Beacon Securities analyst Gabriel Leung thinks the new acquisition by VitalHub (VitalHub Stock Quote, Chart, News TSXV:VHI) should be immediately accretive and will likely be a boost to the company’s patient flow.

Beacon Securities analyst Gabriel Leung thinks the new acquisition by VitalHub (VitalHub Stock Quote, Chart, News TSXV:VHI) should be immediately accretive and will likely be a boost to the company’s patient flow.

In an update to clients Thursday, Leung reiterated his “Buy” rating for VHI but upped his one-year target from $2.65 to $3.25, saying there could be further upside once the full details on the impact of the new addition become clearer.

Toronto-based VitalHub has been screaming up the charts over the past couple of weeks, climbing from $1.70 per share on August 12 to now $2.10.

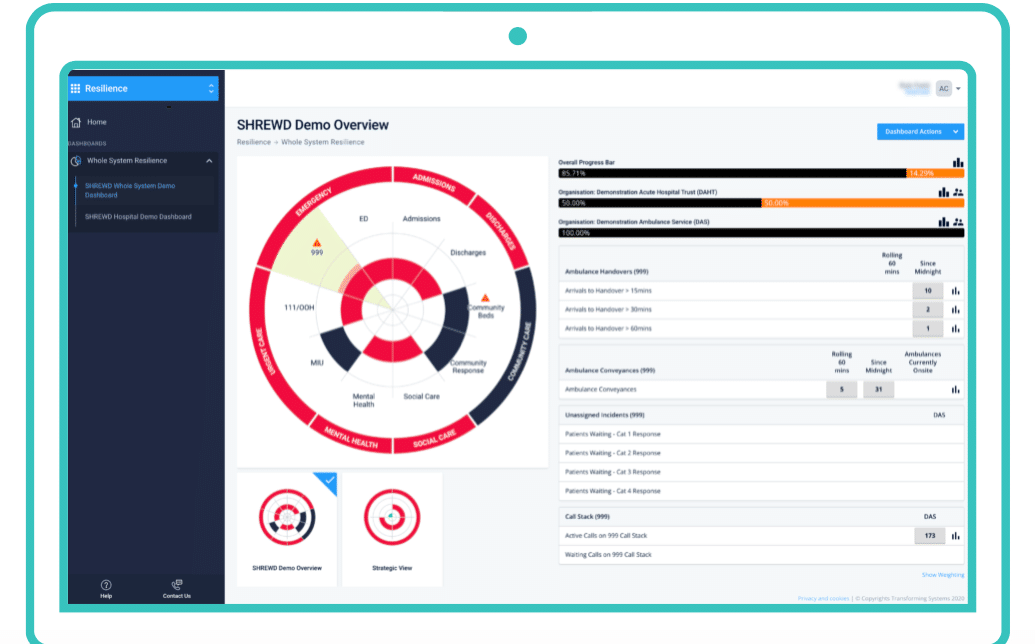

The company, which develops and supports web, mobile, electronic healthcare record solutions in the creation of SaaS-based healthcare applications, announced on August 20 the acquisition of UK-based Intouch with Health, which specializes in patient-focused flow-management solutions for hospitals. Headquartered in Gloucestershire, England, Intouch has 38 employees and contractors and has products used by over 53 National Health Services (NHS) Trusts in the UK, representing 130 hospitals, along with having international business including in Australia, Latvia, Qatar and Canada.

The deal will involve $6.7 million in cash with a $1.4-million potential three-year earnout. VitalHub said Intouch had unaudited total revenue for the past 12 months of £3,141,975 including recurring revenue of £1,329,198 and profit after tax of £185,261. The company comes with cash on hand of about £1,284,000 with no debt.

“With the advent of virtual healthcare visits growing within hospitals we feel Intouch’s product offering is appropriate and timely and anticipate an immediate impact on our overall business. We have partnered with Intouch already in Canada and look forward to growing this relationship as a single entity,” said Dan Matlow, CEO of Vitalhub, in a press release.

Calling the company’s metrics very attractive, Leung noted that Intouch’s EBITDA margins are in the 15 per cent range and that the company has been growing by about 15 per cent year-over-year, with recurring revenue comprised of maintenance and SaaS revenue and non-recurring contributions coming from perpetual licenses, services and some hardware.

“We view this transaction as being very attractive for several reasons. First, patient flow is an area which the management team knows very well, as it was the focus of their last venture at Medworxx, which was acquired by Aptean,” said Leung in his report. “We believe this acquisition (combined with VHI’s OakGroup assets) could help accelerate VHI’s market share gain in patient flow, which we estimate to be a ~$350-million recurring revenue opportunity across several key geographic markets.”

“Second, we believe there is significant cross-sell opportunities of VitalHub’s software (notably Oculys) within Intouch’s UK hospital base and vice-versa. Third, we believe the acquisition metrics were very attractive and should improve as integration progresses.

And lastly, this acquisition increases the company’s current revenue run-rate by ~50 per cent, bringing greater scale to its business,” Leung wrote.

Leung thinks VHI will generate fiscal 2020 revenue and EBITDA of $12.3 million and $1.9 million, respectively, and fiscal 2021 revenue and EBITDA of $18.4 million and $3.3 million, respectively. His new $3.25 target represented at press time a projected return of 61 per cent.

(All figures in Canadian dollars except where noted otherwise.)

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment