Toronto-based fintech startup Overbond Ltd. has just closed a $7.5 million seed financing round led by Morrison Financial Services, which normally focuses on construction and real estate financing rather than start-up venture capital.

Overbond intends to use the financing to expand its fully-digital primary bond issuance platform.

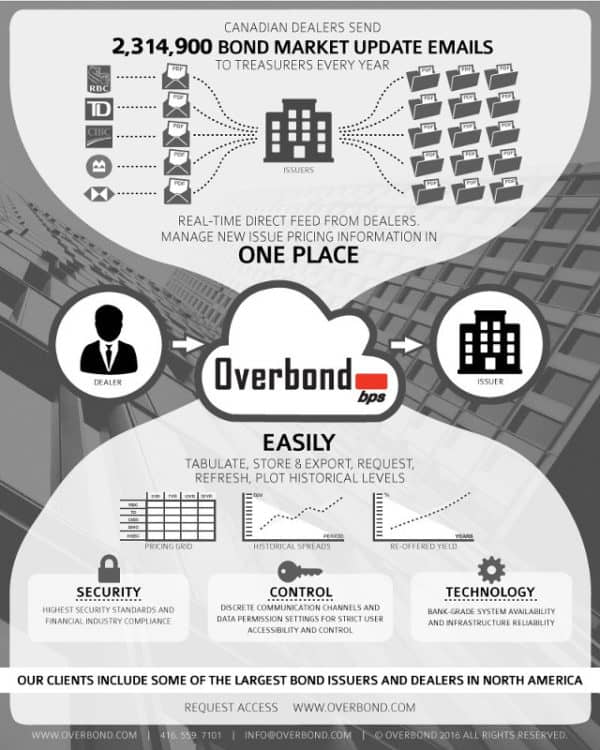

Focused on making the primary bond issuance process digital, transparent and secure, Overbond is the first fintech entrant into the primary bond issuance market, creating a platform that connects corporate and government issuers with dealers and investors directly.

“We look forward to the next phase of working with our clients – investment banks, corporate and government bond issuers and fixed-income investors – to help investment banking and bond issuance transition to a digital approach,” said Overbond co-founder and CEO Vuk Magdelinic.

Overbond graduated from both the MaRS fintech cluster in Toronto and the Communitech technology innovation supercluster, before moving on to the Toronto chapter of the Founder Institute program.

It has, until now, been bootstrapped by its founders.

Bonds being issued for the first time, aka. the primary bond market, will see the process of bond origination through to deal execution streamlined with Overbond, with an added digital component involving analytics and communication.

While most fintech start-ups have focused on “disrupting” the more normal customer-facing aspects of finance, Overbond has invented a platform aimed at the fixed-income market, automating the primary bond market.

Unlike the big banks, though, the bond market still sees broker taking orders manually, over the phone or by email, one at a time, which they keep track of on spreadsheets.

Each year, Canadian dealers and issuers spend 125,000 hours managing the receipt of more than 2.3 million bond market updates by email, a problem which is an order of magnitude worse in the United States.

“It’s a mind-blowing problem,” says Magdelinic.

The combination of manual order taking by brokers in real time and increasingly strict regulations in the financial industry has led to a liquidity crunch that could be alleviated by the application of technological automation.

“Overbond’s experienced team is making a significant impact in institutional capital markets,” said David Morrison, president of Morrison Financial. “Our investment combined with Overbond’s vision will no doubt have a significant impact on how new bonds are issued.”

In April, the company introduced Overbond BPS, an end-to-end, two-way pricing communication tool for bond issuers and dealers.

This weekend, from Friday through Sunday, Overbond will be hosting simultaneous hackathons at the Universities of Toronto and Waterloo, open to students only, with a top prize of $1,000 for solving “an exciting Fintech problem”, which involves simulating “AI/cognitive computing” algorithms in two different bond trading worlds.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment