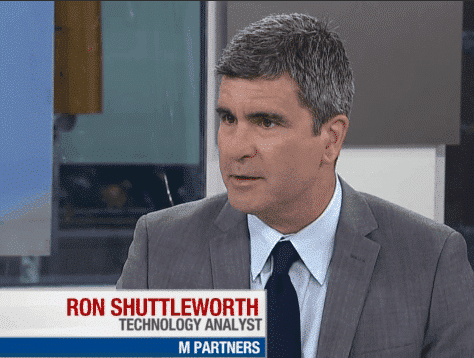

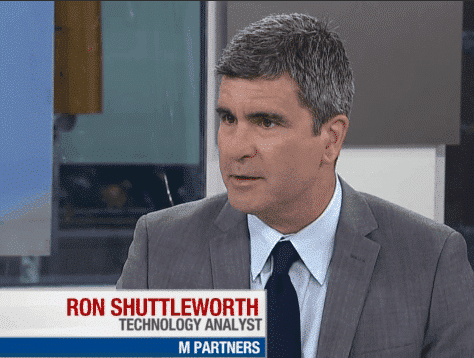

M Partners analyst Ron Shuttleworth says Solium Capital (Solium Capital Stock Quote, Chart, News: TSX:SUM) is “crushing expectations”.

Last Tuesday, before market, Solium reported its Q1, 2013 results. The company earned $2.67-million on revenue of $18.2-million, up 43% from the last year’s Q1.

Shuttleworth says Solium’s Q1 revenue exceeded his topline expectation of $14.8-million by 23%. He says two key drivers were responsible for Solium’s exceptional performance. First, already seasonally strong employee equity transaction activity became exceptional because of strong equity markets, and revenue from assets acquired during fiscal 2012 was higher than forecast. Together, says Shuttleworth, these drivers represented $3.4M of incremental revenue over his estimate.

In a research update to clients following the quarter, Shuttleworth maintained his BUY rating on Solium, but upped his one-year target from $4.75 to a street-high $6.

Calgary’s Solium Capital, which was founded in 1999, helps companies sort through the regulatory tangle that is equity-based compensation. This type of remuneration, which 97% of companies offer their employees, is extremely complex because of changing regulatory environments, employee churn and localized rules. Until last year, Solium concentrated largely on the Canadian market, but has recently scaled up to capitalize on opportunities in the U.S. and U.K.

Shuttleworth has revised his fiscal 2013 revenue forecast upward from $55.7-million to $62.1-million, and his EBITDA estimate from $13.4-million to $14.7-million. These numbers, he says, better reflect recently acquired assets.

At press time, shares of Solium Capital were up .9% to $4.36.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment