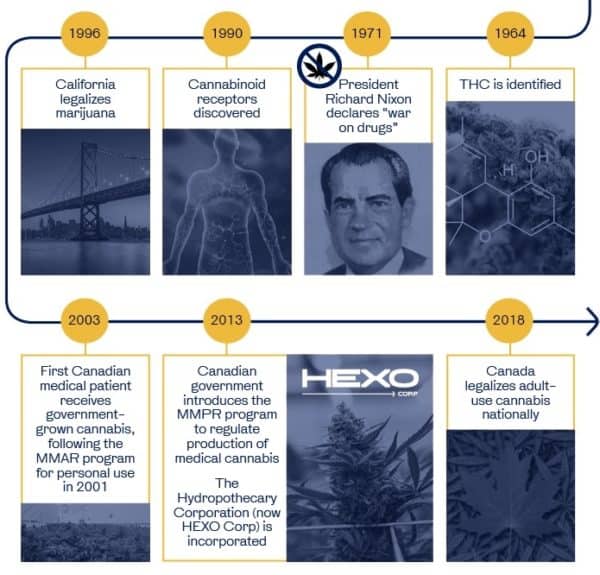

Further expansion at HEXO (HEXO Stock Quote, Chart TSX:HEXO, NASDAQ:HEXO) highlights just how undervalued the stock currently is, says Beacon Securities analyst Russell Stanley.

Further expansion at HEXO (HEXO Stock Quote, Chart TSX:HEXO, NASDAQ:HEXO) highlights just how undervalued the stock currently is, says Beacon Securities analyst Russell Stanley.

This morning, Up Cannabis, a wholly owned subsidiary of Newstrike Brands (which was recently acquired by HEXO) announced it had entered into an agreement with New Brunswick to supply cannabis as a licensed producer.

“We are very excited to announce this partnership with Cannabis NB,” said Jay Wilgar, who is CEO of both Newstrike and Up Cannabis. “Being among the select group of licensed producers that will supply cannabis to the New Brunswick marketplace is a privilege, and we look forward to helping Cannabis NB achieve its goals of providing safe, reliable product to adult-use consumers.”

Stanley notes that New Brunswick is the eighth province that HIP has struck a deal with, pointing to an expanding sales reach that will take HEXO’s aggregate annualized capacity form 108,000kg to 150,000kg. Yet the analyst thinks the company isn’t getting much love right now, estimating that HEXO is trading at a 77 per cent discount to its US listed peers.

__________________________________________________________________

CANTECH MARCH CONTEST

Sign up here for Cantech Letter Alerts, stock picks from the pros, and win a copy of the international best seller “The Snowball: Warren Buffett and the Business of Life” by Alice Schroeder

___________________________________________________________________

“HEXO now trades at approximately 14x EV/C2020E EBITDA, which represents a 61% discount to the 35x average amongst cannabis companies with a C$1B+ market capitalization, and a 77% discount to the 61x average that US-listed cannabis companies trade at,” Stanley says. “Potential catalysts include the closing of the Newstrike Brands acquisition, additional partnership and/or product development news, and the Q3/19 results in June (though as noted in our March 14 note, management guided to a flat quarter). The stock has been performing well and is up 15% this past week.”

In a research update to clients today, Stanley maintained his “Buy” rating and one-year price target of $14.00 on HEXO, implying a return of 42 per cent at the time of publication.

Stanley thinks HEXO will post Adjusted EBITDA of negative $21.3-million on revenue of $59.5-million in fiscal 2019. He expects those numbers will improve to EBITDA of positive $151.5-million on a topline of $450.0-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment