Canadian telecom and media company BCE (BCE Stock Quote, Chart, News TSX:BCE) may have impressed with its wireless numbers over the last quarter but there’s likely more where that came from, according to Christine Poole of GlobeInvest Capital Management, who says that immigration is helping Canada’s wireless sector to keep on growing.

Canadian telecom and media company BCE (BCE Stock Quote, Chart, News TSX:BCE) may have impressed with its wireless numbers over the last quarter but there’s likely more where that came from, according to Christine Poole of GlobeInvest Capital Management, who says that immigration is helping Canada’s wireless sector to keep on growing.

BCE released its second quarter fiscal 2019 results earlier this month, beating analysts’ expectations for both top and bottom lines, while clearing the fence with its wireless subscriber additions. The company posted operating revenue of $5.93 billion, up from $5.8 billion a year ago and better than the consensus estimate of $5.9 billion, and adjusted earnings of $847 million or $0.94 per share, also a consensus beat where analysts were calling for $0.90 cents per share.

In the company’s remarks on the quarter, CEO George Cope focused on the EBITDA growth and his own upcoming retirement.

“Adjusted EBITDA increased an exceptional 6.8 per cent in Q2 — our 55th consecutive quarter of year-over-year growth — and together with ongoing operational and capital efficiency drove a strong 10 per cent increase in free cash flow this quarter,” he said. “Mirko Bibic is clearly moving the ball forward as our Chief Operating Officer, and I look forward to working with him throughout 2019 as he transitions to the role of Chief Executive Officer in 2020.”

Drilling down, BCE’s Q2 saw 185,667 total wireless, retail Internet and IPTV net customer adds, a 25.5-per-cent growth rate, with the company reporting its best Q2 since 2001 on postpaid and prepaid wireless net customer additions at 102,980 and 46,498, respectively. BCE’s free cash flow over the quarter grew 10.0 per cent to $1,093 million.

The strong quarter was reflected in the company’s share price which had been trading sideways since mid-June only to take off after the Q2 on August 1, climbing 3.3 per cent since then. After a dismal 2018, BCE has powered ahead in 2019 and is now up 15 per cent year-to-date.

But despite that growth, BCE’s wheelhouse is more about steady performance married with a rock-solid dividend, which currently sits at a yield of about 5.2 per cent. Poole says that investors looking for a solid defensive play will be rewarded by BCE.

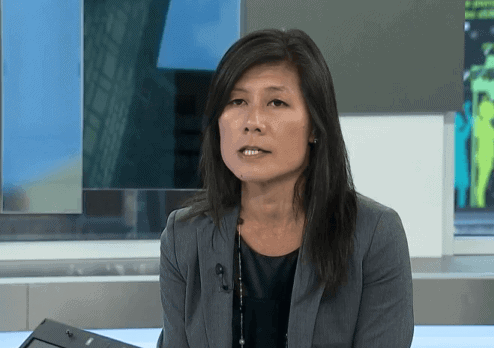

“BCE is a good income stock, a defensive income name,” said Poole, CEO and managing director for GlobeInvest, to BNN Bloomberg on Tuesday. “We do own it in some of our income-oriented portfolios. It provides a nice yield and the company tends to increase its dividend annually in the mid-single digit range.”

Immigration fueling wireless sector…

Poole points to Canada’s growing immigration numbers as fuel for the wireless sector.

“Even though it’s sort of an oligopoly on the wireless side it does appear that all the three major players are continuing to increase their average spend per subscriber and increasing their subscribers,” she said. “We’ve had a big spike in immigration in Canada, partly because of what’s happening in the US, and I think that’s actually helping the overall wireless industry because as new people come into the country they’re not likely to get a wire line, they’re getting a wireless phone and probably more than just one per household.”

“I think that even though penetration in the wireless space is still pretty high, [the telcos] are still all growing,” she says, “And these companies generate a lot of free cash flow and they’re paying a dividend. I don’t expect a lot of upside to these names but you’re definitely getting the income.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment