Last Friday, Redline reported its Q4 and fiscal 2013 results. In the fourth quarter, the company earned $127,107 on revenue of $7.68-million, down from 2012’s Q4 topline of $11-million.

But new Redline CEO Robert Williams was upbeat about the company’s prospects going forward.

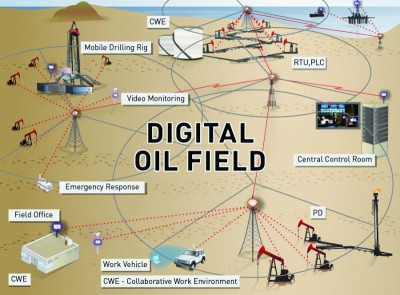

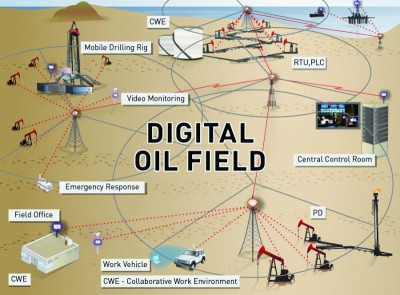

“Our current revenue levels don’t yet reflect the level of interest and activity we are seeing in the energy sector,” he said. “We continue to see strong interest in this sector as evidenced by the signing of a record number of new oil and gas customers, most of these late in 2013, including one of the largest oil companies in the world.”

___________________________________________________________________________________________________________________

This Cantech Letter sponsor has a 70% recurring revenue base and 95% customer retention rate, and was recently described as a “compelling opportunity” by one analyst, who rated the stock a BUY. Click here to find out who this is.

____________________________________________________________________________________________________________________

Bhangui says Redline is now “past a temporary phase of turmoil” and now has a clear growth direction. He says Redline’s tough transition period has left it trading at “ridiculously low multiples”. “All potential multi-baggers are that way (an investment, not a trade),” argued the Byron Capital analyst, “but the metrics are not obvious at an early stage, just like RDL is right now. We believe recognition will follow when it delivers its Q1/14, but then the investors would be buying it at a significantly higher price.”

In a research update to clients yesterday, Bhangui reiterated his STRONG BUY rating and $5.00 one-year target, implying upside of 72.4% at the time of publication.

Bhangui says the energy vertical will be the primary driver of what he expects will be a 30% Compound Annual Growth rate for Redline from 2014 to 2015. He says the company is becoming “increasingly indispensable” to its oil and gas customers.

________________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment