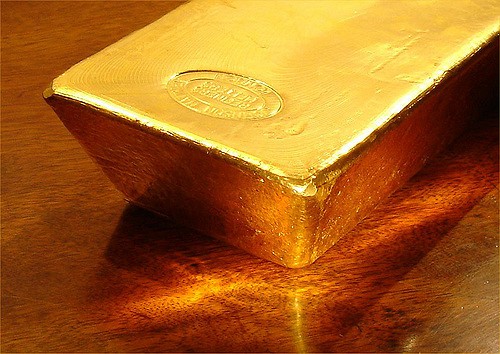

A new product offering could bode well for Goldmoney’s (Goldmoney Stock Quote, Chart, News: TSXV:XAU) topline and cash flow in 2017, says Mackie Research Capital analyst Nikhil Thadani.

This morning, Goldmoney announced the launch of a new product called Goldmoney Maximizer, a new account offering that allows its verified Canadian clients the ability to borrow select currencies against up to 85 per cent of their fully reserved gold assets.

“The Goldmoney Maximizer help network users access their gold savings with another financial option and provides them with the ability to leverage their balance to make additional purchases when gold prices reach desired levels,” said Darrell MacMullin, chief executive officer of Goldmoney Network. “The new lending offering is especially beneficial to our business users who can borrow against their gold balance to pay employees and vendors, or use it to grow their business by leveraging their working capital to purchase supplies, or boost their inventory.”

Thadani says Goldmoney’s new product will almost certainly fill an existing need for some.

“XAU has been working on this product for over six months, based on our discussions with management,” notes the analyst. “The product is in compliance with applicable consumer protection laws. Goldmoney plans to expand this new offering beyond Canada to the USA and Europe by the end of 2017. Currently, the offering is available only to Canadian Network users, excluding those residing in New Brunswick, Nova Scotia, Quebec, and Saskatchewan. Users can monetize/leverage their gold holdings in a tax effective manner (since they have not made a sale) by borrowing against their gold value in one of four currencies to load their Master Card or to buy more gold (maximum one turn is allowed to prevent users from borrowing infinitely). This offering could be especially attractive for users who have large unrealized gold gains.”

In a research update to clients today, Thadani maintained his “Buy” rating and one-year price target of $5.00 on Goldmoney, implying a return of 68 per cent at the time of publication.

Thadani believes Goldmoney will post EBITDA of negative $5.5-million on revenue of $9.6-million in fiscal 2017. He expects these numbers will improve to EBITDA of negative $5.4-million on a topline of $11.9-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment