL will post EBITDA (Net NCI) of $131-million on revenue of $562-million in fiscal 2020. He expects those numbers will improve to EBITDA (Net NCI) of $487-million on a topline of $1.19-billion the following year.

Stanley said CL is now trading at a 60 per cent discount to the broad peer group average.

“We have revised our estimates for Q4/19 and F2020 to better reflect the company’s focus on its core markets of IL, PA and CA, which we discuss in more detail on p. 3. Our revisions for F2021 are immaterial at this point, and we are therefore leaving our 12-month target price unchanged. CL now trades at 5.4x our F2021 EBITDA forecast. This represents a 21% discount to the 6.8x average amongst US operators, and a 60% discount to the 13.4x average for the broad peer group. Potential catalysts include completion of the Origin House, Hope Heal Health (Massachusetts) and Tryke (Nevada/Arizona) acquisitions, updates on the buildouts in Illinois and Pennsylvania, and the Q4/19 results.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment