The decision to pull the trigger on a financing is a sound one for ProMetic Life Sciences (ProMetic Life Sciences Stock Quote, Chart, News: TSX:PLI), says Paradigm Capital analyst Alan Ridgeway.

The decision to pull the trigger on a financing is a sound one for ProMetic Life Sciences (ProMetic Life Sciences Stock Quote, Chart, News: TSX:PLI), says Paradigm Capital analyst Alan Ridgeway.

This morning, ProMetic announced it had closed a previously announced bought deal that saw the company issue 13.2-million shares at $1.90 for proceeds of $25.08-million. The deal was led by Canaccord and included RBC and Beacon Securities.

Ridgeway says the financing will give ProMetic the runway to bring its large pipeline of drugs forward. The analyst reminded that resin sales can be lumpy, and that timing is simply not under ProMetic’s control.

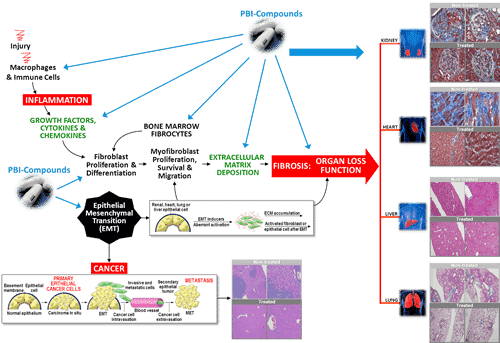

“With >$30M of cash on hand following the raise, management now has the resources to fully fund PBI-4050’s Phase II program and the registration trials for plasminogen, AAT, IVIG and two additional products. In addition, if PBI-4050 produces positive results in any of its planned Phase II studies, PLI should be in a stronger position to partner the asset,” said Ridgeway.

In a research update to clients this morning, Ridgeway maintained his “Buy” rating and $3.10 price target on ProMetic, implying a return of 56% at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment