A new conference on blockchain technology will take place in Toronto later this year, hosted by Ripple, the cryptocurrency whose price has just surged to new heights, rising 70 per cent overnight amid heavy trading.

A new conference on blockchain technology will take place in Toronto later this year, hosted by Ripple, the cryptocurrency whose price has just surged to new heights, rising 70 per cent overnight amid heavy trading.

The event called Swell by Ripple is being billed as a come-together of banking and tech leaders who are “committed to changing the way the world moves money,” with keynote speakers such as Ben Bernanke, former chairman of the US Federal Reserve System and Sir Tim Berners-Lee, inventor of the world wide web.

“The program brings together a roster of payments experts and industry luminaries to discuss trends, success stories of blockchain implementations and real-world blockchain use cases to meet changing customer demands for global payments,” says Ripple.

The five-year-old company is in the midst of a torrid run, with the price of its XRP currency jumping from 17 to almost 30 cents in 24 hours, nearly doubling in value. The cause of the bump is still unknown, although trade publications have linked it to heavy trading of XRP in Korea, according to Fortune magazine.

So named because they use a shared record-keeping system called blockchain to ensure that digital funds can be traded between users but not copied or spent more than once, cyrptocurrencies have been shooting up in value as of late, with more versions (called Initial Coin Offerings or ICOs) emerging almost daily.

Reuters reports that at the start of 2017, the market cap for all cryptocurrencies was about $17.5 billion USD, with its largest and most well-known offering, bitcoin, making up almost 90 per cent of that value, according to industry data firm CoinMarketCap.

Now, the total industry value has shot to $120 billion, with bitcoin comprising 46 per cent of the market. The rush of investors hoping to cash in on the technology has some financial experts worried about a crypto-bubble, similar to the dot-com crash of the late 1990s.

“It’s just created new value out of nowhere,” said Rob Moffat, a partner at Balderton Capital, a London-based venture capital firm focusing on financial technologies. “There’s no fundamentals behind any of this – it’s all based on public perception, so you can start to see some really strange phenomena.”

That theory has been supported by billionaire U.S. investor Howard Marks, noted for having predicted the dot-com bubble. Marks has said that digital currencies are an “unfounded fad … based on a willingness to ascribe value to something that has little or none beyond what people will pay for it”.

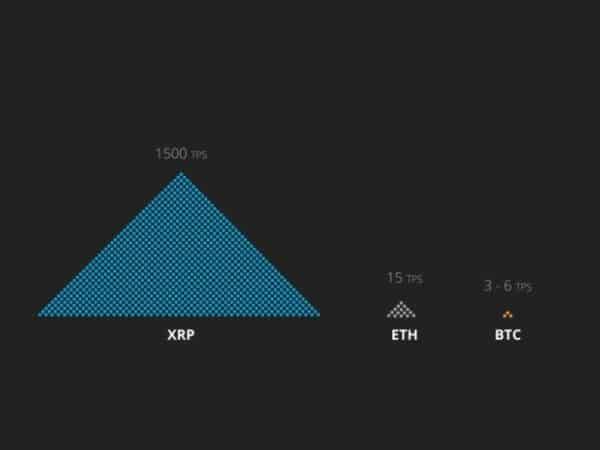

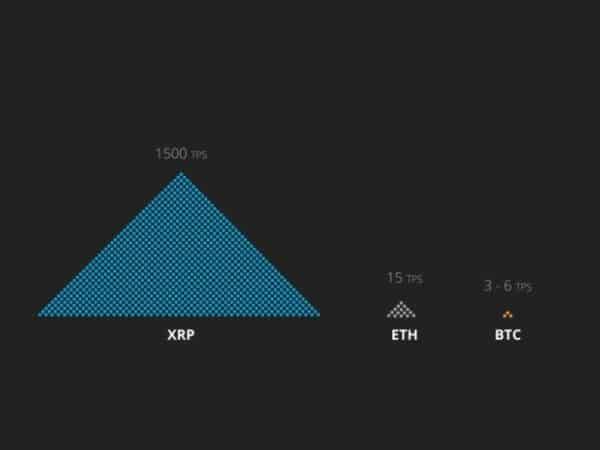

Yet others see the currency chaos as simply the mark of a new industry getting off the ground, a sentiment which appears to be gaining in popularity as more established institutions try out the technology. Ripple has already been adopted by some banks as a way to transfer funds between institutions, while another major player, Ethereum has been touted by the United Nations as a way to distribute money to Syrian refugees.

“The idea of this thing being a bubble is silly. We’re in the bottom of the first innings,” said Miguel Vias, head of XRP markets at Ripple.

Swell by Ripple will take place from October 16 to 18 in downtown Toronto.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment