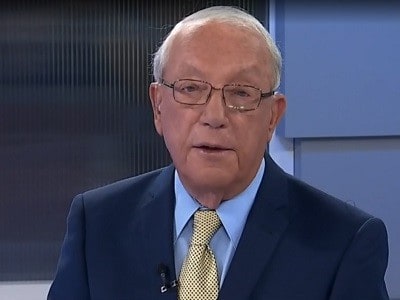

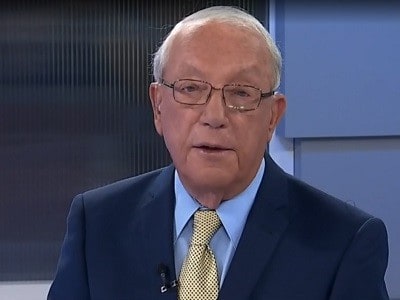

And while the salad days of mobile phone dominance are behind it, there’s lots to look forward to in its new incarnation as a security and software company, says David Cockfield of Northland Wealth Management, who thinks that the stock is worth owning.

“We don’t own it but I like to follow it. They’ve been doing quite well. The company has changed totally from what it was. They’re back into software, which I think they’re pretty good at,” says Cockfield, managing director and portfolio manager at Northland Wealth, to BNN Bloomberg on Thursday.

“I would still say that it’s one of the most secure systems that you can buy,” he says. “They’ve got their pricing on their telephones, which are being produced by somebody else. I would say, if you own it then hold it, and even buy a bit of it on dips.”

Since bottoming out near the end of December, BB has been a strong performer on the TSX, now trading up 25 per cent year-to-date. BlackBerry’s last earnings report came on December 20, where the company beat the consensus forecast for both revenue and profit, generating $226 million in revenue and $59 million in net income.

__________________________________________________________________

CANTECH MARCH CONTEST

Sign up here for Cantech Letter Alerts, stock picks from the pros, and win a copy of the international best seller “The Snowball: Warren Buffett and the Business of Life” by Alice Schroeder

___________________________________________________________________

BlackBerry CEO John Chen has received plenty of praise for his efforts in reorienting the company away from hardware and handsets and towards software and services related to cybersecurity and connected devices.

“March 7 is our 35th anniversary and it’s no longer a turnaround story. It’s really going to turn into a growth story,” says Chen to BNN Bloomberg on Wednesday. “I came in about five, five and a half years ago and we’ve set a chapter 2.0.

“We’re very proud of our heritage and our handset business but we’re going to move into a much more higher growth market,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment