The latest big Canadian tech IPO is a symbol of the continued success of technology on the Toronto Stock Exchange, says the TMX.

This morning, Ontario-based Real Matters (Real Matters Stock Quote, Chart, News; TSX:REAL) began trading on the TSX after raising more than $150-million through a syndicate of banks, including BMO, TD, and National Bank Financial. The IPO price valued the company at approximately $1.2-billion dollars, and the company joins Zymeworks (Zymeworks Stock Quote, Chart, News: TSX:ZYME) as the largest IPOs since Shopify (Shopify Stock Quote, Chart, News: TSX, NYSE:SHOP) went public in 2015.

The Real Matters IPO shows a continued appetite for technology amongst Canadian investors, and Wellington Financial’s Mark McQueen applauded the company for utilizing the interest here, pointing out that many other recent IPOs, including Ottawa’s Kinaxis (Kinaxis Stock Quote, Chart, News: TSX:KXS) had a much larger contingent of U.S.-based investors. McQueen says this development is, contrary to the beliefs of some, a good thing.

“As Bay Street investment bankers closed the books on the Real Matters IPO roadshow, it was clear that many good decisions were made along the way,” said McQueen in a blog post Monday. “How else can one summarize a deal that was reportedly “seven times oversubscribed?”.

McQueen says the upshot of the deal is that Real Matters stock has been placed in the hands of those with a longer-term focus.

“By avoiding the traditional error of placing IPO stock into the hands of U.S. hedge funds, for example, Real Matters is doing its best to limit the likelihood that a huge amount of its offering will be flipped on the morning of its first trading day. For more than 15 years, 30-40% of the daily trade on the TSX is undertaken by U.S.-based institutional investors,” he said.

The most notable tech IPOs of the last couple of years are still sizzling hot. Shares of Kinaxis, which IPO’d at $13.00 are now trading north of $80.00, and at least one analyst, Richard Tse of National Bank Financial, has a target of $100 on the stock. And shares of Shopify, which IPO’d at $17.00 in 2015, are now above $120.

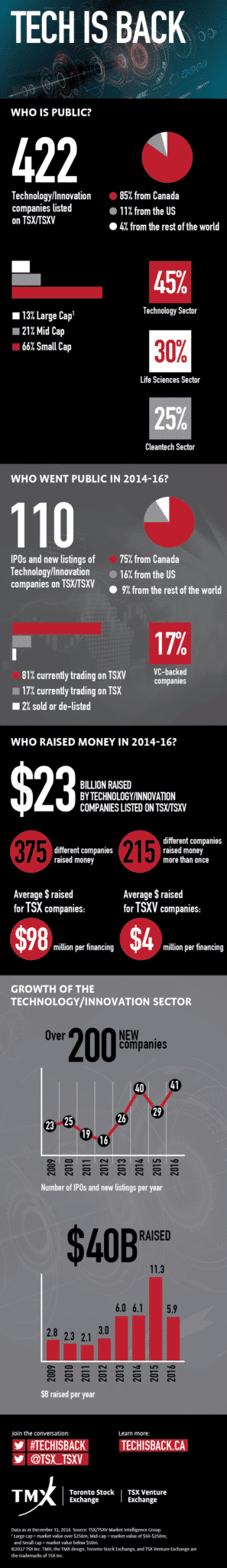

The Toronto Stock Exchange today summarized the revival of technology on its exchange in an infographic. It shows, amongst other things, that there were 110 new technology listings on the TSX and TSX Venture Exchange betweem 2014 and 2016, and that $23-billion has been raised by techs on these exchanges.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment