Li notes that Pason’s sharp drop in rental days was at least somewhat offset by by a 27% rise in EDR revenue per day to $371. This, he says highlights one of Pason’s core advantages; it’s technology works so well it has the ability to leverage pricing power.On Tuesday, Pason Systems (TSX:PSI) reported its Q3, 2012 results. The company earned $19.34-million on revenue of $93.08-million.

Pason CEO Marcel Kesller said the numbers came despite a sharp decline from Canadian drillers.

“In both the United States and Canadian markets, drilling days and the active rig counts were lower in the third quarter of 2012 compared with the third quarter of the previous year, with the decline in Canadian activity significantly steeper than in the United States. International markets saw an activity increase.” he said.

Industrial Alliance analyst Steve Li says Pason did pretty well despite the sharp decline in drilling activity, which he says highlights just how unique its offerings in oil-field instrumentation are. Li, however, says such softness in Canadian drilling activity has caused him to revise his target on Pason slightly. In a research update to clients yesterday, Li downgraded Pason to Buy from Strong Buy and lowered his target price on the stock to $18.25 from his previous $19.

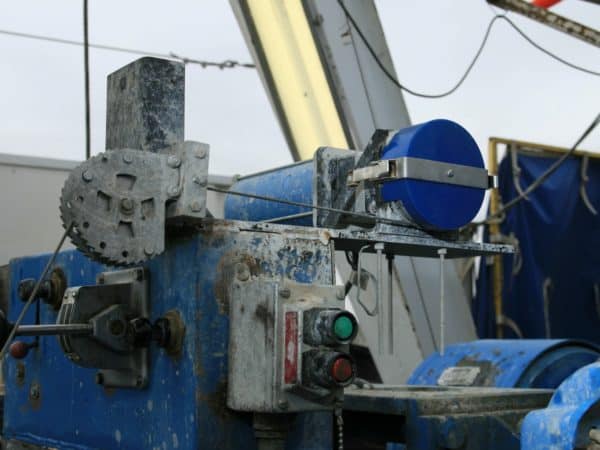

Calgary’s Pason Systems, which provides complex instrumentation systems to offshore drillers, has both benefited from and led a trend towards increased use of data in the oil and gas sector. The company’s core offering, Pason EDR, links the rig manager and rig crew on a data network with others onsite and off.

Li notes that Pason’s sharp drop in rental days was at least somewhat offset by by a 27% rise in EDR revenue per day to $371. This, he says highlights one of Pason’s core advantages; it’s technology works so well it has the ability to leverage pricing power.

At press time shares of Pason Systems were down .7% to $15.91.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment