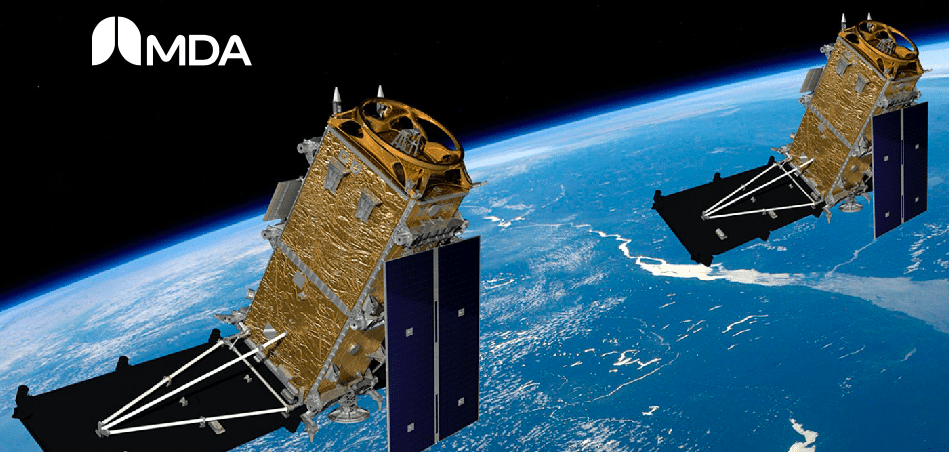

Following a quarter that was in-line with his expectations, Cormark Securities analyst Richard Tse says shares of MacDonald Dettwiler (MacDonald Dettwiler Stock Quote, Chart, News: TSX:MDA) are fairly valued.

Following a quarter that was in-line with his expectations, Cormark Securities analyst Richard Tse says shares of MacDonald Dettwiler (MacDonald Dettwiler Stock Quote, Chart, News: TSX:MDA) are fairly valued.

Yesterday, MDA reported its Q1, 2016 results. The company earned $40.7-million on revenue of $562-million, a topline that was up 5.3 per cent from the same period last year.

Tse says MDA’s revenue was directly in line with what he had modeled and earnings were just a penny short. The analyst says he believes the stock is currently close to fair value, but says some positives could occur later this year that might change his opinion.

“We continue to believe the stock is close to fair value,” says Tse. “That said, given the heightened bid activity, we believe the potential for an outsized lift in bookings could have us revisiting our rating – but we currently don’t expect much visibility on that until H2/F16. While MDA had momentum exiting 2015, our tracking of global awards across the industry YTD suggests a slow start to the year which we believe was corroborated by MDA Management on its conference call last night when it pointed to the bulk awards expected to occur in H2/16 (similar to 2015). At the same time, with the appointment of a new President and CEO (Howard Lance), there’s also the risk of a potential pause from the changeover.”

In a research update to clients today, Tse maintained his “Market Perform” rating and one-year price target of $90.00 on Macdonald Dettwiler.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment