The executive team of YM Biosciences. Byron Capital analyst Douglas Loe says upcoming Phase Two data on the company’s lead offering, CYT387 will likely justify advancing the treatment to Phase Three trials, where he expects partnership interest will be high.

On Friday, YM BioSciences (TSX:YM) released its fiscal 2012 results. The company’s loss of $20.3-million on revenue of $1.1-million compared favourably to last year’s loss of $40-million on $1-million in revenue.

YM CEO Dr. Nick Glover said the company’s gains came more in the lab than on the balance sheet.

“We made significant progress with CYT387 during fiscal 2012, highlighted by our reporting at ASH 2011 of positive interim data that potentially differentiates our drug from other JAK inhibitors. Leveraging these data, over the last several months we conducted productive discussions with regulatory authorities in the U.S. and Europe, which have affirmed the range of options available for the pivotal program for CYT387,” he said, adding: “We continue to conduct a robust business development campaign aimed at exploring potential opportunities to further develop and commercialize the drug with other companies, seeking relationships that will focus on realizing the broader commercial opportunity for CYT387.”

Byron Capital analyst Douglas Loe says there were no major surprises in the report. He notes the company had $132.5-million in cash at quarter’s end, a number that would be enough to fund the companies activities, on a run rate basis, until fiscal 2017. But Loe expects clinical cost to accelerate once CYT387 moves to Phase Three. The Byron analyst says Phase Two data expected later this year will likely justify advancing the treatment to Phase Three trials, where he expects partnership interest will be high. In a research update to clients Friday, Loe maintained his BUY rating and $5.25 target price on YM Biosciences.

_________________________

This article is brought to you by Zecotek (TSXV:ZMS). Zecotek holds over 50 patents and launched a major U.S. patent infringement lawsuit earlier this year. Click here to learn more.

___________________________

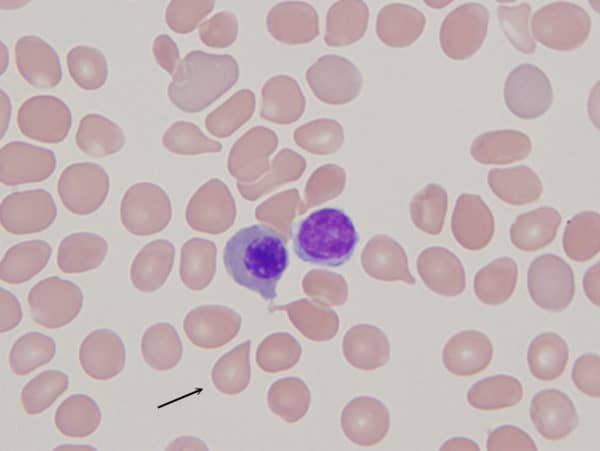

Mississauga-based YM Biosciences was formed in 1994 and IPO’d in 2002 on the TSX and London’s AIM market. The company, which is now currently listed on the TSX and the AMEX in the US, has raised more than $120 million since it inception. YM’s lead offering CYT387 targets the orphan bone marrow that causes Myelofibrosis, a disorder in which the bone marrow fails to produce enough new blood cells. Today, more than 18,000 people in the United States are afflicted with Myelofibrosis.

YM’s pipeline also includes gastric and lung cancer treatment Nimotuzumab, which is currently in a phase two clinical trials.

At press time, shares of YM Biosciences on the TSX were down 2.82% to 1.72.

______________

_______________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment