Canadian space tech company MDA (MDA Stock Quote, Charts, News, Analysts, Financials TSX:MDA) now has a few months under its belt after IPO-ing earlier this year, and while the sparks have yet to fly, portfolio manager John Zechner thinks the space and satellite sector has a long runway ahead of it.

“I like this one. It’s the old MacDonald Dettwiler. They came back to the public markets this year,” said Zechner, chairman and founder of J. Zechner Associates, speaking on BNN Bloomberg on Monday.

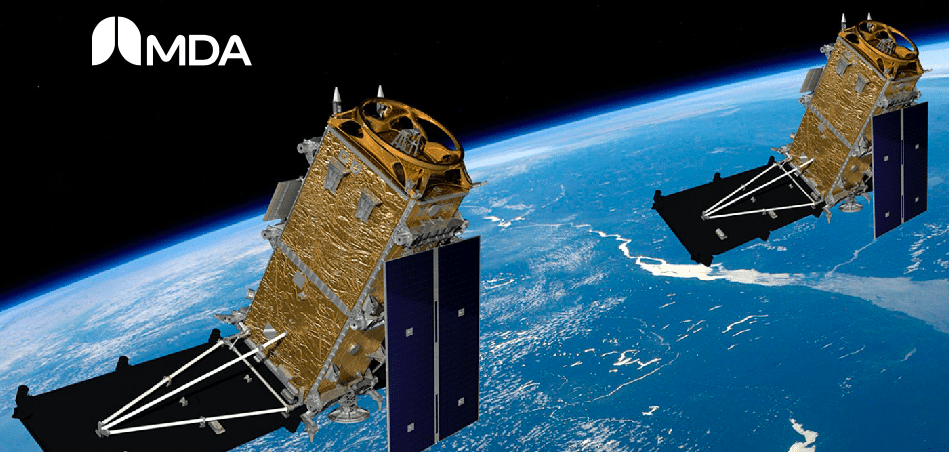

“The low-orbiting satellites is a great growth area. They’ve obviously got their equipment like the Canadarm and they’ve built the infrastructure for this as well. The components and the software for analysis on low-Earth orbit satellites. It’s a great growth area over the next couple years,” Zechner said.

US space tech name Maxar Technologies decided last year to get rid of its original business in MDA, the former MacDonald Dettwiler and Associates, leaving it with DigitalGlobe satellite business, itself bought in 2017 for $3.1 billion.

The buyers for MDA were a Canadian group of investors led by John Risley of Northern Private Capital and, among others, Jim Balsillie of Research in Motion fame. The $1-billion deal took MDA off the public markets for about a year until MDA had its initial public offering in April of this year. There, MDA issued about 28.6 million shares at $14.00 per share for gross proceeds of about $400 million, which was about $100 million under the company’s reported original intention to raise $500 million selling shares at between $16 and $20 per share.

“Today marks the beginning of an important chapter for MDA,” said MDA CEO Mike Greenley in a press release marking the IPO. “With the rapid expansion of the global space economy over the next ten years, our world-leading expertise and capabilities are well aligned with the projected high growth sectors, such as space exploration, on-orbit servicing, space-based communications and Earth observation. We have the agility of a new space company coupled with an impressive track record that makes us a partner of choice in the emerging commercial space market.”

Zechner says the demand for satellite-based information keeps growing.

“A funny aside, I was just getting an estimate on getting our roof replaced. I’ve been in this house for 25 years and it’s time to get it done. And the guy came the other day for the estimate and he says, ‘Well, first, I’ve got to get the pictures from the satellite’ — they’re doing everything from space, never mind defence and security and agriculture and everything else,” Zechner said.

“So much of what’s important is being taken from these low level, satellites. I think there’s great growth there in interpolating the data and generating it and using it is a great area of growth, and I think MDA is one of the few companies in Canada (now that we don’t have a Maxar as a Canadian company anymore) where you’re getting that capability,” he said.

“[It’s] at a decent valuation, too, generating free cash flow and probably a 25 per cent growth rate over the next five years,” Zechner added.

And while MDA’s satellite tech and analysis capabilities are participating in the surge of interest in the sector, this week the company announced a contract for its Robotics and Space Operations segment for NASA’s upcoming Commercial Lunar Payload Services (CLPS) program, which aims at putting people back on the moon. MDA will provide lunar landing sensors to support missions by Intuitive Machines, putting MDA’s sensors as part of the first soft landing US mission on the Moon in half a century.

“Landing technology has been a critical component of successful flight since the dawn of aviation and now, working with partners like Intuitive Machines, we are commercializing that technology for space flight,” said Greenley in a press release.

Since its debut in April, MDA’s share price hasn’t travelled far, dropping a bit below $14.50 in June before heading back to $16.00 more recently.

The company released second quarter 2021 results earlier this month, showing a 15.5 per cent year-over-year increase in revenue to $126.7 million, marking three quarters in a row of topline growth. MDA’s net loss was $0.1 million and adjusted EBITDA was $39.4 million compared to $44.6 million a year earlier. Broken down, the second quarter saw MDA’s GeoIntelligence segment revenue come in at $48.2 million, Robotics and Space Operations revenue at $35.6 million and Satellite Systems revenue at $42.9 million. Satellite Systems was up a full 31 per cent from a year earlier.

The Q2 featured new contract wins for Earth observation imagery and analytics, according to the company, with contracts coming from existing customers like the Canadian Space Agency and the US National Oceanic and Atmospheric Administration. Post-Q2, MDA announced a $35.3 million contract with the CSA for its Canadarm3 program, while the company’s Satellite Systems segment received new subcontracts from Airbus and a contract with L3Harris Technologies and Lockheed Martin for antenna products.

“Driven by steady progress and momentum across the business, in the second quarter the Company delivered solid financial performance highlighted by double-digit revenue growth, gross margin improvements and robust Adjusted EBITDA margin performance of 31.1 per cent,” said Greenley in a press release.

“With affordable and available financing in place to fund our strategic growth, a strong balance sheet and a healthy pipeline of existing and new opportunities, MDA is ideally positioned to capitalize on market growth,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment