After delivering top and bottom line beats in its latest quarter, digital ad tech company Sabio (Sabio Stock Quote, Charts, News, Analysts, Financials TSXV:SBIO) just got a vote of confidence from Paradigm Capital analyst Daniel Rosenberg, who reiterated a “Buy” rating on the stock while raising his target price in a Wednesday report to clients. Rosenberg said Sabio is carving out a unique space for itself in the online ad sector and is posting industry-leading growth.

Sabio, a leading demand-side platform providing Connected TV (CTV) and over-the-top (OTT) advertising platforms, announced its third quarter 2022 financials on Tuesday, featuring record revenue of $11.9 million, up 75 per cent year-over-year, and adjusted EBITDA up 78 per cent to $1.2 million. The company saw its CTV/OTT segment generate $6.7 million in revenue compared to $2.9 million a year earlier, making it the first quarter where the segment brought in the majority of revenue at 56 per cent. Sabio’s Mobile segment generated $5.0 million in revenue for the Q3. (All figures in US dollars except where noted otherwise.)

“Sabio has become one of the fastest growing technology and solutions providers in the rapidly expanding CTV and OTT advertising space as demonstrated by delivering 132 per cent (virtually all organic) year-over-year revenue growth, substantially higher than the market,” said CEO Aziz Rahimtoola in a press release.

“Our unique App Science data and analytics approach to reaching CTV/OTT consumers and cord-cutters continues to resonate with advertisers who are looking for solutions that help maximize ROI,” he said.

Looking at the results, Rosenberg said the $11.9 million topline was ahead of his estimate at $8.9 million as well as the consensus at $8.5 million, while the adjusted EBITDA gain of $1.2 million was also better than expected compared to Rosenberg’s forecast at negative $0.4 million and the Street’s call at negative $0.5 million.

Rosenberg said Sabio’s strong quarterly results stand out in comparison to other ad tech companies who have already reported, bucking the trend during a challenging economic period.

Below: Cantech Letter’s interview with Sabio CEO Aziz Rahim

“Sabio reported strong Q3/22 results that were ahead of expectations, growing 75 per cent year-over-year. Key performance indicators were also robust with management seeing no change in demand for its differentiated solution which saw a 39 per cent increase in deal size year-to-date,” he wrote.

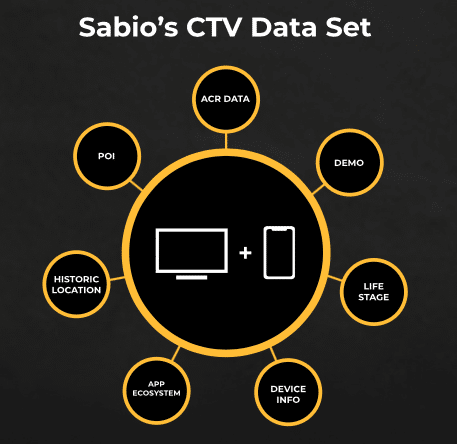

Rosenberg called Sabio’s CTV offering supplemented by AppScience insights a key differentiator within the ad tech space, one that is increasingly attracting blue chip clients.

“We find it notable for a small AdTech company to attract marketing dollars from enterprise-grade customers and do so without burning substantial capital,” Rosenberg said. “We believe this speaks to the value of Sabio’s differentiated offering. While near-term business spending may see macro headwinds, it appears Sabio’s CTV growth is far outpacing any demand erosion. We believe the company’s risk-reward profile is compelling at current levels.”

Rosenberg has upped his forecasts, now calling for full 2022 revenue of $38.7 million (previously $35.4 million) and adjusted EBITDA of $0.5 million (previously $0.1 million), and moving to 2023 revenue at $50.4 million (previously $44.5 million) and EBITDA at $3.2 million (previously $2.7 million). With his new estimates came an increase to the Paradigm target on Sabio, which moved from C$3.00 to C$3.25 per share and at the time of publication represented a projected one-year return of 257 per cent.

Disclosure: Sabio Holdings is an annual sponsor of Cantech Letter.

Share

Share Tweet

Tweet Share

Share

Comment