Computer Modelling Group CEO Ken Dedeluk. Industrial Alliance Securities analyst Steve Li likes Computer Modelling Group, but thinks the company’s valuation has become overextended. Shares of Calgary-based Computer Modelling Group (TSX:CMG) have been steadily rising for much of 2012, lifting the company’s stock from a little more than $14 in January to recent highs over $20.

Industrial Alliance Securities analyst Steve Li likes Computer Modelling Group, but thinks the company’s valuation has become overextended.

Li says that CMG’s trading premium to its peers has always been justified, in his view, by the company’s best in class reservoir simulation technology. But today that valuation gap, when measured across all metrics, including EV/Sales, EV/EBITDA, and P/E, has grown too great to advise that investors use the current price as an entry point, he says. In a research update to clients this morning, Li maintained his price target of $19 on CMG, but downgraded the stock to HOLD from his previous BUY recommendation.

_________________

This story is brought to you by Serenic (TSXV:SER). Serenic’s cash position as of its most recently reported quarter was greater than its market cap as of October 29th, which was $3.96-million. The company has zero long-term debt. Click here for more info.

__________________

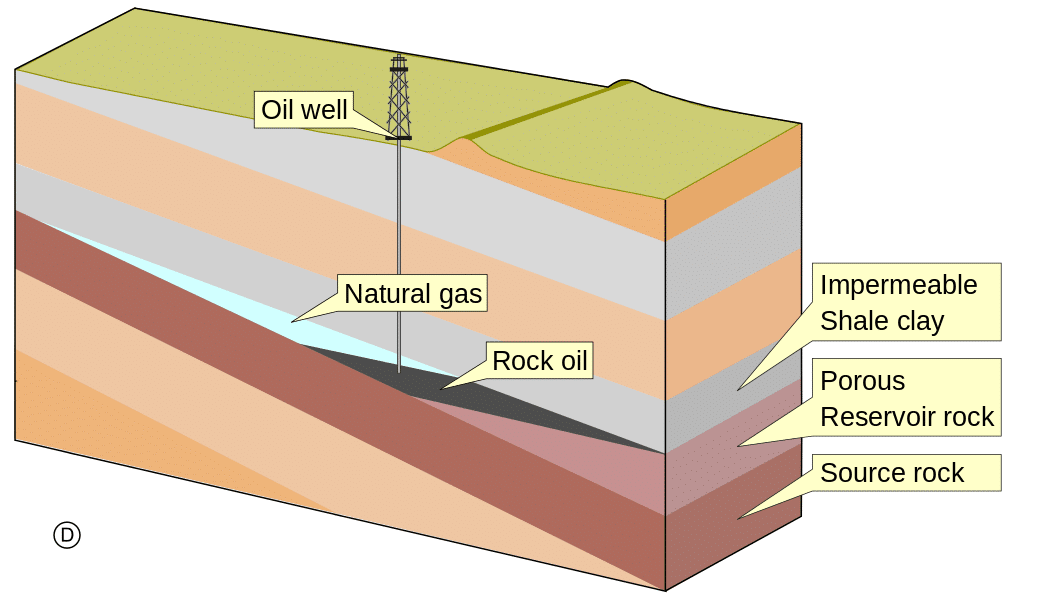

Computer Modelling Group is an Alberta technology success story. In 1978, the company was a small Calgary based research facility, and was actually a non-profit entity for the first seventeen years of its existence. When CMG decided to go for a profit, they were pretty good at it and continue to be; the company has more than doubled its revenue from $23.7 million in fiscal 2007 to more nearly $61 million in 2012. Today, CMG has five offices around the world, and is more likely to make a sale of its leading edge reservoir simulation software outside of Canada than here at home. The scope of CMG’s market has grown because reservoir simulation software has become an important tool for oil and gas companies. Computer models allow them to better predict the expected production, allowing for more better financial decisions.

Li says he derives his target price of $19 from a 17.5x EV/EBITDANTM. The Industrial Alliance analyst points out that even after inclusion of the the company’s quarterly dividends and the expected special dividend of $0.10, the potential return on CMG is merely break-even. This, coupled with a lack of visibility on the macroeconomic environment, gives the analyst pause against his normally positive bias on the company.

Shares of Computer Modelling Group closed today up 1% to $19.95.

__________________

___________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment