“One of the premium brands.”

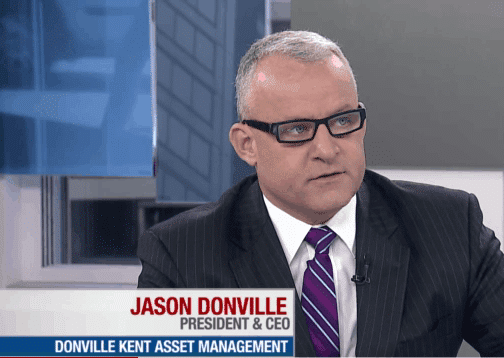

Last week, Jason Donville of Donville Kent Asset Management appeared on BNN’s MarketCall to talk small caps with host Mark Bunting. One of the names he was asked about was Amaya Gaming (TSXV:AYA).

Although Donville does not own the stock, he says if he were to jump into the space he would choose Amaya because he believes it stands above many of the fledgling, money losing companies looking to capitalize on expected changes to US gambling laws.

Donville says Amaya has been working diligently with Indian bands in the United States proving up its technology, so the company can hit the ground running if and when the regulatory environment is more welcoming. Many believe US gambling laws are about to change because gambling could provide an important source of revenue for cash starved governments.

In February, two senators California senators introduced draft legislation to regulate online gaming there. The proposed bill, called the The Internet Gambling Consumer Protection and Public-Private Partnership Act of 2012 proposes to tax internet poker at a rate of 10% of gross revenue.

________________________________________________________________________________________________________________________

his story is brought to you by Zecotek Photonics (TSXV:ZMS). As of November 16, 2011, Zecotek owned title to or controlled more than 55 patents and applications. Click here to learn more.

_________________________________________________________________________________________________________________________

Amaya Gaming, which was founded in 2004 and IPO’d on the TSX Venture Exchange in July of 2010, has in the past designed electronic table games that allow players to remotely play majong, bingo or horse racing. But the company vaulted to public attention early in 2011 when it secured a license from the Betting Control and Licensing Board of Kenya to operate online gaming. Amaya diversified its reach last year when The company acquired struggling Calgary-based Chartwell Technologies in July for just under $23 million, and followed that with the December pickup of Cryptologic, a company founded in 1995 by brothers Andrew and Mark Rivkin that became one of the world’s largest online gaming platform providers, but was also struggling.

Donville, who says he is more growth oriented than necessarily geared towards small caps, runs what he describes as a “concentrated fund”, placing relatively large bets on five or six of his favourite stocks. The five biggest stocks in his portfolio often represent 50% of the total value, he says. Over the past two years ended March 31st, Donville Kent Capital Ideas returned 11.81%, while the TSX delivered just 4.24% growth.

At press time, shares of Amaya Gaming were even at $3.80.

You can view the full interview here.

_____________________________________________________________________________________________________________________

Comment

One thought on “Amaya Gaming is a Premium Brand, says Jason Donville”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Opps wrong article!