Bitcoin is bigger than you think.

Bitcoin is bigger than you think.

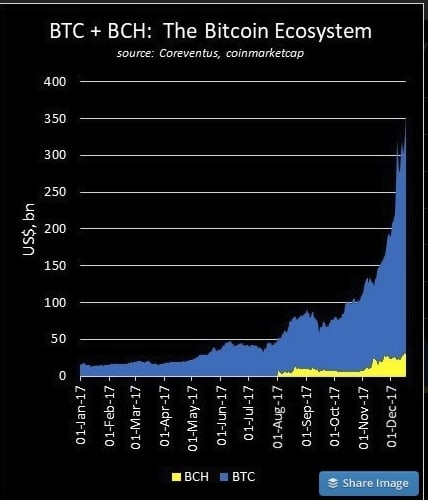

The massive increase in Bitcoin’s price is perhaps part of the story. We see an overlooked factor -the survival and growth of Bitcoin Cash, which currently has a market cap of just over $30 billion, which is just under 10% of Bitcoin’s market cap.

Bitcoin Cash (BCH) was created in a hard fork from Bitcoin (BTC) on August 1, 2017. Every owner (HODLer) of Bitcoin as of the day owned an identical number of Bitcoin Cash coins.

For more detail on this, please see our prior note on forks here.

The first major point is that supporters of BTC and BCH alike claim that their preferred Bitcoin is the real one. The second is that both have some claim; both originate off the same blockchain and only split on Aug 1. Furthermore, the market is saying likewise. Third and most important, we believe one will probably win, and from a systemic and investment perspective, it’s useful to view them as an ecosystem.

Both BTC and BCH have grown substantially since the fork, and BCH has been typically about 10% the size of BTC – making it the 3rd largest cryptocurrency by market cap.

Strengths/Weaknesses: BTC is Bigger, but BCH is Better.

BItcoin’s strengths are those of the proverbial 800 pound gorilla. It has the market cap, the brand name, the recognition beyond the crypto community and the ubiquity on ATMs and exchanges. Weaknesses are it’s very expensive to use as a currency, with average transaction fees on Saturday of over $26, and very slow, with confirmation times frequently in excess of an hour.

Bitcoin Cash’s strengths are scalability – transaction fees are much lower, for example. This weekend they averaged just under $0.25. The larger block size (8MB going to 32MB in 2018) will ensure superior transaction handling. There’s also momentum and considerable support, including well-known former Bitcoin supporters such as Calvin Ayre and Roger Ver (aka “Bitcoin Jesus”). Finally, its strength is also due to its survival; many thought it would disappear or become marginalized, and that hasn’t happened. Weaknesses are that it’s not recognized as Bitcoin by as many within the community – and then the obverse of BItcoin’s strengths: it’s smaller, not well recognized and harder to trade or purchase.

So in conclusion: BCH has a solid shot -but it’s BTC’s game to lose.

1. The fact the BCH is still going strong is a solid testament to its viability.

2. BTC has high transactions fees which we firmly believe will kill its viability as a currency unless resolved. We believe BTC could be done in short order without it. Anyone still using Netscape? Anyone? Altavista?

3. But speculation, in our opinion, has driven BTC’s price and trading volumes, and those users are not going to be so sensitive to high fees as someone looking for a fast, cheap crypto to buy a latte with.

4. But (#2) BTC also has proposals to deal with the scalability issue such as Rootstock and Lightning.

Finally, what about the other BTC forks?

There’s Bitcoin Gold (BTG), which has a market cap of $5.1 bn, and is the 11th largest crypto – we don’t know what to make of it at this time, but are looking into it. Bitcoin Platinum? Turned out to be a scam. Bitcoin God? We’ll find out December 25th, but we’re not holding out hopes. Ditto on Super Bitcoin, although we admire its lack of relative hubris. But for now, we see the ecosystem composed of BTC and BCH…we will see in the New Year if there’s room for others.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment