It may not be the sexiest corner of the market but data centre REITs are having a moment right now with the surge in mobile phone use worldwide over the past year and a half. That makes a name like Digital Realty Trust (Digital Realty Trust Stock Quote, Charts, News, Analysts, Financials NYSE:DLR) a sweet choice, says portfolio manager Andrew Moffs of Vision Capital, who says the sector is the right place to be.

“Digital Realty Trust is a $47 billion market cap REIT. It’s big in the data centre space and it’s the original data centre REIT in this sector,” says Moffs, senior vice president at Vision Capital, speaking on BNN Bloomberg on Monday.

“The data centre sector has benefited, of course, lately from all the activity people are doing both online but more importantly on their mobile devices and the interconnection between different providers at these facilities is where Digital Realty creates value,” he said.

Real estate investment trusts (REITs) cover the block in terms of different types of properties for their investments, with data centre REITs focusing on owning and managing buildings used for housing servers and network infrastructure, often with industry-specific requirements around heating and cooling and security for data storage and processing.

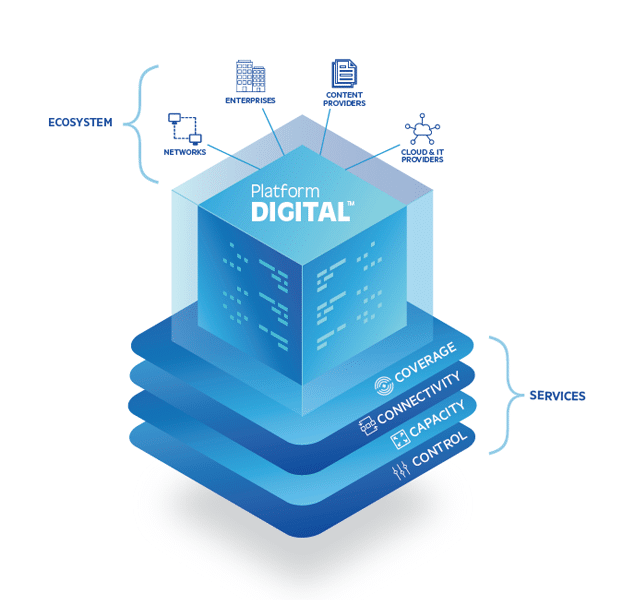

And enterprise-focused Digital Realty is a big player in the space, with over $4 billion in annual revenue and a data centre solutions platform for clients in its PlatformDIGITAL. In total, Digital Reality has over 280 facilities in 49 urban centres across 25 countries worldwide.

Now headquartered in Austin, Texas, Digital Realty went public back in 2004 and has been expanding its empire over the years, making a number of small and big acquisitions. Most recently of note was the $8.4-billion purchase of European data centre company Interxion.

The stock, which comes with a dividend currently with an almost three per cent yield, has been doing very well in recent years, returning about 70 per cent over the past half-decade. So far in 2021, DLR is up about 22 per cent.

Moffs said the data centre space has been consolidating not only internally but through a merger with cell tower properties.

“We think from a top-down perspective the date centre space a really great sector to be in. You’re seeing a lot of activity, a lot of privatizations of data centres currently. The smaller data centre REITs are being taken out,” Moffs said.

“What’s interesting is you’re about to see a convergence where there is a synergy for having a data centre at the base of the cell tower, given that if all that data is being transferred over mobile devices wouldn’t it be great to have the data centre at the flip of the antenna that’s receiving all that frequency?” he said. “So, you’ve actually seen American Tower [for example] enter the space now with it with a takeover of one of the data centre REITs.”

“All that being said, the sector does trade at a premium to net asset value and a lot of that growth is built into the stocks. And as they get larger it’s much more difficult for these REITs to grow creatively and find the next acquisition. So, I expect over the next five years, you will see that convergence between infrastructure assets between data centres and towers, generally speaking,” Moffs said.

In its third quarter report, delivered in late October, Digital Realty posted revenue up four per cent year-over-year to $1.1 billion and funds from operations per share of $1.54 compared to $1.19 per share a year earlier. Net income available to stockholders was $124 million or $0.44 per share compared to a loss of $0.14 per share a year earlier whil adjusted EBITDA was up just one per cent to $610 million. (All figures in US dollars.)

“Digital Realty’s global platform, broad product spectrum and significant scale underpinned our strong third quarter results,” said Digital Realty CEO A. William Stein in a press release. “Record new logo growth and continued strong bookings in the quarter reflect the global adoption of PlatformDIGITAL, while our robust internal processes enabled us to execute consistently for our growing list of customers.”

The company ended the third quarter with $14.1 billion in total debt outstanding, while more recently it announced new refinancing which involved upsizing its credit facility from $2.35 billion to $3.0 billion. Digital Realty said its new financing of global revolving credit facilities have a sustainability-linked pricing component where pricing is subject to adjustment based on annual performance targets.

Management said the move represents its commitment to sustainable business practices.

“We believe the successful refinancing underscores the institutional lender community’s view of the strength of our balance sheet and underlying business, while providing us with greater financial flexibility as we continue to prudently fund the growth of our global platform,” said President and CFO Andrew P. Power in a press release.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment