Shuttleworth says Mitel’s strength in virtualization mean it has lower exposure to hardware than its peers, and therefore its earnings leverage is at the top of its category.Last Thursday, Mitel Networks (TSX:MNW) reported its Q2, 2013 results. The company’s topline of $145.5-million beat its own guidance of between $140 and $145-million, and beat the street consensus of $142.5-million.

It was a rebound quarter for the Ottawa-based telco. After returning to Canada with a TSX listing midway through the year, the company’s Q1 was a rare recent misstep, forcing it to cut two-hundred jobs and initiate a short-term restructuring.

M Partners analyst Ron Shuttleworth says Mitel’s Q2 bested his expectations as well. Shuttleworth says he was expecting revenue of $143-million. He now believes that there is a distinct possibility that the second half of Mitel’s fiscal year could also exceed estimates, especially if macro uncertainty declines. In a research update to clients Friday, Shuttleworth reiterated his BUY recommendation on Mitel and increased his 12-month share price target to $5 from $4.50.

In April of 2010, Mitel went public for the second time. The company IPO’d on the Nasdaq at $14 a share, but the IPO was not a success. Then, in January of 2011, the company brought in industry veteran Rich McBee from Danaher to right the ship. McBee presides over a new Mitel with increasing revenue, record gross margins and an growing sweet spot in moving small and medium sized businesses to the cloud.

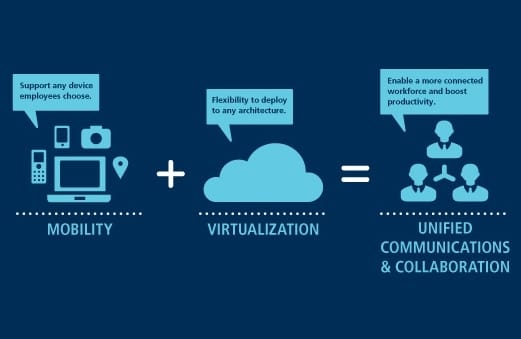

Shuttleworth says Mitel’s strength in virtualization mean it has lower exposure to hardware than its peers, and therefore its earnings leverage is at the top of its category. The M Partners analyst’s price revision comes as the result of a bump in his EBITDA expectations. He now believes the company will post EBITDA of $93.2-million in fiscal 2013, up from his previous estimate of $79.8-million.

At press time, shares of Mitel on the TSX were up .3% to $3.14.

_______________

________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment