CMG, makers of software for the oil and gas industry, posted its FQ318 results, which showed growth in Annuity and Maintenance (A&M) revenues for the third quarter in a row, showing stronger fundamentals for the company whose stock has been on a rough ride over the past couple of years.

“We believe the results further confirm that the bleeding is over, and we feel the market is not paying attention to the improving fundamentals of this best of breed business,” says the analyst in a report to clients on Wednesday, in which the analyst described the stock as a “no-brainer” at these levels.

“EBITDA came in at $7.4M (40.4% margin). We went into the quarter significantly below Street on EBITDA, calling for EBITDA of $7.6M (40.4% margin) vs. Street’s $8.0M (42.0% margin),” says the analyst. “We feel that the EBITDA miss is a product of unreasonable Street estimates, rather than the Company underperforming. We expect Opex to normalize at current $10.00 levels and CMG to return to historical margins (45%-50%) in the next 12 to 18 months.”

Ezzat says that the CMG brand and products have a strong international presence, as witnessed by the company’s growing market share worldwide, with more recent gains in Colombia and the Middle East.

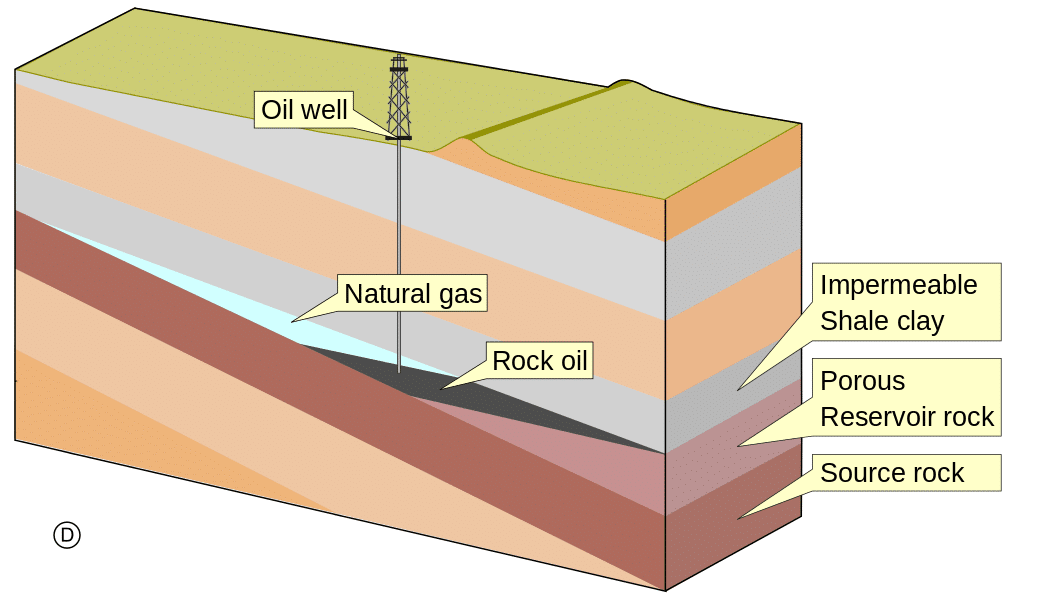

“CMG is a great refuge for investors seeking a more defensive name (in the short run), while keeping leverage to the secular growth in secondary/tertiary oil production,” says the analyst.

Last month, Echelon nominated CMG as a Top Pick for 2018. Ezzat gives CMG a 12-month target price of $11.50, representing a 26.7 per cent return on investment at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment