So says Michael Sprung of Sprung Investment Management, who thinks the stock is closer to a Hold at the moment.

Montreal-based CAE has seen its share price rise steadily for the past half-decade, with the pace picking up in 2019. So far, the stock is up almost 38 per cent for the year, and that’s on top of a dividend whose yield is currently at 1.3 per cent.

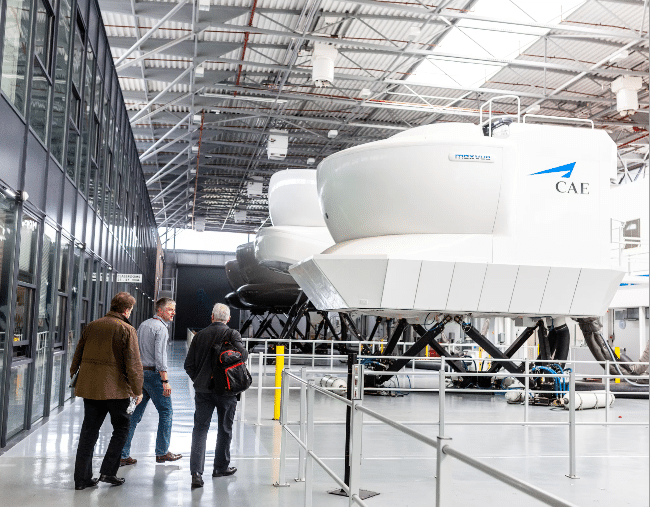

CAE, which makes simulation technologies for the airline, healthcare and defense industries along and has training facilities in 35 countries, is benefiting from sector tailwinds most including a global growth in demand for air travel. Air travel has grown annually by mid-single digits in recent years, with the trend expected to continue into 2035.

All that traffic will require a lot more trained pilots, and with the a large cohort of today’s pilots are expected to retire soon, making for a healthy market for CAE.

Speaking to BNN Bloomberg on Tuesday, Sprung said CAE is also faring well thanks to the grounding of Boeing’s 737 Max, which will need more training simulators to make up the difference once the planes are allowed back in the air.

“CAE is certainly a stock that has done extremely well for us. I own it and our clients own it. Our cost base on this stock is really quite low compared to its current price,” says Sprung, president of Sprung Investment.

“I’m often asked if there’s a really well-managed company in Quebec and I say, yes, CAE is extremely well managed, and they’re in a very good position. These problems that they’re having with the 737 Max, CAE is going to be a beneficiary of that in training pilots,” he said.

On the 737 grounding, CAE CEO Marc Parent has said that his company is well-positioned and is already building unordered pilot training simulators for the eventual go-ahead for the 737 Max.

“Our experience is that airlines rarely do just the minimum that the regulators will ask them, even should the training requirements be exactly the same as before,” Parent said to the Canadian Press in November. “I fully expect that some airlines, a lot of airlines, will move beyond that because they'll want to have dedicated 737 MAX simulators for their own reasons. So we'll be ready for that.”

But all that success for CAE has pushed the stock perhaps too high, says Sprung.

“The price today is a comparably rich valuation compared to where it has been. Even if you go a year or two out, it’s still selling at over a 22x expected multiple on earnings and at mid to high teens on cash flow,” Sprung says. “So, I don’t think that it’s a screaming buy here.”

“There are times when we’ve thought that maybe we should take some profit in this company and certainly if we saw a few more dollars on the upside we’d probably do that, but we still consider it a long-term, core hold,” Sprung said.

“It’s been such a good competitor in its industry, it’s really one of Canada’s stars, in our

opinion,” he added.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment