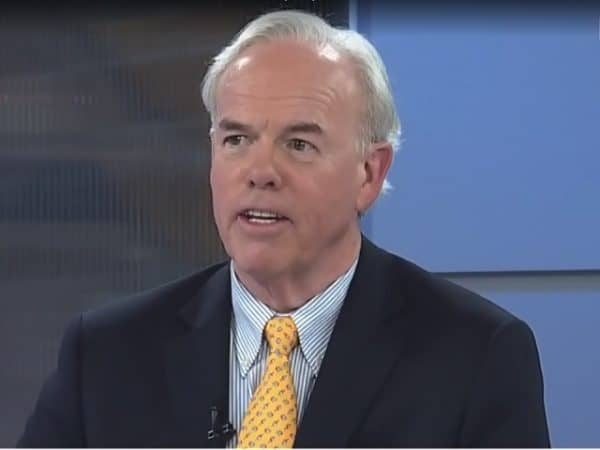

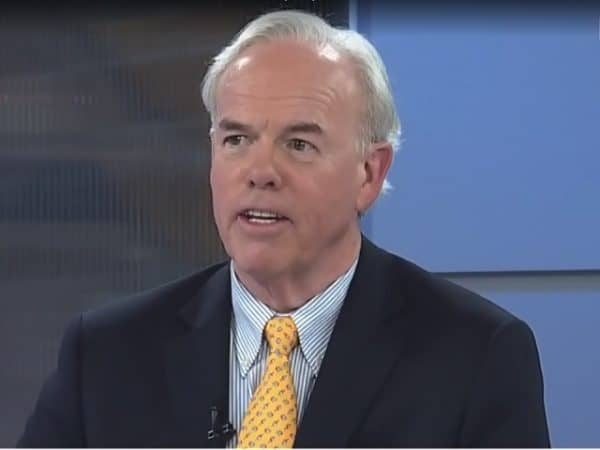

Artificial intelligence may be finding its way into even more aspects of the modern world, but the AI and robotics-focused exchange-traded fund Robo Global Robotics & Automation Index ETF (Global Robotics & Automation Index Stock Quote, Chart, News: NYSE:ROBO) may be too smart for its own good, says Terry Shaunessy, President of Shaunessy Investment Counsel.

Artificial intelligence may be finding its way into even more aspects of the modern world, but the AI and robotics-focused exchange-traded fund Robo Global Robotics & Automation Index ETF (Global Robotics & Automation Index Stock Quote, Chart, News: NYSE:ROBO) may be too smart for its own good, says Terry Shaunessy, President of Shaunessy Investment Counsel.

From automation to advanced analytics to smart devices and applications, tech companies are finding a myriad of uses for AI and robotics. And for the past few years, the Robo Global Index has been geared at investors wanting to take advantage of the growing field by offering exposure to a diversified set of companies in the space.

Like the rest of the tech sector, ROBO hasn’t fared particularly well in 2018, but 2017 was a banner year for the ETF, producing a 44 per cent return and bringing in US$1.5 billion in new assets, along with posting a three-year average annualized returns of 18.7 per cent.

Launched in August of 2013, Robo Global is currently made up of 88 companies, a fair number of which are far from household names, even to seasoned investors.

“ROBO is a really specialized ETF. It’s kind of expensive — around 75 basis points,” Shaunessy told BNN Bloomberg. “It’s a fairly new ETF and the biggest feature of this is that PhDs from recognizable schools figure prominently in the way this thing is put out there.”

On the composition of his Robo Global team, CEO Travis Briggs has said, “From day one, we have differentiated ourselves as a firm. We went out to put together a team that not only knows finance, but also a team of partners and advisory board members who know robotics and automation. So, if you look at five of our partners and our nine-person strategic advisory board, with over 200 years of robotics experience and five PhDs, we’ve put together a group that really cannot only define what the space looks like, but also predict where it’s going.”

But Shaunessy argues that book smarts alone won’t necessarily produce a winning formula, even in the STEM-heavy tech sector.

“I would tend to be a bit careful with this simply because if we’re buying it simply on the basis of PhDs … when we hear that, we tell everybody about Long Term Capital who in 1994 actually had Nobel Prize people,” he says. “[They] came in to run a big hedge fund and it was out of business by ’98. So you have to be a bit careful. Scientific knowledge and the ability to make money in an investment are two entirely different things,” Shaunessy says.

“I would encourage the individual to go look at the underlying and pick a couple of big positions that they may have and then just do a little bit of your own research, because a lot of times it may be best to just forget about the ETF and just buy one or two names that you can get your head around,” he says.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment