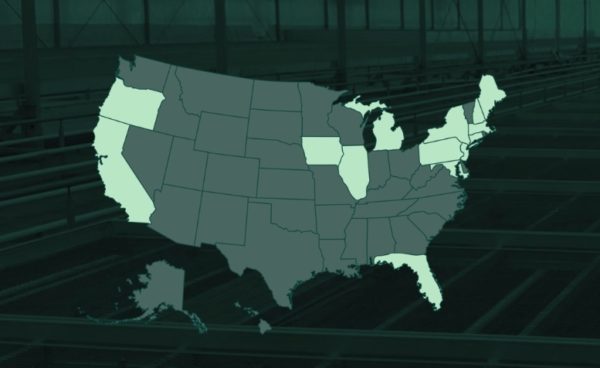

With the purchase of a vertically integrated medical marijuana operation in the major market state of Michigan, US cannabis company Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) should have a head start on the competition in the state’s newly opened up rec cannabis market, says analyst Russell Stanley of Beacon Securities, who on Monday reiterated his “Buy” rating and 12-month target price of $40.00. (All figures in US dollars.)

With the purchase of a vertically integrated medical marijuana operation in the major market state of Michigan, US cannabis company Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) should have a head start on the competition in the state’s newly opened up rec cannabis market, says analyst Russell Stanley of Beacon Securities, who on Monday reiterated his “Buy” rating and 12-month target price of $40.00. (All figures in US dollars.)

Yesterday, New York-based Acreage announced an agreement to acquire the real estate assets of Michigan-based Blue Tire Holdings, which will include a 55,000 sq. ft. facility in Flint that will be used for cultivation, manufacturing and packaging and will also serve as Acreage’s flagship retail location in the state, which will open its rec cannabis market on December 6.

Stanley, who has already factored in the Blue Tire purchases into his estimates but nonetheless views the announcement as a positive, says that Michigan has been an overlooked market opportunity.

“Michigan’s medical program was established in 2008, and it now has approximately 300k registered patients, making it the 2nd largest in the United States. However, it has traditionally been a caregiver-based program, and a framework for a regulated commercial industry was only passed in 2016, so commercial licensing is still in its early days,” Stanley says.

“[The approved Proposal 1 vote] requires the state to begin accepting applications for recreational dispensaries within 12 months, and we expect existing medical providers to have a significant head start over new entrants,” he says.

Stanley expects Acreage to generate revenue and Adj. EBITDA in fiscal 2018 of $69 million and negative $13 million, respectively, revenue and Adj. EBITDA in fiscal 2019 of $272 million and $60 million, respectively, and revenue and Adj. EBITDA in fiscal 2020 of $533 million and $158 million, respectively.

The analyst’s $40.00 target represented a return of 63 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment