CAE is “unjustly cheap” says NextGen Financial’s Jeff Young

Nexgen Financial Senior VP and CIO Jeff Young was on BNN’s Market Call today with host Michael Hainsworth to talk about dividend paying stocks.

On the day the European Central bank announced an aggressive plan to buy government bonds to help lower borrowing costs for countries struggling with debt, Hainsworth asked if the move is simply “kicking the can down the road”.

Young says the ECB’s action doesn’t solve any of Europe’s systemic issues, but it does remove the worst case scenario of a country or large bank going under, at least for the time being. Nonetheless, he still believes dividend stocks, which have been a shelter from volatility for several years, are a good place to be because the category has become so broad and includes varying levels of risk and return.

One of Young’s favourite stocks is Canada’s CAE Inc. (TSX:CAE). He says the stock has become “unjustly cheap” because of fears of cuts to US military spending. But CAE has done a good job of bringing down the volatility in their earnings, says Young, pointing to the C$314 million acquisition of Oxford Aviation Academy in May. The Nexgen VP is also encouraged by CAE’s potential to sell to Asian airlines, who have more of an outsource model for their pilot training.

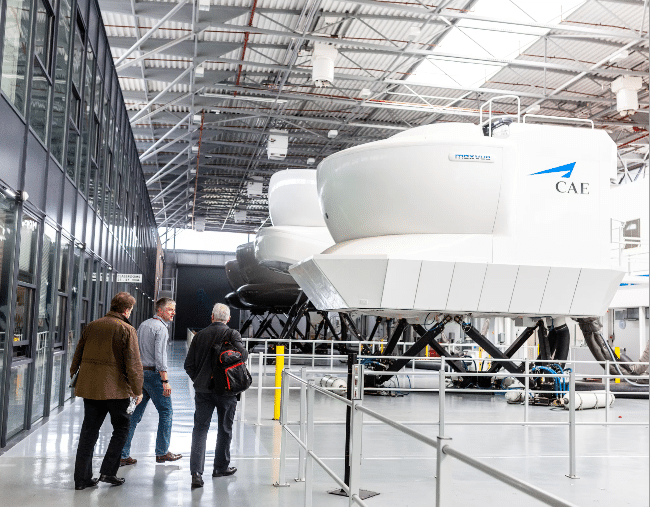

CAE Inc., which was founded in 1947 in Saint-Hubert, Quebec has built its considerable business on the back of flight simulators. The company is the gold standard in the industry, having sold their simulators to over a hundred different airlines. CAE now trains more than 75,000 crew members each year, many at its at 426,000 square foot facility at the Dallas/Fort Worth International Airport, the largest business aviation training facility in the world.

Shares of CAE on the TSX closed today up 1% to $10.19.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.