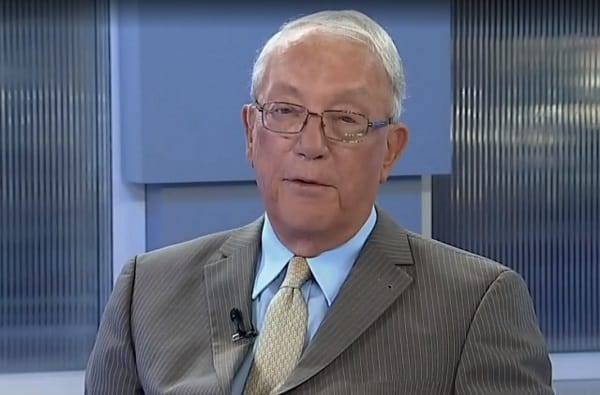

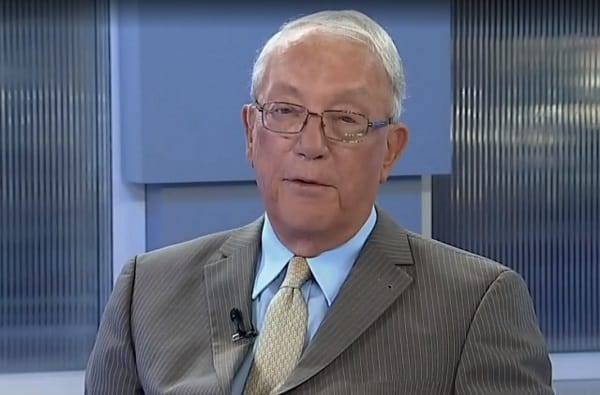

But helped by stronger numbers from its fiscal fourth quarter reported early last month and the stock now stands up 11 per cent year-to-date. A sign that investors should be paying attention? Possibly, says David Cockfield of Northland Wealth Management, but one must always be cagey with airlines.

“I’ve had a lot of experience over the years with airline stocks and most of it has been bad,” says Cockfield, in conversation with BNN Bloomberg on Thursday. “The number that have gone bust over the years is quite amazing. It’s an area in which I’ve been bruised too often to step back into.”

Airlines are notorious for their fortunes being dependent upon extraneous factors, not the least of which is the price of oil. That reality hit home with WestJet’s Q4 numbers delivered on February 5, which saw profit fall by 39 per cent on the back of fuel costs which rose by 20 per cent over the quarter. The 26 cents per share profit beat analysts’ expectations of 14 cents per share, but for the year, the company’s profit fell a full 67 per cent, from $279 million to $91.5 million.

“In 2018 we executed several significant milestones on our path to becoming a high-value global network airline,” said CEO Ed Sims. “As we enter 2019, we continue to build momentum and are well-positioned to deliver on our strategic initiatives and expand margins.”

Cockfield predicts the airline industry will stay strong for the foreseeable future.

“WestJet had a pause but their more recent numbers look good,” he says. “In terms of the environment, I don’t see the North American environment deteriorating in terms of travel. In fact, every time I talk to someone they’re going somewhere.”

“[WestJet] has instituted some profit-protecting moves and I think that the demand is going to be there, so I think they’re going to do okay,” he says. “It has corrected with some of the more recent numbers that we’re that great. I would say that if you hold it, continue to hold it.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment