ATB Capital Markets analyst David Kideckel is taking a more cautious approach to the short term when it comes to The Valens Company (The Valens Company Stock Quote, Chart, News TSX:VLNS) but the cannabis extraction and white-label products name should do very well over the long term.

ATB Capital Markets analyst David Kideckel is taking a more cautious approach to the short term when it comes to The Valens Company (The Valens Company Stock Quote, Chart, News TSX:VLNS) but the cannabis extraction and white-label products name should do very well over the long term.

Kideckel updated clients in a July 7 note ahead of Valens’ second quarter earnings due on July 15.

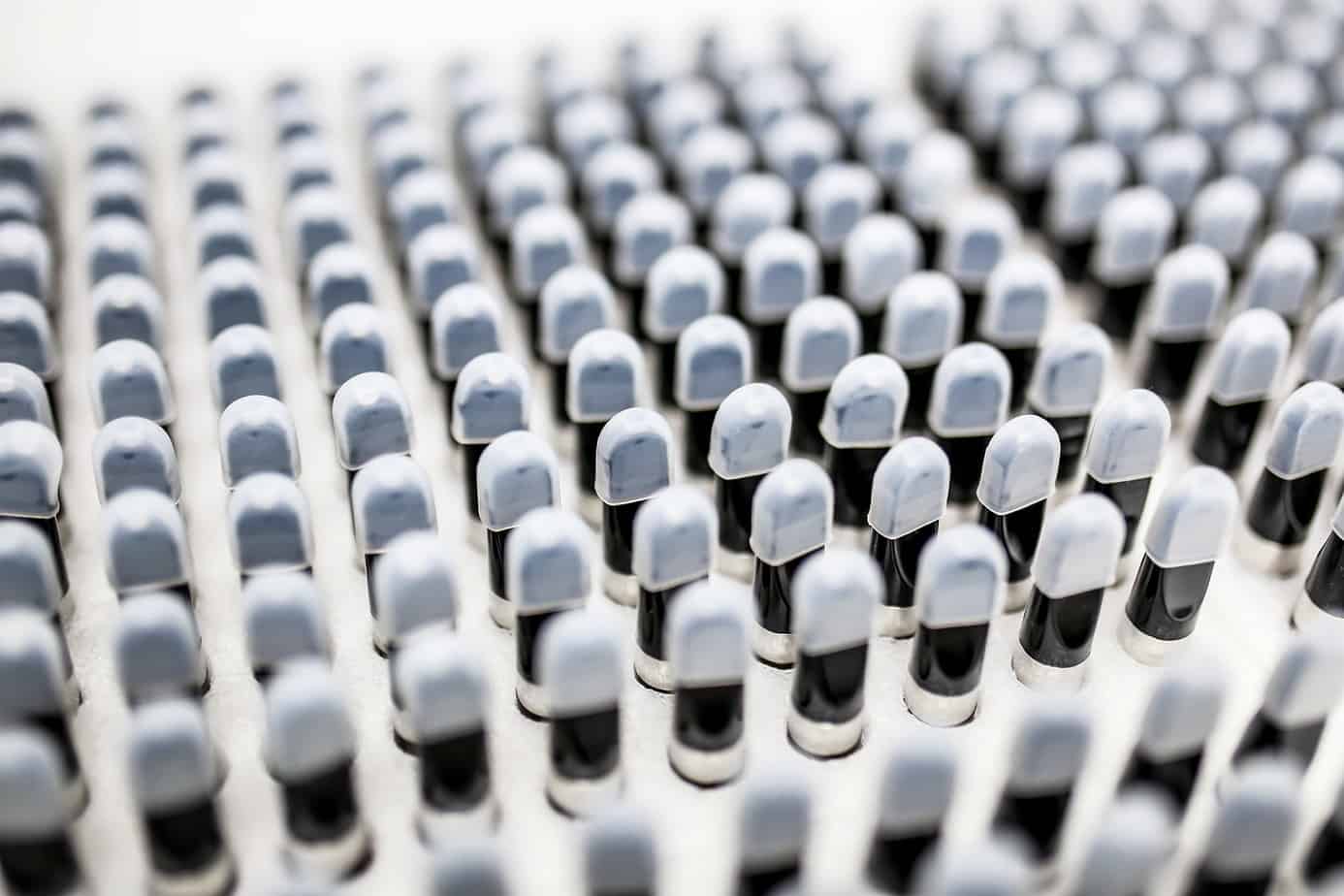

Kelowna, BC-based Valens (formerly Valens GroWorks) recently completed a re-branding which moves the company from a primarily extraction business to one focused more intently on product development.

“Since announcing our rebrand at the end of 2019, we have been working tirelessly to bring on new partners and launch innovative product lines and brands poised to dominate the oil-based market in Canada. As we continue to expand and diversify our platform, we look to further demonstrate to the market that we are positioned for long-term global success with our bespoke cannabinoid-based product development and manufacturing capabilities,” said Valens CEO Tyler Robson in a press release.

Kideckel says that with the tolling (extraction) market facing a glut of inventory in the Canadian market, the lower prices are bound to hit Valens’ revenue over the next few quarters. As such, Kideckel expects Valens’ white-label segment to play a more significant role perhaps sooner than previously assumed.

“We expect Valens’ tolling segment to gradually and partially recover over the back half of FY2020, and especially in FY2021, as LPs work through excess inventory, and Canadian cannabis retail sales continue their upward trend,” Kideckel wrote.

“However, we estimate that Valens white label segment will remain a larger proportion of sales and the Company’s most important and strategic long-term revenue growth driver.

While we expect the tolling part of Valens’ business to gradually recover due to the Company’s differentiating capabilities, including its five different types of extraction, we remain cautious in our estimates to factor a high degree of uncertainty, in large part due to the lack of control Valens has over this,” he wrote.

As such, the analyst has rejigged his estimates for the upcoming second quarter financials, calling for total revenue of $16.2 million (previously $24.1 million) and adjusted EBITDA of $1.3 million (previously $7.9 million).

Kideckel noted that Valens has entered into a number of new custom manufacturing agreements over the last few months to produce a range of products including vapes, oils, topicals, softgels and beverages, all of which help to reinforce the analyst’s confidence in Valen’s ability to keep picking up more contracts and continue on as “a partner-of-choice” for cannabis CPG companies.

“As the Canadian cannabis industry transitions from Cannabis 1.0 (dried flower) to Cannabis 2.0 (derivative products), we believe Valens’ differentiated capabilities and ability to partner with CPG companies will lead the Company to a top spot among Canadian extractors. We believe that Valens’ unique product offering, IP portfolio, strong management, and advanced manufacturing capabilities, pave the way for the successful execution of the Company’s white-label strategy in Canada and internationally,” Kideckel wrote.

With the update, Kideckel maintained his “Outperform” rating but dropped his target from $8.00 to $6.50, representing at the time of publication a projected 12-month return of 183 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment