Recently, there have been multiple media stories, such as this one on CNBC, saying that investors are selling gold to buy Bitcoin.

Recently, there have been multiple media stories, such as this one on CNBC, saying that investors are selling gold to buy Bitcoin.

We looked at the data, and we find no evidence that this is happening on a large scale, yet. We do believe that bitcoin – and many cryptocurrencies may benefit if this does become a trend.

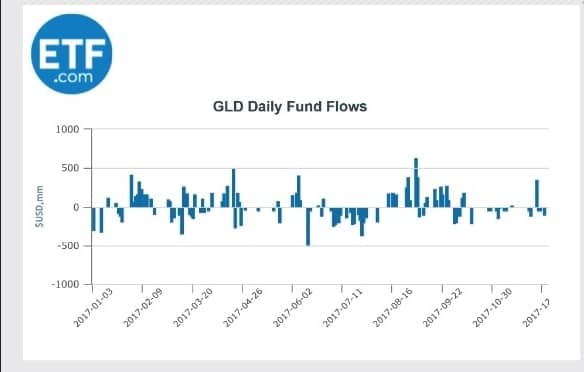

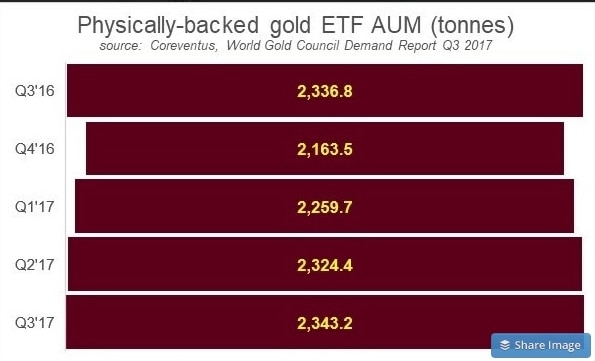

As we can see from the two charts above, both the largest physical gold ETF (top, in $) and the top 10 physical gold ETFs (bottom, in tonnes) actually increased their holdings. As physical gold itself is difficult to trade, hence the creation of the physical gold ETFs, we use them as a proxy for fast money leaving gold – or in this case, not really leaving gold.

Two other conclusions come to mind:

Physical gold ETFs are big enough to matter. The total value of gold ETFs is only about $100 billion – but now Bitcoin’s market cap is $274 billion, and that is more than enough to cause increased demand for Bitcoin – and would certainly be a major signal that could last for a while.

The best is yet to come. Many commentators are saying Bitcoin is the new gold, including Apple co-founder Steve Wozniak. Like Steve, we believe Bitcoin is superior albeit less shiny and not as good for jewelry. Bitcoin is more easily tradeable and has an absolute cap on amount. And even the followers of gold-bug former Republican presidential hopeful Ron Paul prefer bitcoin.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment