In a research update to clients previewing tomorrow’s fourth quarter and fiscal 2014 earnings, Li maintained his “Hold” rating and $25.50 one-year target on Computer Modelling Group.

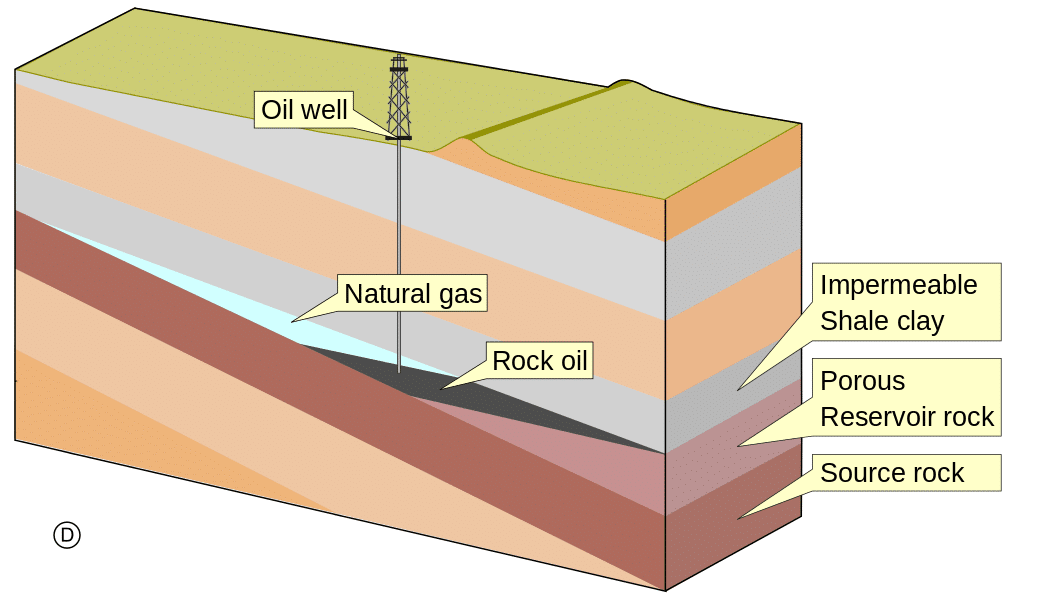

Noting that its stock trades at 13.4x his EBITDA estimate for 2015 and 34.5x his P/E estimate for the same year, Li says investors should wait for a better entry point on CMG, While he likes the opportunity in the fact that unconventional oil production represents less than 10% of total production, but accounts for 70% of the world’s oil reserves, he thinks the stock is currently fully valued.

For the fourth quarter, Li expects CMG will post EBITDA of $12.4-million on revenue of $21.2, beating the street consensus of $11.2-million from a topline of $20.5-million. For the year, he expects EBITDA of $40.7-million on revenue of $75.8-million.

Founded in 1978, Calgary-based Computer Modelling Group has become a world leader in reservoir simulation software.. Reservoir simulation software has become an important tool for oil and gas companies because computer models allow them to better predict expected production, enabling better financial decisions.

Li says the opportunity for upside in Computer Modelling Group could come in the form of an accretive acquisition, a weaker Canadian dollar, or greater overall demand for reservoir simulation.

_____________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment