A 2011 study showed that 64% of Canadians paid off their balance in full each month, compared with just half of Americans.A new report released by MasterCard, entitled “The Cashless Journey”, pats Canada on the head for its progress towards becoming one of the most advanced countries in the world in terms of cashless payments, just behind Belgium and France.

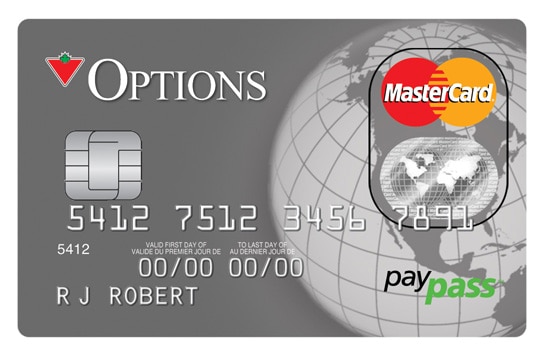

Much of the progress cited in the report is the result of eager adoption by Canadians of new technologies such as PayPass Tap & Go and near-field-communications (NFC) terminals, and also our adoption of EMV (Europay-MasterCard-Visa) chip technology which has already been in use in Europe for several years. The US has still to fully mandate the universal adoption of EMV chip technology, but will likely do so in the near future. (MasterCard’s deadline for the liability shift in the U.S. is October 1, 2016, for example.)

The survival of the old magnetic strip over the past 20 years or so is a surprise because it was a fairly leaky technology, and relatively open to fraud and malfunction. The adoption of the chip system for card use is a big upgrade in terms of security, etc.

On the positive side of the ledger, societies which move away from cash are less open to bribery and corruption, which is a huge cost of doing almost anything outside of Western Europe and North America.

The shift to EMV standards is also great news for credit card companies. As of October of 2015, merchants whose payment system does not support EMV will be liable for fraudulent transactions. Previous to that, if a false or fraudulent transaction was charged to your credit card, the credit card companies would simply eat it. The liability shift, which will have completely happened by October 2015, places the liability for fraudulent transactions on individual merchants.

In 2012, financial institutions reimbursed over $439 million in fraudulent credit card transactions to Canadian consumers. After the completion of the liability shift, financial institutions and credit card companies will no longer be on the hook for that sum.

Canada’s progress towards cashlessness may not only be down to our willingness to adopt new technologies for payment. We’re also more fiscally prudent than our American cousins. A 2011 study showed that 64% of Canadians paid off their balance in full each month, compared with just half of Americans.

MasterCard’s report focuses on total global consumer spend ($63 trillion), accounting for 11% of total financial transactions. Importantly, it includes non-retail transactions (such as housing or bill payments) rather than strictly point-of-sale consumer transactions. While cash accounts for 60% of POS consumer transactions, that rate falls to 34% when accounting for these other types of payments.

Canada takes the 3rd spot, behind Belgium and France in the “nearly cashless” tier, with the United States at 7th position behind the Netherlands but ahead of Germany. Attitudes towards the use of cash are often freighted with cultural attitudes, which hinder the progress of otherwise forward-looking countries like Germany and Japan towards becoming cash-free.

Meanwhile, anomalous situations such as in Kenya are instructive. An innovative remittance and payment system called M-Pesa has been widely adopted very quickly in Kenya, allowing users to pay or to send money without so much as a bank account. The removal of traditional obstacles have speeded the progress of Kenya towards becoming a cashless society.

It’s not as though there are no incentives to discourage the use of cash as an exchange medium. Heavy cash usage is frequently an indicator of other societal problems, and can be a burden on the system to the tune of 1.5% of GDP.

_________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment