Mackie Research analyst André Uddin says investors can expect long-term organic growth and margin improvements from specialty pharma company Medexus Pharmaceuticals (Medexus Pharmaceuticals Stock Quote, Chart, News TSXV:MDP).

Mackie Research analyst André Uddin says investors can expect long-term organic growth and margin improvements from specialty pharma company Medexus Pharmaceuticals (Medexus Pharmaceuticals Stock Quote, Chart, News TSXV:MDP).

Uddin published an update to clients Monday where he kept his “Speculative Buy” rating and $6.30 target price for Medexus, which at press time translated into a projected return of 91 per cent.

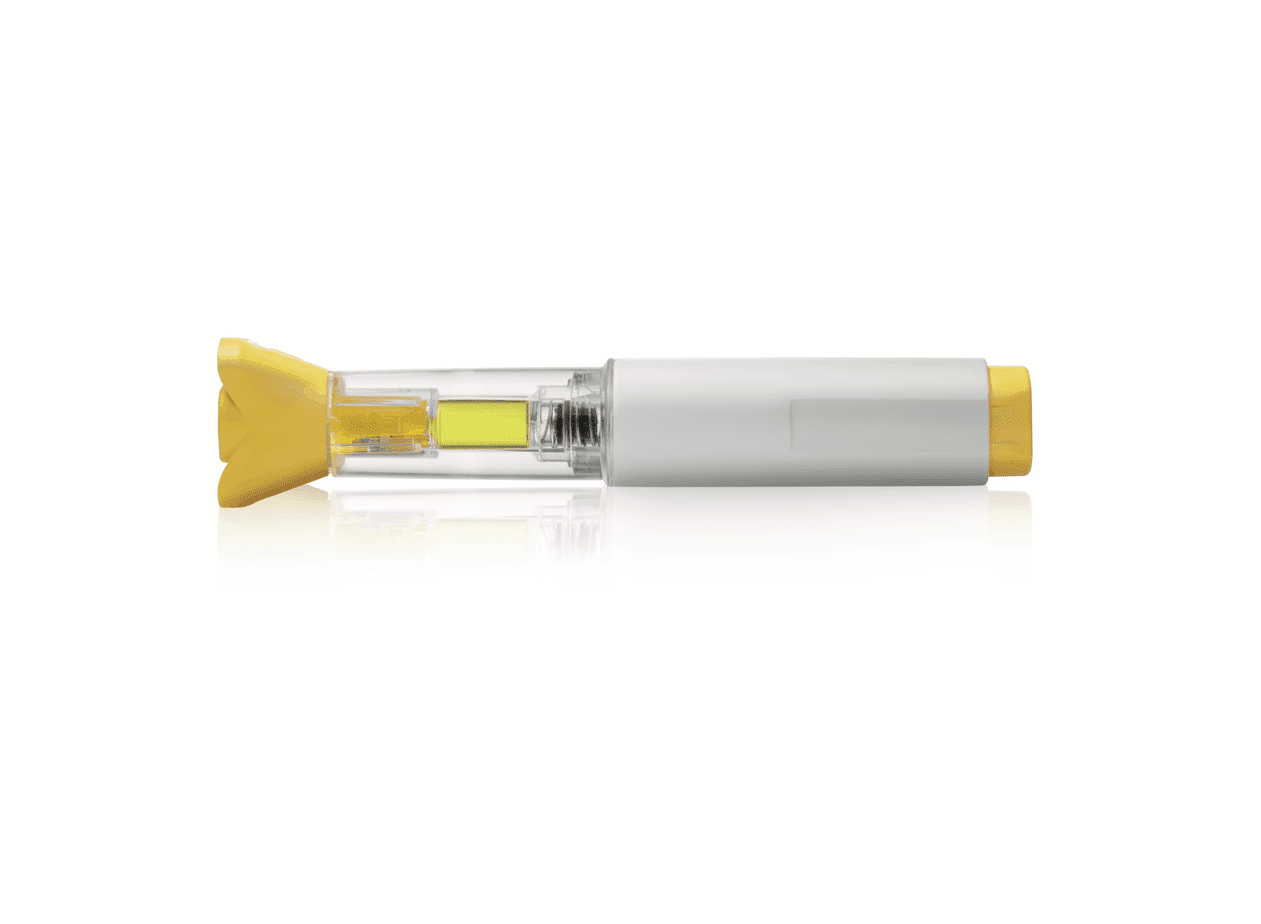

Montreal-based Medexus has a commercial platform marketed in both the US and Canada focusing on auto-immune diseases, hematology and allergies with lead products Rasuvo and Metoject, Ixinity and Rupall.

Shares of the stock jumped by 23 per cent on Tuesday, after the company released its fourth quarter fiscal 2020 financials on Monday. Medexus saw revenue rise to $25.6 million from $12.7 million a year earlier, including organic growth of 27 per cent. Gross profit climbed from $7.7 million for Q4 2019 to $13.3 million and adjusted EBITDA rose from $0.1 million a year ago to $4.2 million.

The quarterly results reflected a one-month of contribution from Ixinity, acquired at the end of February 2020, totaling $9.5 million.

“The integration of IXINITY is complete and it leverages our existing US-based infrastructure, as we have added a product generating approximately $40 million of revenue on an annual basis (based on the twelve-month period ended December 31, 2019) with roughly the same number of employees as we had before the acquisition,” said Medexus CEO Ken d’Entremont in a press release.

“We see significant potential for further growth of IXINITY in the US and other markets. Importantly, we financed this transaction without any equity dilution, using a credit facility, which, together with the solid cash flow of the combined companies, reinforces the strength of our balance sheet and our commitment to driving value for shareholders,” he said.

In a usually weak season for specialty pharma, MDP’s $25.6 million in revenue beat Uddin’s estimate of $24.0 million and the Reuters consensus of $19.6 million. Adjusted EBITDA of $4.2 million was also ahead of Uddin’s $4.0-million estimate. At the quarter’s end, Medexus had $7.4 million in cash and $57.9 million in debt, while in May the company partially restructured its debt.

In his comments, Uddin pointed to Medexus’ US business which should see revenue double.

“MDP is marketing two drugs in the US– Rasuvo and Ixinity. In Q4, Rasuvo generated $10.9 million in sales – ahead of our estimate of $8.5 million compared to $8.5 million last year. Rasuvo unit market demand increased 11 per cent in FY20. We expect the drug sales to continue growing in FY21. Ixinity sales in Q4 were $9.5 million – annual sales of the drug were US$32 million in CY2019, a 40 per cent increase over CY2018. We believe Ixinity sales should double the segment revenues in FY21 and provide MDP with

long-term organic growth going forward,” Uddin wrote.

As for its Canadian segment, Uddin said fiscal 2021 should see revenues slightly decrease due to marketing activity reductions but the analyst thinks the opex decrease should generate high-margin cash flow for the company.

“We view MDP as a high growth play that is significantly undervalued by the market,” Uddin said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment