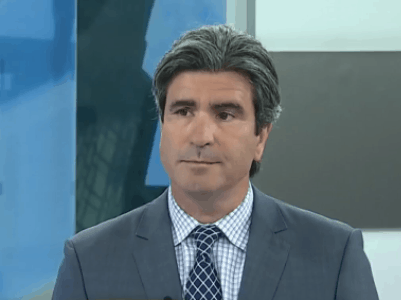

After a year in which his coverage universe returned 40%, M Partners tech analyst Ron Shuttleworth is proving 2012 was no fluke.

Just halfway through 2013, Shuttleworth, who maintains coverage on nine stocks for the boutique Bay Street firm, is already up 38%. The S&P/TSX index, meanwhile, has grown by just 2.4%. His generated alpha (the difference between his return and the benchmark index’s return) of 35.6% is beginning to turn heads.

The M Partners analyst has had a couple home runs already this year. Redknee (Redknee Stock Quote, Chart, News: TSX:RKN) which last November acquired certain assets from Nokia Siemens Networks for $54-million, has more than doubled this year, and is trading near all-time highs.

Shuttleworth says some felt the company would have trouble integrating the massive assets, but management, led by founder Lucas Skoczkowski, is proving that it knew what it was getting into. He notes that Redknee has eliminated low margin sales and been active in upgrading Nokia Siemens Network customers to its own cloud-based billing solutions.

Ron has a nose for market anomalies with respect to technology stocks,” says Difference Capital Managing Partner Tom Liston. “His strength is finding significantly undervalued small caps and then delivering a concise investment thesis to investors.

Shuttleworth thinks there is still upside in Redknee. Following the company’s recent Q3, he upgraded his price target on the stock to $5. It closed the market Monday at $4.28.

Former top-rated analyst Tom Liston, who recently left Cantor Fitzgerald to become a Managing Partner with publicly listed merchant bank Difference Capital, says he isn’t surprised that Shuttleworth’s returns are outsized.

“Ron has a nose for market anomalies with respect to technology stocks,” says Liston. “His strength is finding significantly undervalued small caps and then delivering a concise investment thesis to investors.”

Shuttleworth is riding another triple-digit winner this year with Solium Capital (Solium Capital Stock Quote, Chart, News: TSX:SUM), a Software as a Service company that helps untangle equity-based compensation plans for large companies. He says Solium, which has seen its stock soar from $2.65 to recent highs above $6.00, is simply “crushing expectations”. Shuttleworth likes the company’s prospects because after luring 75% of the top 100 companies listed on the TSX as clients, Solium is turning its gaze to the U.S. and international markets.

Those looking for another winner in the basket of the other seven stocks in Shuttleworth’s coverage universe will be met with some consistent underlying trends. His major themes are an expansion in enterprise spending, a deepening of mobile commerce, the growth of Platform as a Service (PaaS) companies, and a move to larger firms employing “Big Data”. Many of these themes run through his top picks going forward including Waterloo-based logistics firm Descartes Systems Group (Descartes Systems Group Stock Quote, Chart, News: TSX:DSG), and Ottawa-based cloud communications firm Mitel Networks (Mitel Networks Stock Quote, Chart, News: TSX:MNW).

The M Partners analyst notes that at the same time that investors are finally willing to pay more for quality in the technology sector, the earnings multiples of his coverage universe is generally expanding. Bay Street investors will no doubt be looking closely at Shuttleworth in the second half of the year to see how much alpha this potent combination might produce.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment