On Tuesday, Valeant agreed to purchase Afexa for approximately $76-million, topping a hostile bid from rival Paladin Labs (TSX:PLB).

Today’s events end a long saga for Afexa, and while the company has a 30-day “go-shop” option in which they can explore other bids, that scenario seems unlikely after William B. White, Afexa’s Chairman today said “The board is pleased that Valeant has come forward with an offer that is significantly higher than Paladin’s hostile bid.

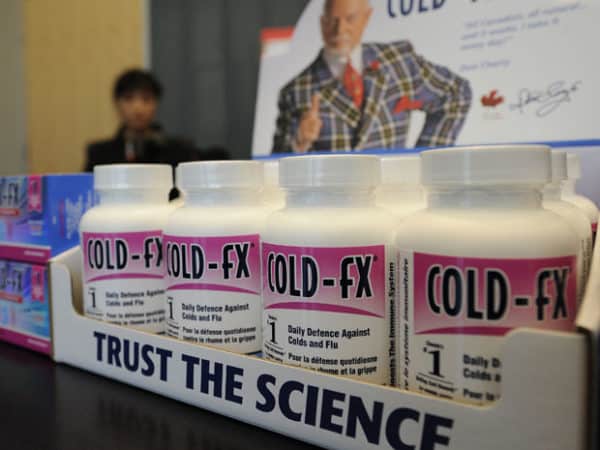

It has been a rough ride of late for Afexa shareholders. Investors clearly didn’t like the uncertainty around the company’s management situation, sending shares of the beleaguered company as low as $.365 cents this past July. Earlier this year, Afexa had announced that Jack Moffatt, the man who steered it since a 2008 shakeup, would not be back and the company had not found a replacement. And the numbers weren’t helping. Afexa’s fiscal 2011 revenue was just $39.6 million, down from $56.1 million in 2010. But things aren’t weren’t all bad for Afexa. The company recently received positive word from a clinical trial on its CVT-E002. The trial, conducted at the Wake Forest Baptist Medical Centre in Winston-Salem, N.C., showed the treatment reduced the incidence and severity of acute respiratory infections for patients with chronic lymphocytic leukemia.

The acquisition of the business (and name) of Valeant instantly made Biovail Canada’s largest publicly traded drug manufacturer. The newly created entity got its financial house in order late last year with a billion dollar splash into the debt market. Valeant immediately looked around for acquisitions, settling on Dermik, a dermatology unit of Sanofi for $425 million after its $5.7 bid was rebuffed by the board of US based drug developer Cephalon. Then, last month it acquired a dermatology unit from Johnson & Johnson for $345 million.

Along the way, Valeant posted a profitable Q1 and Q2 that were more than double the same six month period in 2010, a number that “demonstrated the strength of our diversified business model,” according to Valeant CEO J. Michael Pearson.

For Montreal’s Paladin, the situation is muddied somewhat by a very recent investment into Afexa. Though Paladin’s August 10th bid of $.55 cents a share has been bested by Valeant’s $.71 cent per share offer, Paladin now owns just under 15% of the Afexa, meaning the $15.4 million shares of Afexa it does own are now instantly profitable. Paladin shareholders are still reeling from the news that CEO Johnathan Goodman was seriously injured in a cycling accident last week.

Shares of Afexa, meanwhile, today closed at exactly Valeant’s bid price of $.71 cents, up 20.3%.

__________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment